ROBLOX CORPORATION Reports Fiscal Year 2022 Fourth Quarter Earnings Results for December 31, 2022

March 6, 2023

Earnings report

ROBLOX CORPORATION ($NYSE:RBLX) reported their fiscal year 2022 fourth quarter earnings results on February 15, 2023 for the period ending December 31, 2022. The overall revenue for the quarter was USD -289.9 million, a decrease of 102.3% compared to the same period the previous year. Despite the significant decline in revenue, net income was USD 579.0 million, which is an increase of 1.8% year over year. This increase in active users played a key role in the net income increase despite the decline in revenue.

Share Price

ROBLOX saw impressive growth, as its stock opened at $42.1 and closed at $45.1, a surge of 26.4% from the previous closing price of 35.7. The impressive stock performance demonstrates ROBLOX’s continuing pursuit and success in creating an excellent virtual social platform experience for its users. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Roblox Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 2.23k | -924.37 | -41.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Roblox Corporation. More…

| Operations | Investing | Financing |

| 369.3 | -441.05 | 43.64 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Roblox Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.38k | 5.07k | 0.51 |

Key Ratios Snapshot

Some of the financial key ratios for Roblox Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 63.6% | – | -40.0% |

| FCF Margin | ROE | ROA |

| -2.6% | -152.6% | -10.4% |

Analysis

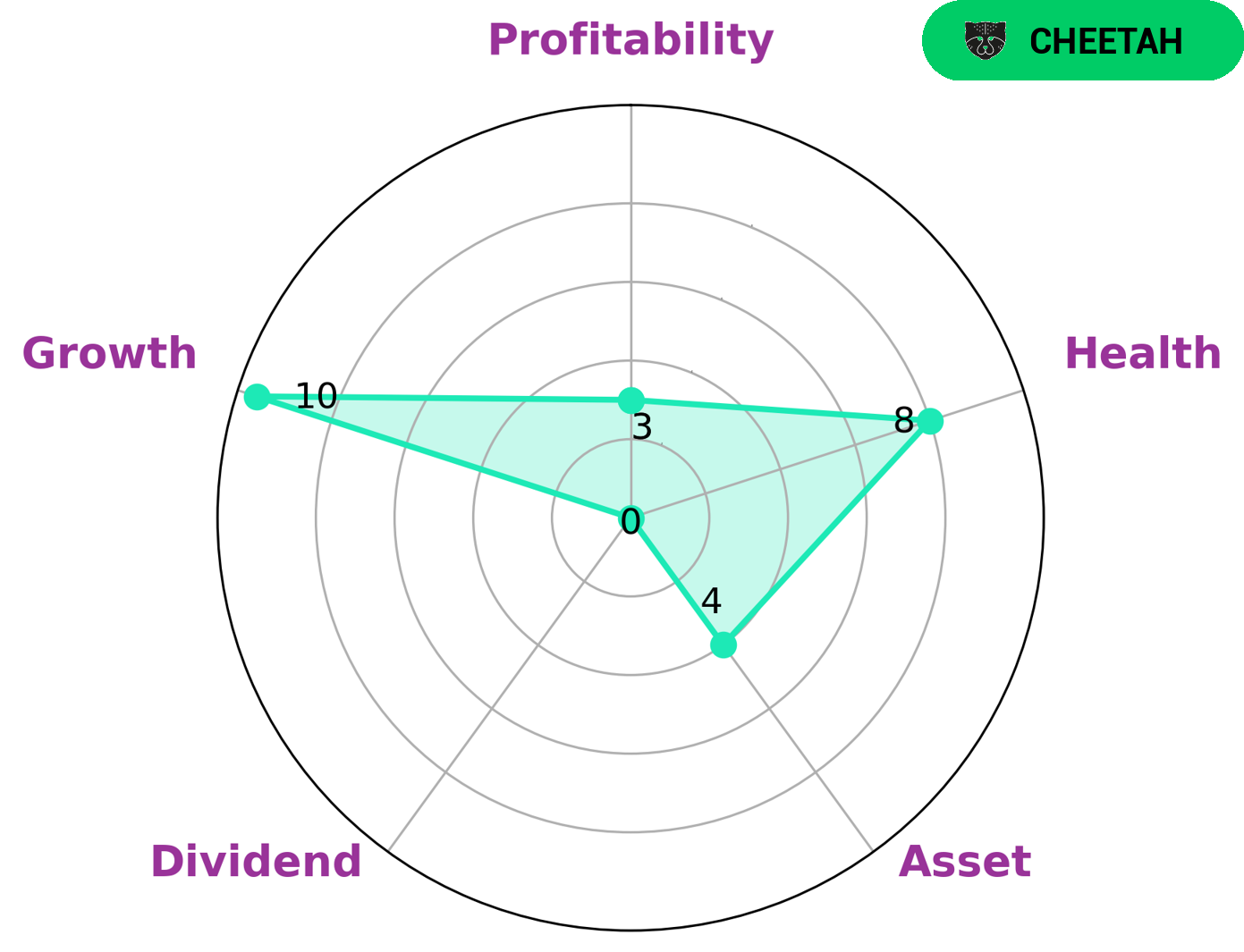

GoodWhale conducted an analysis of ROBLOX CORPORATION‘s wellbeing and the results are impressive. Our Star Chart indicates that ROBLOX CORPORATION is in good health by scoring an 8/10. Taking into account its cashflows and debt, the company is capable to pay off debt and fund future operations. Furthermore, ROBLOX CORPORATION has a good growth profile, a medium asset base and a weak dividend profile. In addition, ROBLOX CORPORATION is classified as a ‘cheetah’, as it has achieved high revenue or earnings growth despite its lower profitability. Considering this analysis, investors that are looking for growth opportunities and are willing to take higher risks may be interested in investing in ROBLOX CORPORATION. As the company has high revenue and earnings growth, investors could potentially benefit from good returns in the long-term. Thus, investors with a short-term outlook and high-risk tolerance may be drawn to ROBLOX CORPORATION. More…

Peers

The company was founded in 2004 and is headquartered in San Mateo, California. Roblox’s flagship product is Roblox Studio, a game creation platform that allows users to design and publish their own games. The company also operates roblox.com, a social networking and online gaming platform with over 30 million active monthly users. Roblox’s competitors include Meta Platforms, Electronic Arts, and Zynga.

– Meta Platforms Inc ($NASDAQ:EA)

Electronic Arts Inc. is an American video game company based in Redwood City, California. It is the second-largest gaming company in the Americas and Europe by revenue and market capitalization, after Activision Blizzard. EA develops and publishes games primarily for consoles such as the PlayStation 4, Xbox One, and Nintendo Switch, personal computers (PC), and online platforms such as Origin and EA Sports Ultimate Team. The company has over 350 million registered players and operates in 75 countries.

Summary

Roblox Corporation recently reported its quarterly results, noting total revenue of USD 289.9 million, a decrease of 102.3% year over year. Despite this, the company reported net income of USD 579.0 million, an increase of 1.8% compared to the same period the previous year. The stock price moved up after the announcement, indicating investor confidence in the company’s future growth prospects. Overall, Roblox Corporation appears to remain in a strong financial position despite the decline in recent revenue, and investors may wish to consider investments in the company for potential long-term returns.

Recent Posts