ROBLOX CORPORATION Reports FY2022 Fourth Quarter Earnings Results for December 31 2022

March 4, 2023

Earnings report

ROBLOX CORPORATION ($NYSE:RBLX) reported their fourth quarter earnings results for FY2022, as of December 31 2022, on February 15 2023. The total revenue for the quarter was USD -289.9 million, a decrease of 102.3% compared to the same period the prior year. Despite the substantial decrease in revenue, ROBLOX CORPORATION experienced an increase in net income of 1.8% over the same period the prior year, totaling USD 579.0 million. These results provide valuable insight into the company’s financial performance in this past quarter and indicate an optimistic outlook for further growth in the future. Despite these challenging factors, ROBLOX CORPORATION has reported a strong performance and continues to show resilience in a difficult economic climate.

Moving forward, ROBLOX CORPORATION will continue to strive to remain competitive by investing in research and development, creating innovative products and services, and expanding its user base. The company is expecting to further increase their user engagement and create substantial long-term value for shareholders. Ultimately, ROBLOX CORPORATION is well-positioned to achieve success and maintain its position of leadership in the gaming industry.

Market Price

The result showed a strong performance, with their stock opening the day at $42.1 and closing at $45.1, a 26.4% increase from its prior closing price of 35.7. The high close is a testament to the company’s positive momentum throughout the fourth quarter, as well as its reliable performance for investors. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Roblox Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 2.23k | -924.37 | -41.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Roblox Corporation. More…

| Operations | Investing | Financing |

| 369.3 | -441.05 | 43.64 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Roblox Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.38k | 5.07k | 0.51 |

Key Ratios Snapshot

Some of the financial key ratios for Roblox Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 63.6% | – | -40.0% |

| FCF Margin | ROE | ROA |

| -2.6% | -152.6% | -10.4% |

Analysis

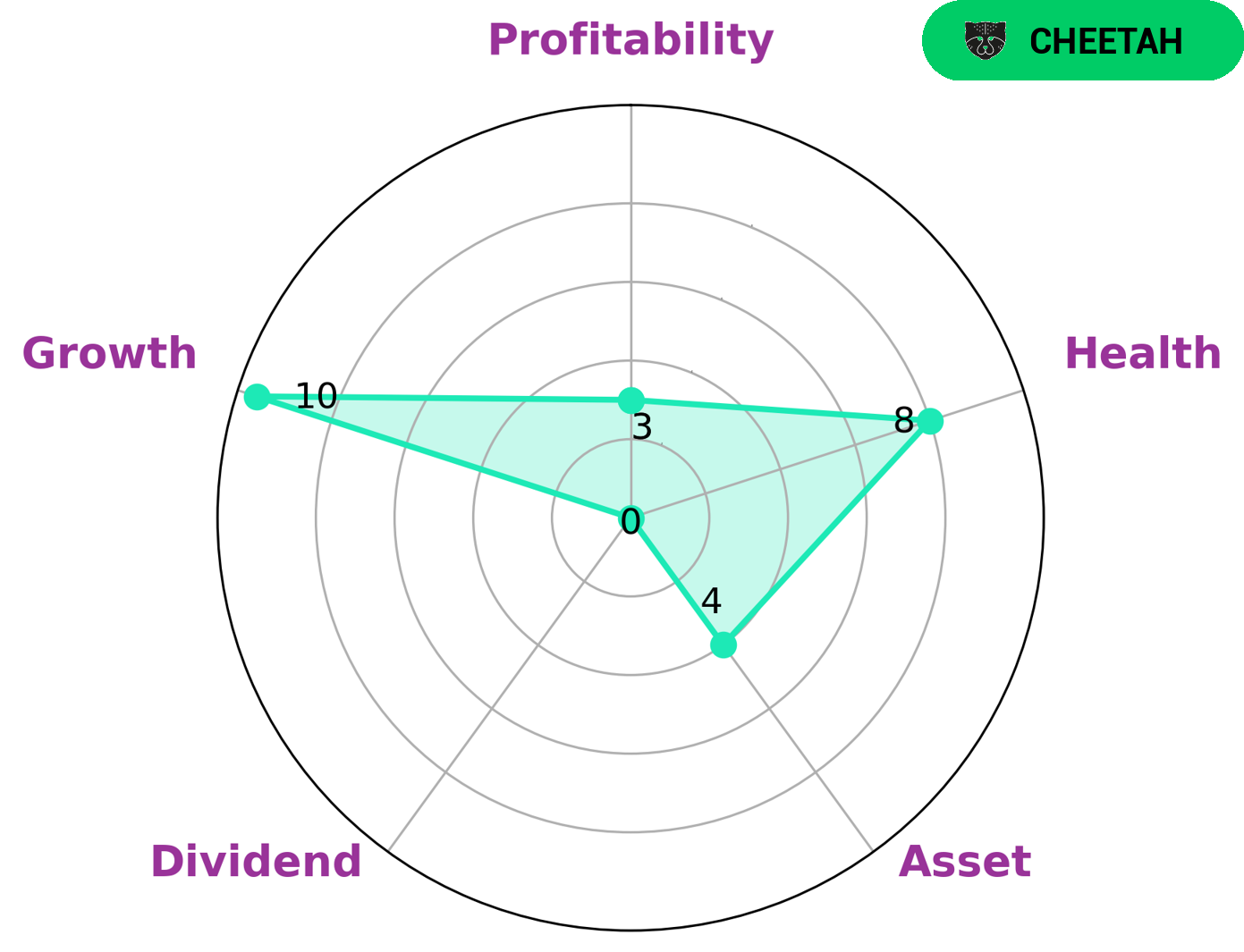

As an analysis conducted by GoodWhale, ROBLOX CORPORATION presents an impressive fundamental picture. According to our Star Chart, ROBLOX CORPORATION has a strong health rating of 8/10 when it comes to cashflow and debt. This is indicative that the corporation is able to pay off its debts and fund future operations. Additionally, ROBLOX CORPORATION falls under the ‘cheetah’ classification, a type of company that often reaps large revenue or earnings growth but can also be considered less stable due to lower profitability. For this reason, ROBLOX CORPORATION may be attractive to different types of investors due to its growth potential, yet medium performance with regards to assets and weak dividend and profitability scores. Overall, ROBLOX CORPORATION presents an interesting opportunity for potential investors. More…

Peers

The company was founded in 2004 and is headquartered in San Mateo, California. Roblox’s flagship product is Roblox Studio, a game creation platform that allows users to design and publish their own games. The company also operates roblox.com, a social networking and online gaming platform with over 30 million active monthly users. Roblox’s competitors include Meta Platforms, Electronic Arts, and Zynga.

– Meta Platforms Inc ($NASDAQ:EA)

Electronic Arts Inc. is an American video game company based in Redwood City, California. It is the second-largest gaming company in the Americas and Europe by revenue and market capitalization, after Activision Blizzard. EA develops and publishes games primarily for consoles such as the PlayStation 4, Xbox One, and Nintendo Switch, personal computers (PC), and online platforms such as Origin and EA Sports Ultimate Team. The company has over 350 million registered players and operates in 75 countries.

Summary

Roblox Corporation reported a decrease in total revenue of 102.3% for the quarter, however, net income increased by 1.8% year over year. This suggests that cost management is helping to control losses in the face of declining revenue. The stock price moved up on news of the results, indicating investor confidence in the company’s ability to turn the situation around and deliver long-term success. Ultimately, Roblox Corporation is an interesting investment opportunity that could potentially present investors with a good return if its strategy pays off in the future.

Recent Posts