Rover Group Stock Surges Double-Digit After Posting Record-Breaking Q4 Earnings and Bookings in 2023.

March 1, 2023

Trending News 🌥️

The results released by the Rover Group ($NASDAQ:ROVR) have sent its stock price into the stratosphere. The company exceeded expectations with its Q4 revenue, which grew substantially year-on-year. This was driven by a surge in bookings, which grew at a record-breaking pace. This meant that the earnings per share (EPS) figure of $0.03 was far higher than predicted, with analysts forecasting a break-even result. Investor confidence was further enhanced by a significant increase in profitability. Year-on-year, the company was able to achieve double-digit operating margins, which is a testament to the company’s efficient business strategy and cost containment initiatives.

Furthermore, the company’s cash position remains strong, allowing it to make strategic investments and drive further growth. The positive results from the Rover Group have had a dramatic impact on its stock price. Shares have surged by as much as double-digits as investors eagerly look forward to what the future holds for the company. With the company in a position of strength, investors believe that there is plenty of upside potential in the company’s stock.

Stock Price

On Tuesday, ROVER GROUP stock surged double-digits, opening at $3.9 and closing at $4.2,representing a 10.3% increase from the previous closing price of $3.8. This came in response to their record-breaking Q4 earnings and bookings in 2023, which has been met with a largely positive sentiment from investors and traders at the time of writing. ROVER GROUP had a great year in 2023, and this stock surge further elevates the company’s financial status. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Rover Group. More…

| Total Revenues | Net Income | Net Margin |

| 174.01 | -21.98 | -15.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Rover Group. More…

| Operations | Investing | Financing |

| 1.65 | -224.96 | 3.36 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Rover Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 418.26 | 109.99 | 1.61 |

Key Ratios Snapshot

Some of the financial key ratios for Rover Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 22.3% | – | -12.3% |

