Sono-Tek’s Earnings Outlook Brightens as Company Records Positive Results

May 27, 2023

Trending News ☀️

SONO-TEK ($NASDAQ:SOTK): Sono-Tek Corporation‘s recent earnings report has brought a bright outlook for the company. The report showed that the company had recorded positive results in its third quarter earnings, indicating a promising future for Sono-Tek. The company is known for its innovative ultrasonic coating and spraying technology, which has been used in the medical, electronics, automotive, and other industries. The company has been able to consistently grow through the development of new technologies and a strong customer base. They have recently seen an increase in demand for their ultrasonic coating and spraying system, as well as their other products and services.

Sono-Tek’s outlook is further bolstered by its strong balance sheet and large backlog of orders that are expected to be filled in the near future. The company also has plans for expansion into new markets, which will help to further increase their revenue and profits in the long term. With such a strong outlook, Sono-Tek’s stock looks to be a good investment opportunity for the future.

Share Price

On Thursday, SONO-TEK CORPORATION stock opened at $5.4 and closed at $5.2, a 6.2% drop from its closing price of 5.6 the day before. Despite the drop, the company’s overall earnings outlook is still positive as it has reported positive results in the past several quarters. SONO-TEK CORPORATION has seen significant growth in its sales, profits, and share price over the last two years. The company has continued to expand its product offerings and enhance its customer service capabilities to capitalize on the increasing demand for their products. This has allowed SONO-TEK CORPORATION to achieve consistent revenue growth in recent quarters. With its recent success, SONO-TEK CORPORATION is confident in its future prospects.

The company is investing heavily in research and development to ensure that its products remain competitive in a rapidly evolving market. SONO-Tek is also actively seeking out new partnerships and strategic alliances to further expand its reach and increase its market share. Despite the drop in stock price, investors appear to remain confident in SONO-TEK CORPORATION’s ability to deliver on its promises. With its positive results and growing customer base, the company is well-positioned for continued success in the coming years. As a result, many investors are optimistic that the company will continue to see strong earnings growth in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sono-tek Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 16.4 | 1.13 | 7.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sono-tek Corporation. More…

| Operations | Investing | Financing |

| 1.5 | -5.22 | 0.06 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sono-tek Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 19.48 | 5 | 0.92 |

Key Ratios Snapshot

Some of the financial key ratios for Sono-tek Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 8.7% | 53.2% | 13.9% |

