Skyline Champion Stock Fair Value Calculator – SKYLINE CHAMPION Reports Positive Earnings Results for FY2024 Q1

August 13, 2023

☀️Earnings Overview

On August 1 2023, SKYLINE CHAMPION ($NYSE:SKY) reported their financial results for the first quarter of FY2024, ending June 30 2023. Total revenue for the quarter amounted to USD 464.8 million, a decrease of 36.0% compared to the same quarter in the prior year. Net income for the period totaled USD 51.3 million, a decrease of 56.2% from the corresponding quarter in the preceding year.

Share Price

On Tuesday, SKYLINE CHAMPION reported positive earnings results for its first quarter of fiscal year 2024. The company’s stock opened at $69.3 and closed at $69.4, down by just 0.3% from its previous closing price of $69.7. This is a sign that the company is performing well and is optimistic about its future prospects. This indicates that the company is becoming more efficient in terms of operations and is on track to meet its quarterly and annual goals. SKYLINE CHAMPION has been working to improve its competitive positioning in the market by investing in new technologies and expanding its product offerings.

This has allowed the company to stay ahead of its competitors and remain competitive in the industry. The positive earnings results for the first quarter demonstrate that its investments are paying off. The company remains committed to investing in new technologies and expanding its product offerings to remain competitive in the market and ensure long-term success. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Skyline Champion. More…

| Total Revenues | Net Income | Net Margin |

| 2.35k | 335.92 | 14.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Skyline Champion. More…

| Operations | Investing | Financing |

| 443.66 | -67.82 | -40.04 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Skyline Champion. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.62k | 326.74 | 22.59 |

Key Ratios Snapshot

Some of the financial key ratios for Skyline Champion are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 22.7% | 77.2% | 19.1% |

