Spartannash Company Intrinsic Value Calculator – SPARTANNASH Co. Reports Q2 FY2023 Earnings on June 30th, 2023

August 21, 2023

🌥️Earnings Overview

The SPARTANNASH COMPANY ($NASDAQ:SPTN) reported their earnings results for the second quarter ending June 30th 2023, showing a 20.5% decrease in total revenue from the same period in the previous year to USD 2312.4 million. Though revenue was down, net income rose by 71.7% to USD 19.5 million year over year.

Price History

On Thursday, SPARTANNASH COMPANY reported its financial results for the second quarter of its fiscal year 2023. The company’s stock opened at $23.2 and closed at $23.3, representing a 1.9% increase from the previous closing price of $22.9. The company reported positive numbers in revenue growth, earnings per share, and cash flow. SPARTANNASH also reported strong financial performance in the areas of inventory management, cost control, and customer service.

Overall, SPARTANNASH delivered solid results for the quarter and exceeded analysts’ expectations. The company attributed its success to its ability to identify and respond quickly to the needs of its customers, while displaying strong financial discipline in operations and cost control. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Spartannash Company. More…

| Total Revenues | Net Income | Net Margin |

| 9.83k | 40.57 | 0.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Spartannash Company. More…

| Operations | Investing | Financing |

| 131.49 | -107.3 | -28.5 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Spartannash Company. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.33k | 1.56k | 22.2 |

Key Ratios Snapshot

Some of the financial key ratios for Spartannash Company are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 2.8% | -4.7% | 0.9% |