| FCF Margin | ROE | ROA |

| 6.4% | 9.9% | 7.3% |

Analysis

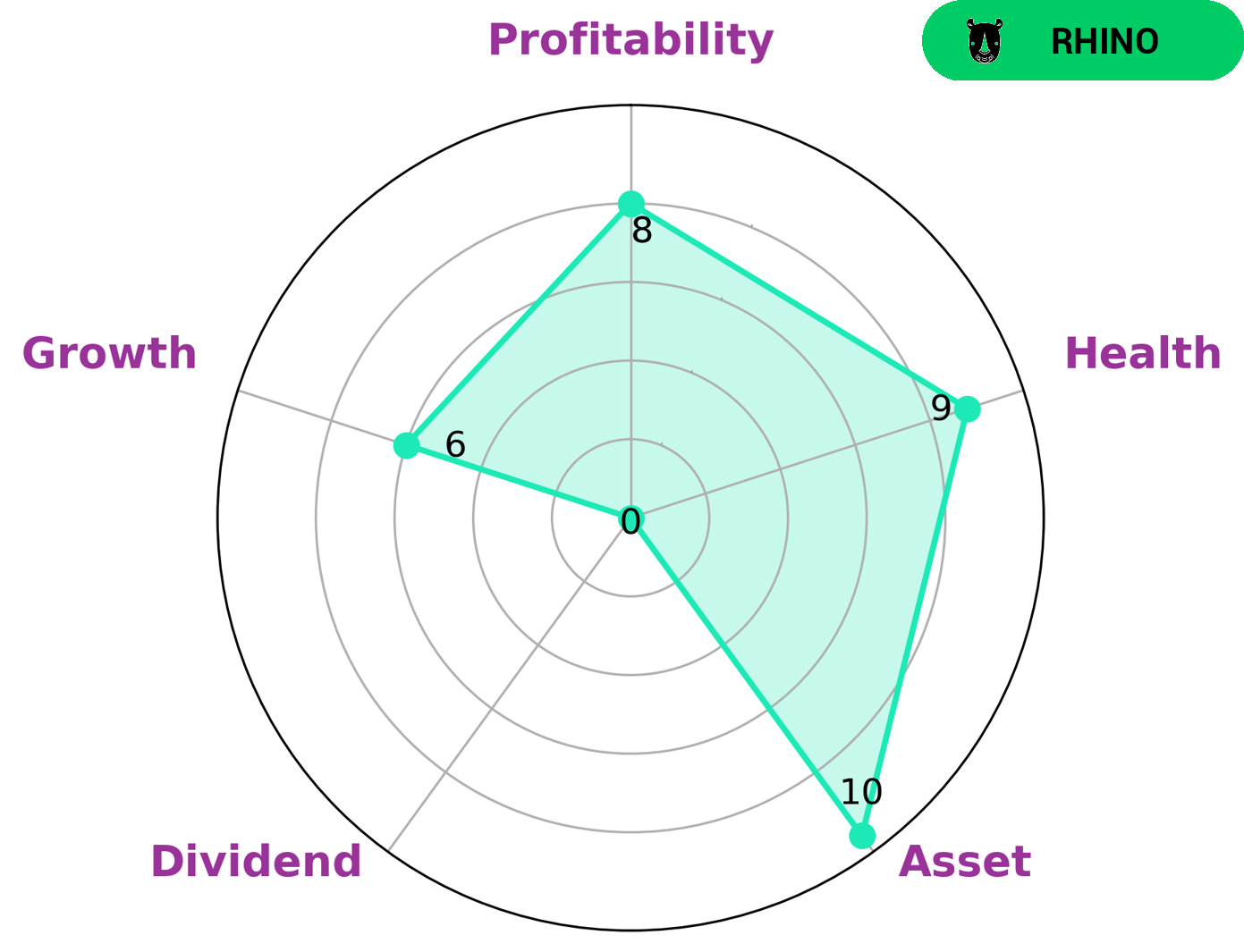

GoodWhale recently conducted an analysis of SONO-TEK CORPORATION‘s wellbeing and found that it had a high health score of 9/10 based on its cashflows and debt. We were able to conclude that the company had the capacity to pay off debt and fund future operations. Additionally, we found that SONO-TEK CORPORATION was strong in asset, profitability, and medium in growth. Its only weak area was dividend. Based on the results of our analysis, we classified SONO-TEK CORPORATION as a ‘rhino’, meaning that the company has achieved moderate revenue or earnings growth. We believe that investors who are looking for stable companies with a history of steady growth may be interested in investing in SONO-TEK CORPORATION. More…

Peers

Sono-Tek Corp is a leading manufacturer of ultrasonic spraying equipment, with a long history of innovation and a strong commitment to quality. The company’s products are used in a wide range of industries, including electronics, automotive, packaging, and medical. Sono-Tek’s main competitors are Shibaura Electronics Co Ltd, Kuramoto Co Ltd, and WG Tech (Jiang Xi) Co Ltd. While all three companies offer similar products and services, Sono-Tek has a clear advantage in terms of experience and reputation.

– Shibaura Electronics Co Ltd ($TSE:6957)

Shibaura Electronics Co Ltd is a Japanese electronics company with a market cap of 34.33B as of 2022. The company has a Return on Equity of 11.66%. Shibaura Electronics Co Ltd is a leading manufacturer of electronic products and components, including semiconductors, LCDs, and batteries. The company’s products are used in a wide range of industries, including automotive, telecommunications, and consumer electronics.

– Kuramoto Co Ltd ($TSE:5216)

Kuramoto Co Ltd is a Japanese company with a market capitalization of 4B as of 2022. The company has a return on equity of 1.7%. Kuramoto Co Ltd is involved in the manufacturing and distribution of electronic and electrical products. The company’s products include semiconductors, integrated circuits, LCDs, and other electronic components. Kuramoto Co Ltd is headquartered in Tokyo, Japan.

– WG Tech (Jiang Xi) Co Ltd ($SHSE:603773)

WG Tech (Jiang Xi) Co Ltd has a market cap of 2.53B as of 2022, a Return on Equity of 0.85%. The company is a leading provider of tech products and services in China.

Summary

Sono-Tek Corporation is a publicly traded technology company that designs, manufactures, and distributes ultrasonic coating systems. Analysts have recently given an outlook on Sono-Tek’s earnings, with their stock price moving down the same day. Investors should carefully consider risk when conducting an analysis of Sono-Tek’s financials. This can be done by focusing on their income statement, balance sheet, and cash flow statement. Investors should also review management discussion and analysis, which provides insights into their strategy and performance.

Additionally, studying the company’s competitors and understanding their products and services can provide a basis for comparison. Lastly, investors should pay close attention to the company’s financial ratios such as return on equity, debt-to-equity ratio, and price to earnings ratio in order to identify potential red flags. Doing so can help investors make an informed decision when investing in Sono-Tek.

Recent Posts