| FCF Margin | ROE | ROA |

| 16.6% | 22.2% | 17.3% |

Analysis – Skyline Champion Stock Fair Value Calculator

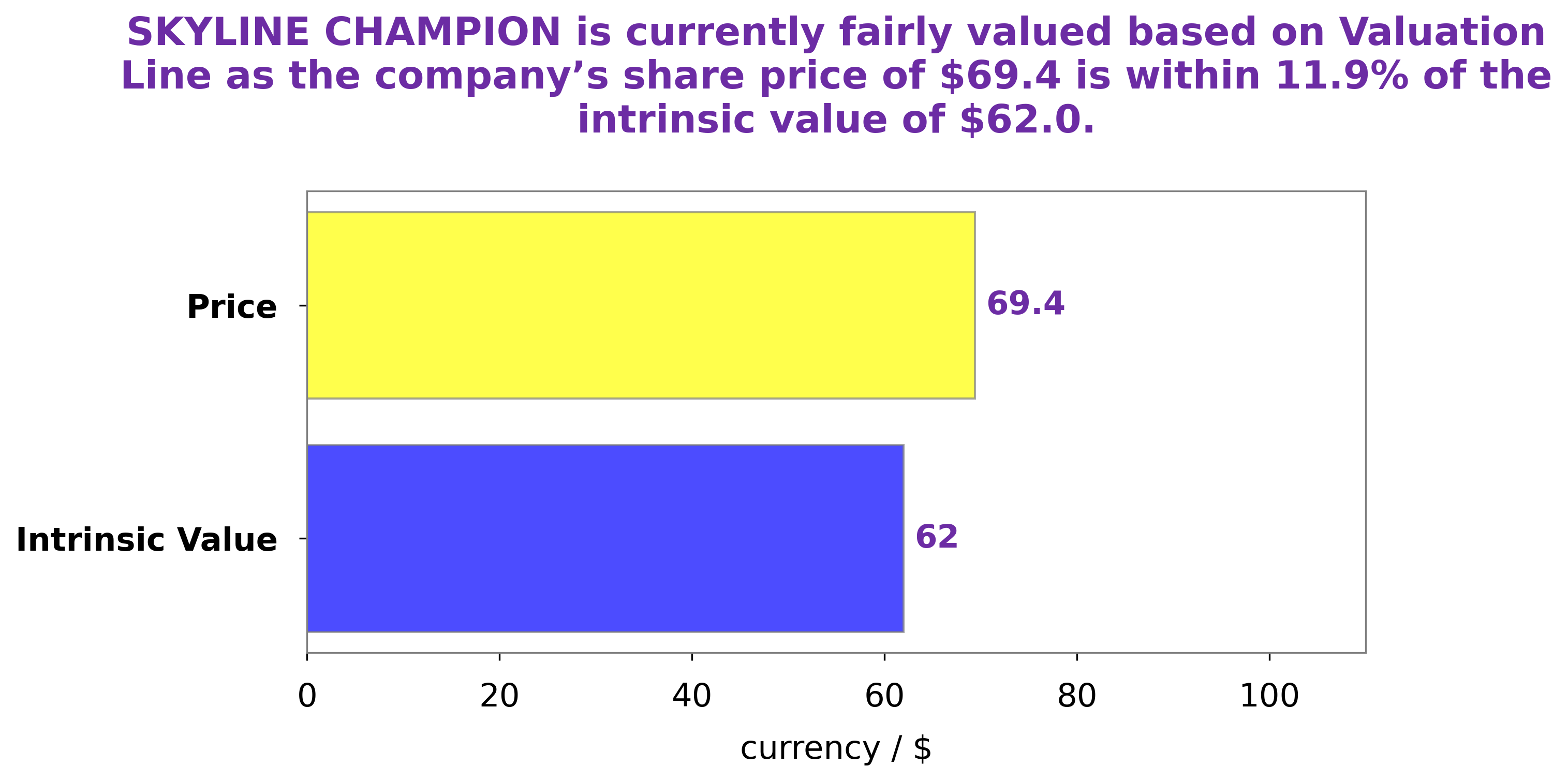

At GoodWhale, we have performed an analysis of SKYLINE CHAMPION‘s fundamentals. Using our proprietary Valuation Line, we have calculated the fair value of SKYLINE CHAMPION share to be around $61.9. More…

Peers

Skyline Champion Corp is one of the leading homebuilders in the United States. The company’s main competitors are Meritage Homes Corp, Tri Pointe Homes Inc, and KB Home.

– Meritage Homes Corp ($NYSE:MTH)

Meritage Homes Corp is a homebuilder in the United States. As of 2022, the company has a market capitalization of 3.06 billion dollars and a return on equity of 23.05%. The company builds homes for a variety of different price points and markets, and has a focus on sustainability and energy efficiency.

– Tri Pointe Homes Inc ($NYSE:TPH)

Tri Pointe Homes Inc is a homebuilding company that focuses on the development of single-family homes. The company operates in various states in the United States, including Arizona, California, Colorado, Florida, Georgia, Illinois, Indiana, Maryland, Nevada, North Carolina, Ohio, Oklahoma, Oregon, South Carolina, Texas, and Virginia. As of 2022, the company has a market cap of 1.86B and a ROE of 16.87%.

– KB Home ($NYSE:KBH)

KB Home is a homebuilding company headquartered in Los Angeles, California. It is one of the largest homebuilders in the United States. The company builds and sells single-family detached and attached homes, townhomes, and condominiums in the United States. It operates in four segments: West Coast, Central, Southeast, and South Central. The company was founded in 1957 and is headquartered in Los Angeles, California.

Summary

SKYLINE CHAMPION reported their fiscal year 2024 Q1 earnings on August 1 2023, which showed total revenue of USD 464.8 million, representing a decrease of 36.0% from the same period in the previous year. Net income was USD 51.3 million, a decrease of 56.2% from the same period in the previous year. This performance may not be attractive for investors, as SKYLINE CHAMPION has experienced a consecutive period of declining revenue and profits.

The company may need to review their strategies and focus on cost reduction initiatives in order to achieve better financial results. Investors should monitor the company’s performance closely, and conduct due diligence before making any investment decision.

Recent Posts