| FCF Margin | ROE | ROA |

| -3.7% | -4.4% | -3.2% |

Analysis

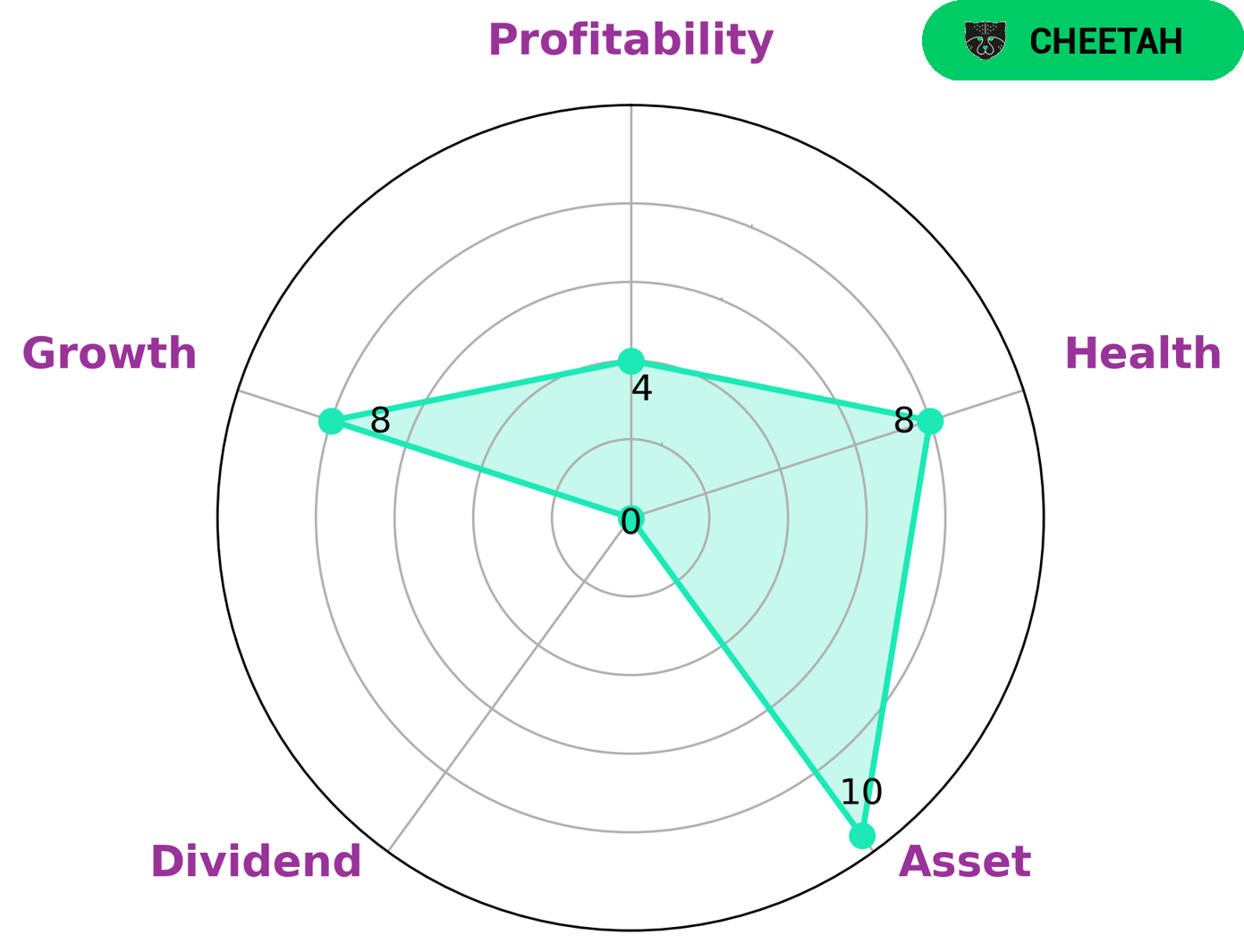

GoodWhale conducted an analysis of ROVER GROUP‘s fundamentals and concluded that the firm has a strong health score of 8/10 according to Star Chart. This indicates that ROVER GROUP is likely to be able to safely ride out any economic downturn without the risk of bankruptcy. ROVER GROUP is classified as a ‘cheetah’, a type of company which achieved high revenue or earnings growth but is considered less stable due to lower profitability when compared to other firms. These companies are particularly attractive to investors focused on capital appreciation and growth. When looking at the firm’s financials, GoodWhale can see that ROVER GROUP is strong in terms of asset, growth, but has a medium performance when it comes to profitability, as well as a weak offering when it comes to dividend payments. Therefore, investors interested in capital appreciation and growth are more likely to be drawn to ROVER GROUP. More…

Peers

It has a number of subsidiaries that provide a range of services for pet owners, including dog walking, pet sitting, and dog boarding. The company also offers a range of pet-related products, including pet insurance and pet food. Rover Group Inc competes with a number of other companies in the pet care industry, including Mad Paws Holdings Ltd, Bright Horizons Family Solutions Inc, and Poppins Corp.

– Mad Paws Holdings Ltd ($ASX:MPA)

Mad Paws Holdings Ltd is an online marketplace for pet services. The company has a market cap of 38.22M as of 2022 and a Return on Equity of -36.33%. Mad Paws connects pet owners with pet care providers in their local area. The company offers a variety of services, including dog walking, pet sitting, and dog boarding.

– Bright Horizons Family Solutions Inc ($NYSE:BFAM)

Bright Horizons Family Solutions Inc is a company that provides child care and early education services. It has a market cap of 3.45B as of 2022 and a ROE of 8.28%. The company has a strong focus on quality and its services are highly rated by parents. It operates in the United States, the United Kingdom, Canada, and India.

– Poppins Corp ($TSE:7358)

Poppins Corp is a leading provider of market intelligence and analysis, with a market cap of 14.92B as of 2022. The company has a strong return on equity of 11.05%, and is considered a reliable source of information and insights on the markets. Poppins Corp provides data and analysis on a wide range of topics, including economic indicators, company financials, and industry trends. The company’s products and services are used by a variety of clients, including investment banks, hedge funds, and private equity firms.

Summary

Rover Group is an up-and-coming company in the technology sector that has seen great success in recent years. They posted a record-breaking fourth quarter in 2023 with double-digit stock surge and bookings on the same day. Analysts are predicting that the company’s investments will continue to bring further success in the coming years.

The stock market has responded positively to the announcement of their Q4 earnings, suggesting that investors are confident in the future of the company. Other reports indicating the approval of new projects and investments from outside sources further suggests that the company is in a strong financial position and is likely to continue its success.

Recent Posts