SITEONE LANDSCAPE SUPPLY Reports Second Quarter Earnings for Fiscal Year 2023

August 22, 2023

🌥️Earnings Overview

On August 2, 2023, SITEONE LANDSCAPE SUPPLY ($NYSE:SITE) released its earnings results for the second quarter of fiscal year 2023 (ending June 30, 2023). Total revenue for the period was USD 1353.7 million, a 11.3% rise from the same quarter of the prior year. Net income decreased by 11.9% to USD 124.0 million compared to the previous year.

Share Price

The report indicated that the company’s stock opened at $171.1, but closed the day at $162.2, a drop of 6.8% from the previous closing price of 174.0. This drop in net income and the subsequent decline in stock price could be attributed to factors such as a decrease in consumer demand resulting from economic uncertainty, as well as a decrease in sales due to higher material costs associated with products SITEONE LANDSCAPE SUPPLY provides. Moving forward, SITEONE LANDSCAPE SUPPLY has taken steps to improve their financial performance, such as focusing on product availability and customer service. They are also investing in expanding their digital tools and new technology to better serve their customers and streamline processes in order to remain competitive in an ever-evolving landscape.

Going into the third quarter of the fiscal year, SITEONE LANDSCAPE SUPPLY is optimistic that their efforts will result in improved financial performance and hopefully a rebound in their stock price. Investors will be watching the company closely as they move into the second half of the fiscal year. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for SITE. More…

| Total Revenues | Net Income | Net Margin |

| 4.18k | 191.9 | 4.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for SITE. More…

| Operations | Investing | Financing |

| 342 | -214.6 | -107.5 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for SITE. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.87k | 1.44k | 31.85 |

Key Ratios Snapshot

Some of the financial key ratios for SITE are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 19.3% | 23.2% | 6.5% |

