SCHN Stock Fair Value Calculation – Schnitzer Steel Industries Set to Report Earnings on Thursday

December 30, 2023

🌥️Trending News

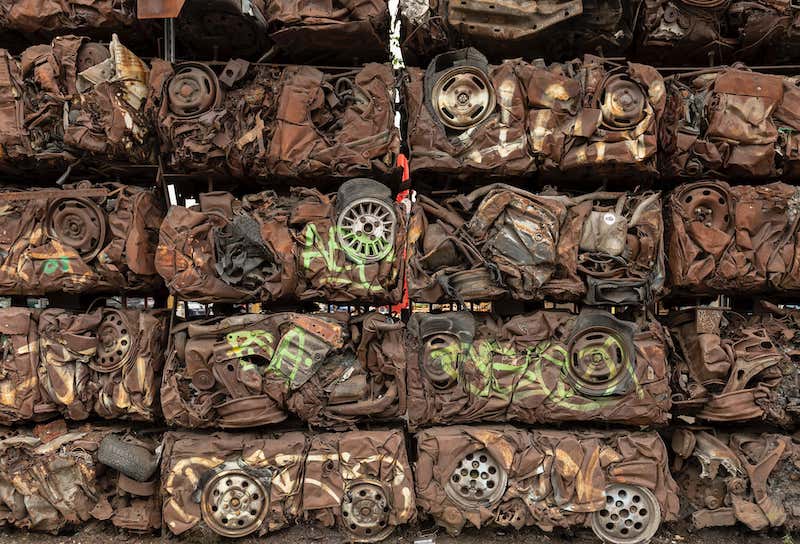

Schnitzer Steel Industries ($NASDAQ:SCHN), Inc. is a global leader in the metals recycling industry, based in Portland, Oregon. It is the largest recycler of automobile scrap in the U.S. and is also among the top steel producers in the country. The company is set to report its earnings on Thursday, and investors are eager to see how it will perform. Schnitzer Steel Industries has a strong financial portfolio and is well-positioned for the future. Its balance sheet has seen improvement year over year and the company has a healthy cash flow.

Additionally, it has a good track record of developing innovative operations and efficiency initiatives that have allowed it to remain highly competitive in the market. The company’s performance over the past year has been impressive. Despite the challenging economic climate, Schnitzer Steel Industries has been able to maintain its profitability and market share. Analysts are expecting the company to report strong results for its upcoming earnings report and anticipate further growth in the coming year. Investors will be watching the company’s performance closely, expecting to see positive results that will lead to increased share prices and a return on their investments. With Schnitzer Steel Industries set to report earnings on Thursday, investors are sure to be paying close attention to the numbers in order to get an accurate picture of the company’s future prospects.

Earnings

SCHNITZER STEEL INDUSTRIES is set to report its earnings on Thursday for the fiscal year 2023 Q3 ending May 31 2021. According to their earnings report, the company has earned a total revenue of 820.72M USD and a net income of 63.64M USD. This marks an 18.7% decrease in total revenue and a 14.7% decrease in net income compared to the previous year.

Furthermore, the company’s total revenue has declined from 820.72M USD to 809.61M USD in the last 3 years. Investors will be closely monitoring the results to get an insight of how the company has performed in the quarter and what the future prospects are for SCHNITZER STEEL INDUSTRIES.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for SCHN. More…

| Total Revenues | Net Income | Net Margin |

| 3.06k | 10.38 | 0.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for SCHN. More…

| Operations | Investing | Financing |

| 250.65 | -316.15 | 94.57 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for SCHN. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.87k | 926.84 | 34.02 |

Key Ratios Snapshot

Some of the financial key ratios for SCHN are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 19.4% | 14.6% | 1.0% |

| FCF Margin | ROE | ROA |

| 3.1% | 2.0% | 1.0% |

Price History

Prior to this announcement, SCHNITZER STEEL INDUSTRIES stock opened at $31.2 and closed at $31.5, representing a slight decrease of 0.2% from the last closing price of 31.6. Investors are now eagerly awaiting the company’s earnings report to gain insight into its financial health. This report will likely determine the direction of the stock in the coming days and weeks. Live Quote…

Analysis – SCHN Stock Fair Value Calculation

At GoodWhale, we have carefully analyzed the fundamentals of SCHNITZER STEEL INDUSTRIES and the results have been quite promising. According to our proprietary Valuation Line, the fair value of SCHNITZER STEEL INDUSTRIES share is around $40.4. However, at the moment SCHNITZER STEEL INDUSTRIES stock is traded at $31.5, which is a 22.0% undervaluation. This presents an excellent opportunity for investors to make a potentially lucrative return on their investment. We believe that the stock is likely to appreciate in the near future, making it a smart choice for any investor looking to diversify their portfolio. More…

Peers

Schnitzer Steel Industries Inc is one of the largest steel producers in the world. Its competitors include Daido Steel Co Ltd, FENG HSIN STEEL CO LTD, and Bengang Steel Plates Co Ltd.

– Daido Steel Co Ltd ($TSE:5471)

Daido Steel Co Ltd is a Japanese steel manufacturer with a market cap of 154.52B as of 2022. The company has a Return on Equity of 7.71%. Daido Steel Co Ltd produces a wide range of steel products, including stainless steel, carbon steel, and alloy steel. The company also manufactures and sells steel products for use in construction, shipbuilding, automotive, and other industries.

– FENG HSIN STEEL CO LTD ($TWSE:2015)

FENG HSIN STEEL CO LTD is a steel manufacturer based in Taiwan. The company has a market capitalization of 34.08 billion as of 2022 and a return on equity of 15.9%. Feng Hsin Steel Co Ltd produces a variety of steel products including hot rolled coils, cold rolled coils, and hot dip galvanized coils. The company also produces steel pipes and tubes, wire rods, and other steel products. Feng Hsin Steel Co Ltd has a production capacity of 2.8 million tons of steel products per year.

– Bengang Steel Plates Co Ltd ($SZSE:000761)

Bengang Steel Plates Co Ltd is a leading steel producer in China with a market cap of 12.33B as of 2022. The company has a Return on Equity of 5.86%. Bengang Steel Plates Co Ltd produces a variety of steel products including plates, coils, sheets, and pipes. The company is vertically integrated and has a diversified customer base.

Summary

Schnitzer Steel Industries, Inc. is set to report its quarterly earnings on Thursday. Investors will be closely watching to see if their numbers match the expectations of analysts. The company is a metals recycling and steel manufacturing company with operations in the United States and around the world. It provides steel products, including rebar, wire rod, coiled rebar, and other specialty products to customers in the construction, automotive, energy, industrial, retail and agriculture industries. Over the past year, Schnitzer’s stock price has been volatile due to geopolitical developments and shifting demand for its products.

Analysts are expecting the company’s net income to increase year-over-year, driven by higher prices and increased demand from certain markets. Looking forward, investors will be looking for confirmation that the company is continuing to increase efficiency and reduce costs in order to maximize profitability. Ultimately, investors will be looking to see if Schnitzer is able to meet or exceed expectations in its earnings report.

Recent Posts