| FCF Margin | ROE | ROA |

| 0.2% | 7.4% | 2.5% |

Analysis – Spartannash Company Intrinsic Value Calculator

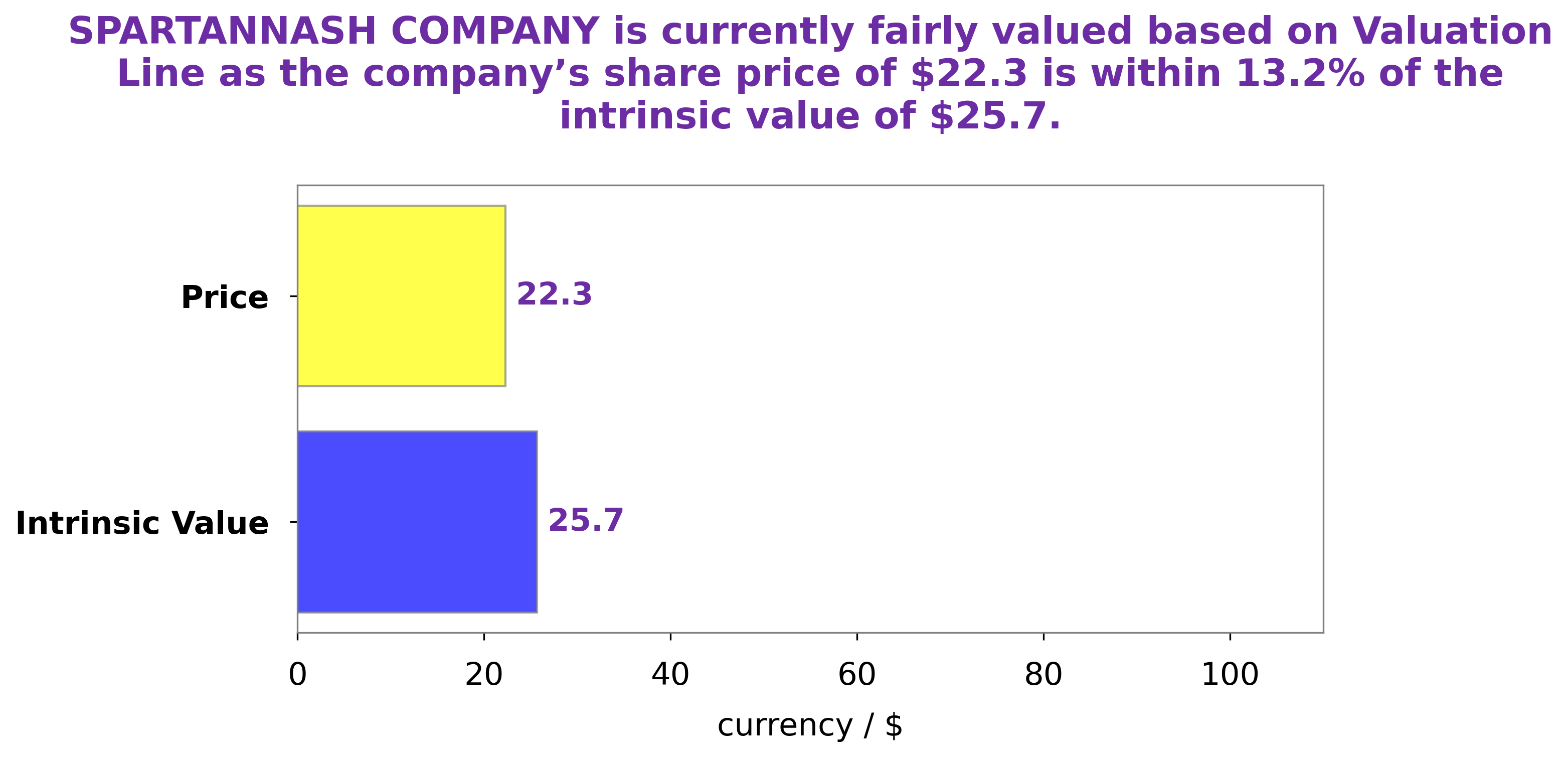

At GoodWhale, we conducted an in-depth analysis of SPARTANNASH COMPANY’s financials. Using our proprietary Valuation Line, we calculated the intrinsic value of the company’s stock to be around $25.0. At the time of writing, SPARTANNASH COMPANY stock is being traded at $23.3 – a price that is 6.9% less than the intrinsic value we calculated. This is a fair price and suggests that the stock may be currently undervalued. More…

Peers

The company operates in the United States and Canada. The company’s competitors include Metcash Ltd, Amcon Distributing Co, and United Natural Foods Inc.

– Metcash Ltd ($ASX:MTS)

Metcash Ltd is a food and grocery distributor in Australia. The company has a market cap of 3.8B as of 2022 and a Return on Equity of 21.5%. Metcash Ltd distributes food and grocery products to independent retailers in Australia. The company offers a range of products including groceries, fresh food, alcohol, and general merchandise. Metcash Ltd also provides logistics and supply chain management services to its customers.

– Amcon Distributing Co ($NYSEAM:DIT)

Amcon Distributing Company is a wholesale distributor of consumer products, including cigarettes, cigars, and other tobacco products; foodservice equipment and supplies; and janitorial, sanitation, and paper products. The company operates in three segments: Cigarettes and Tobacco Products, Foodservice Equipment and Supplies, and Janitorial, Sanitation, and Paper Products. It distributes its products through a network of distribution centers and sales offices in the United States.

– United Natural Foods Inc ($NYSE:UNFI)

UNFI is a leading distributor of natural, organic, and specialty foods in the United States and Canada. The company has a market cap of 2.65B as of 2022 and a ROE of 16.04%. UNFI is a publicly traded company on the Nasdaq Stock Market and is headquartered in Providence, Rhode Island.

Summary

Investors of SPARTANNASH COMPANY are presented with a mixed picture following the release of their second quarter FY2023 financial results. Total revenue for the quarter decreased by 20.5% year over year, but the company’s net income for the quarter rose by a significant 71.7%. As such, it appears that management was able to effectively manage costs and leverage existing resources despite the adverse revenue trend. Investors should continue to monitor the company’s performance in the coming quarters as well as any strategic moves they make to remain competitive in a challenging environment.

Recent Posts