| FCF Margin | ROE | ROA |

| 7.3% | 12.5% | 5.9% |

Analysis

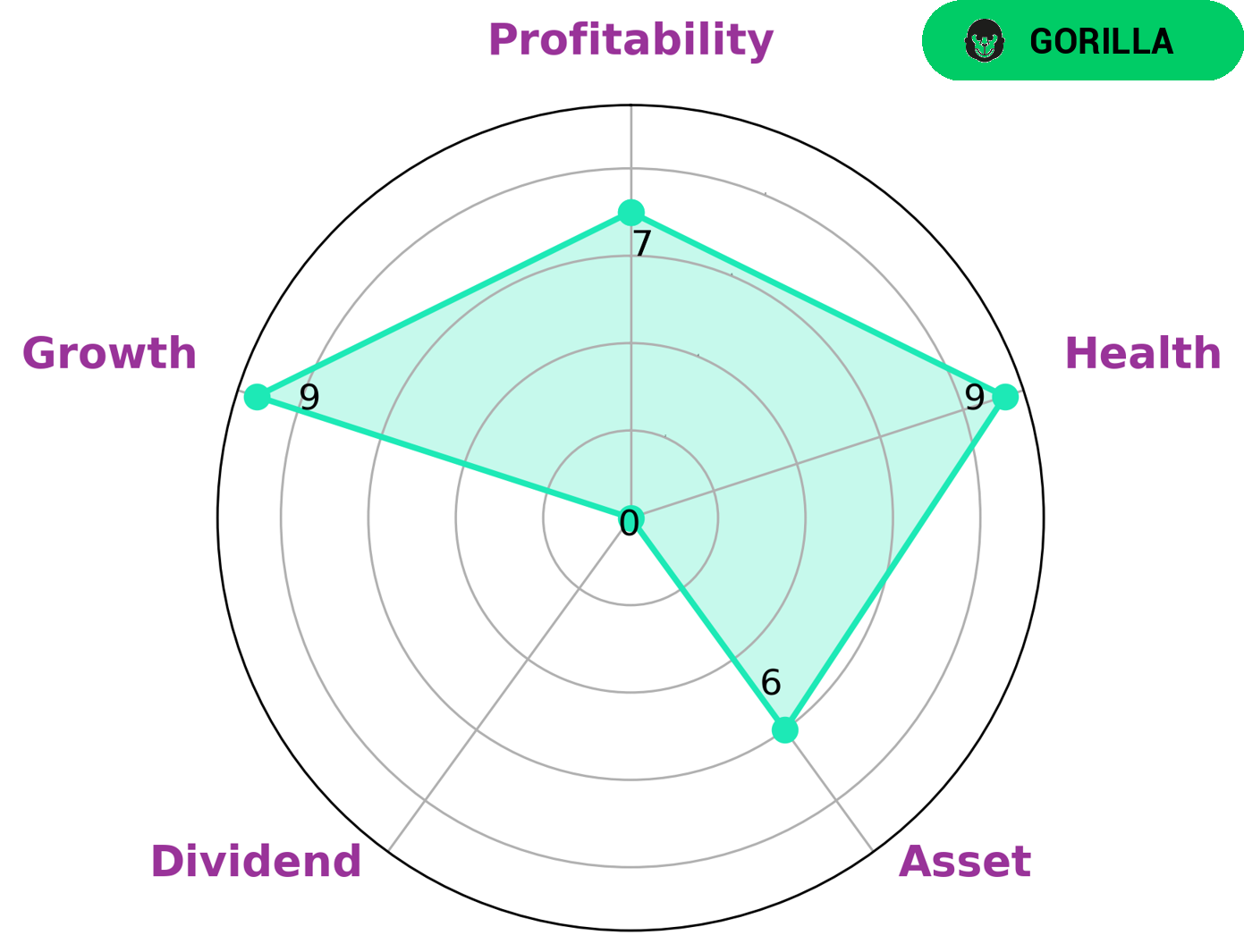

Analyzing SITEONE LANDSCAPE SUPPLY’s financials with GoodWhale, our Star Chart concluded that the company is strong in growth and profitability, medium in assets, and weak in dividends. Our health score for SITEONE LANDSCAPE SUPPLY is 9/10, suggesting that it is capable to safely ride out any crisis without the risk of bankruptcy. Moreover, based on our data, we classify SITEONE LANDSCAPE SUPPLY as a ‘gorilla’ – a type of company we conclude that achieved stable and high revenue or earning growth due to its strong competitive advantage. As such, investors who are looking for long-term growth with steady revenue and earnings may be interested in investing in SITEONE LANDSCAPE SUPPLY. More…

Peers

The company offers a wide range of products, including irrigation supplies, nursery stock, landscape tools and accessories, and more. SiteOne Landscape Supply Inc competes with Hydrofarm Holdings Group Inc, MAX Co Ltd, Thorpe (F W) PLC, and others in the landscape supplies industry.

– Hydrofarm Holdings Group Inc ($NASDAQ:HYFM)

Hydrofarm Holdings Group Inc is a leading manufacturer and distributor of hydroponic equipment and supplies in the United States. The company has a market cap of 102.81M as of 2022 and a Return on Equity of -41.86%. Hydrofarm Holdings Group Inc is a publicly traded company on the NASDAQ stock exchange under the ticker symbol HYFG. The company’s products are used by commercial and hobbyist growers to produce fruits, vegetables, and herbs.

– MAX Co Ltd ($TSE:6454)

As of 2022, Daikin Industries, Ltd. has a market capitalization of 97.87 billion dollars and a return on equity of 7.15%. Daikin is a Japanese multinational air conditioning manufacturing company with headquarters in Osaka. The company makes a wide range of products including air conditioners, refrigerators, and chemicals. It also provides services such as installation, repair, and maintenance.

– Thorpe (F W) PLC ($LSE:TFW)

Thorpe (F W) PLC is a British engineering company. The company is headquartered in Derby, England. Thorpe (F W) PLC designs, manufactures, and supplies equipment and services for the rail, construction, and mining industries. The company’s products and services include locomotives, railway cars, and railway infrastructure. Thorpe (F W) PLC has a market cap of 474.63M as of 2022, a Return on Equity of 10.79%.

Summary

SITEONE LANDSCAPE SUPPLY recently reported their second quarter fiscal year 2023 earnings. The total revenue was USD 1353.7 million, representing a 11.3% increase from the same quarter the prior year. Despite the increased revenue, net income fell 11.9% to USD 124 million year-over-year. This news caused the stock price to fall the same day.

As an investor, it is important to consider whether or not this dip is a buying opportunity. An analysis of the company’s financials, including debt to equity ratio, cash flow, and other metrics, will be helpful in determining whether this company is a good long term investment.

Recent Posts