Royal Gold Intrinsic Value Calculator – ROYAL GOLD Reports Second Quarter Financial Results for FY2023

August 28, 2023

🌥️Earnings Overview

On August 3, 2023, ROYAL GOLD ($NASDAQ:RGLD) reported its financial results for the second quarter of fiscal year 2023, which ended on June 30, 2023. Total revenue for the period totaled USD 144.0 million, a decrease of 1.6% year-over-year. Net income came in at USD 63.4 million, a 10.8% decline from the same quarter in the prior year.

Market Price

The stock opened at $115.2 and closed at $112.6, a 0.5% decline from the last closing price of 113.2. Shareholders are likely to be pleased with the company’s progress and the dividend payment in June. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Royal Gold. More…

| Total Revenues | Net Income | Net Margin |

| 608.84 | 229.49 | 38.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Royal Gold. More…

| Operations | Investing | Financing |

| 412.6 | -887.82 | 300.76 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Royal Gold. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.44k | 603.82 | 43.04 |

Key Ratios Snapshot

Some of the financial key ratios for Royal Gold are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.2% | 16.9% | 50.0% |

| FCF Margin | ROE | ROA |

| -77.9% | 6.8% | 5.5% |

Analysis – Royal Gold Intrinsic Value Calculator

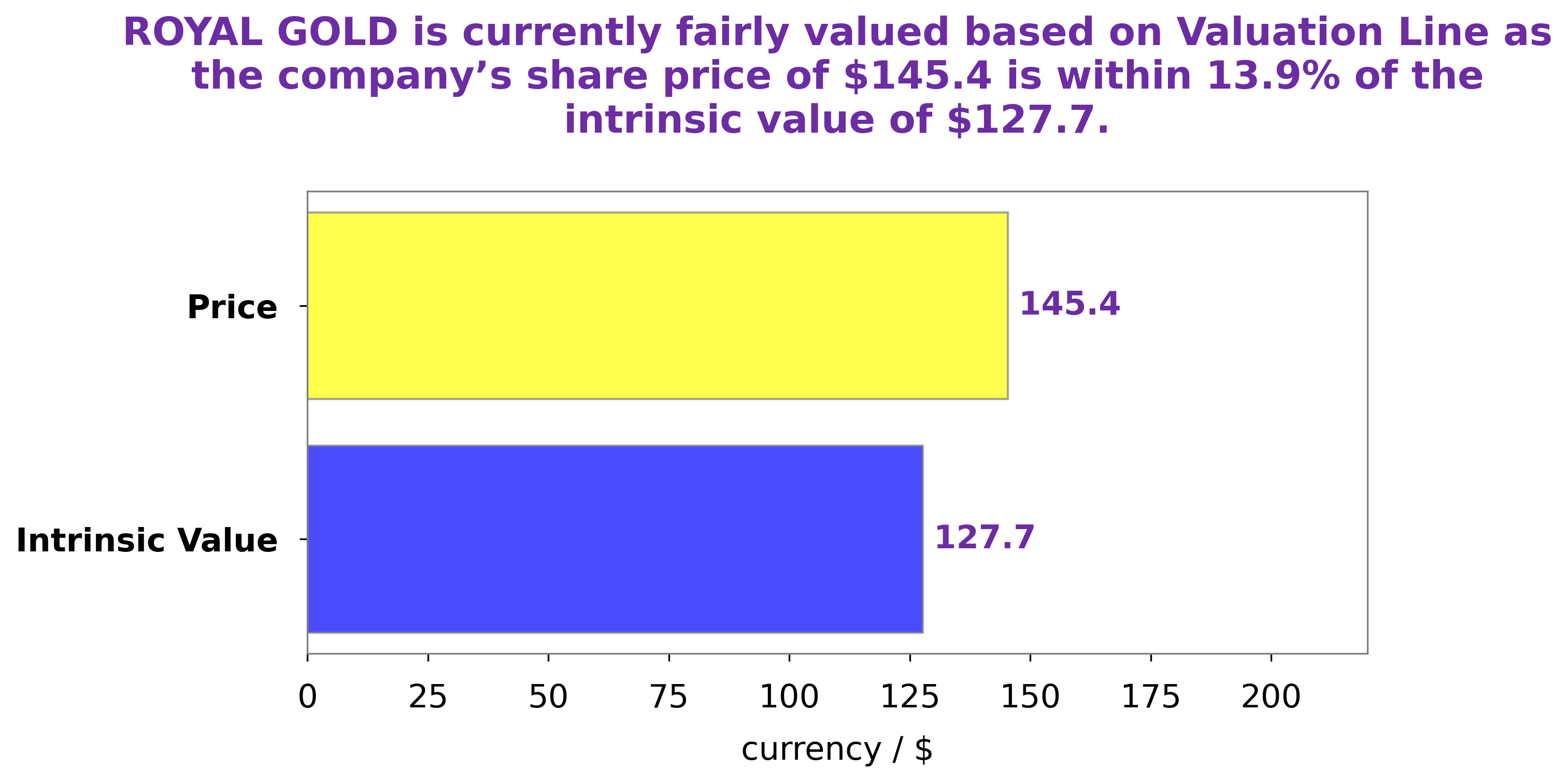

At GoodWhale, we have conducted an analysis of ROYAL GOLD‘s fundamentals. We’ve used our proprietary Valuation Line to calculate the intrinsic value of ROYAL GOLD’s share to be around $115.2. Interestingly, the current market price of ROYAL GOLD’s share is $112.6, making it a fair price, albeit one that is undervalued by 2.2%. This presents an opportunity for investors to accumulate a share that can potentially yield greater returns than what the current market price suggests. More…

Peers

The competition is fierce, but Royal Gold Inc. has managed to stay ahead of the pack thanks to its experienced team and cutting-edge technology.

– Rover Metals Corp ($TSXV:ROVR)

Rover Metals Corp is a Canadian company engaged in the exploration and development of mineral properties. The company has a market capitalization of $2.23 million and a return on equity of -21.65%. Rover Metals Corp is focused on the exploration and development of its mineral properties in Canada. The company’s primary asset is the Lac de Gras diamond property located in the Northwest Territories.

– Euro Ressources SA ($LTS:0JSG)

Euro Ressources S.A. is a France-based company engaged in the mining sector. The Company, through its subsidiaries, is engaged in the exploration and production of gold in Guyana and Suriname. The Company operates the Rosebel gold mine in Suriname. The Company also owns the Rouyn and Malartic properties located in Quebec, Canada.

– Alamos Gold Inc ($TSX:AGI)

Alamos Gold Inc is a gold mining company with operations in North America. The company has a market capitalization of $4.09 billion and a return on equity of 2.28%. Alamos Gold is engaged in the exploration, development, and production of gold. The company’s mines are located in Canada, Mexico, and Turkey. Alamos Gold also has a minority interest in a gold mine in Greece.

Summary

ROYAL GOLD saw a drop in total revenue of 1.6% year-on-year in the second quarter of FY2023, to USD 144.0 million, and net income decreased 10.8% to USD 63.4 million. Investors should monitor the company’s long-term performance and outlook, as well as any response to current economic conditions. Factors to consider may include ROYAL GOLD’s dividend payouts, capital structure, pricing power, liquidity, and management quality. Additionally, investors should compare the company’s results to the performance of its peers in the gold and precious metal industry.

Recent Posts