Roblox Corporation Intrinsic Value Calculation – ROBLOX CORPORATION Reports Second Quarter Fiscal Year 2023 Earnings Results on August 9 2023

August 27, 2023

🌥️Earnings Overview

On August 9 2023, ROBLOX CORPORATION ($NYSE:RBLX) reported their second quarter fiscal year 2023 earnings results, which ended on June 30 2023. The company experienced a significant 15.1% increase in total revenue from the same period in the previous year, coming in at USD 680.8 million. Their net income was reported as USD -282.8 million, a decrease from the -176.4 million loss reported in the prior year.

Stock Price

The company’s stock opened at $32.4, but closed at $29.5—a plunge of 21.9% from its prior closing price of $37.7. ROBLOX CORPORATION attributed the decrease in net income to higher operating expenses which were mainly caused by increased legal and marketing costs. The company also noted that higher purchasing costs associated with game development had a negative effect on their financials. ROBLOX CORPORATION’s CEO, Robert Stephens, commented on the earnings report, stating “Despite the challenging market conditions we faced during the second quarter, ROBLOX CORPORATION was able to maintain a steady growth in revenue thanks to our innovative products and quality user experience. We remain confident that our long-term strategy will help us grow our business and succeed in the years to come.” Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Roblox Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 2.43k | -1.14k | -46.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Roblox Corporation. More…

| Operations | Investing | Financing |

| 388.53 | -3k | 59.55 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Roblox Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.6k | 5.44k | 0.27 |

Key Ratios Snapshot

Some of the financial key ratios for Roblox Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 63.6% | – | -45.5% |

| FCF Margin | ROE | ROA |

| -4.9% | -332.2% | -12.3% |

Analysis – Roblox Corporation Intrinsic Value Calculation

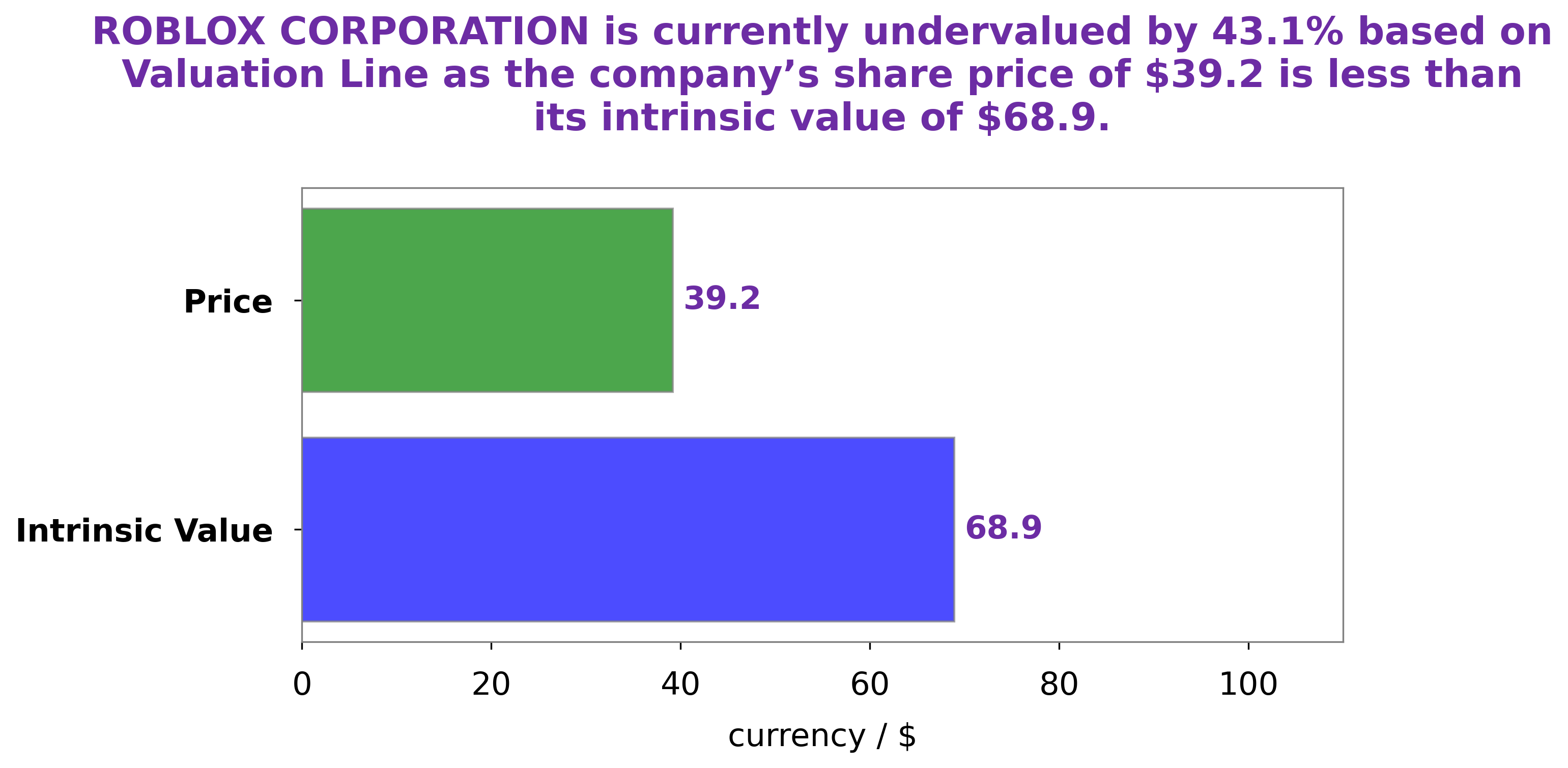

At GoodWhale, we have conducted an analysis of ROBLOX CORPORATION‘s financials, and our proprietary Valuation Line has produced a fair value of around $68.1 per share for the company. However, ROBLOX CORPORATION’s stock is currently trading at $29.5, representing a 56.7% discount to its fair value. This presents an interesting opportunity for investors, as there is potential to capitalize on the discrepancy in share price and fair value. More…

Peers

The company was founded in 2004 and is headquartered in San Mateo, California. Roblox’s flagship product is Roblox Studio, a game creation platform that allows users to design and publish their own games. The company also operates roblox.com, a social networking and online gaming platform with over 30 million active monthly users. Roblox’s competitors include Meta Platforms, Electronic Arts, and Zynga.

– Meta Platforms Inc ($NASDAQ:EA)

Electronic Arts Inc. is an American video game company based in Redwood City, California. It is the second-largest gaming company in the Americas and Europe by revenue and market capitalization, after Activision Blizzard. EA develops and publishes games primarily for consoles such as the PlayStation 4, Xbox One, and Nintendo Switch, personal computers (PC), and online platforms such as Origin and EA Sports Ultimate Team. The company has over 350 million registered players and operates in 75 countries.

Summary

Despite reporting improved revenue of USD 680.8 million for the second quarter of the fiscal year 2023, ROBLOX CORPORATION saw a decrease in net income to USD -282.8 million, resulting in a stock price drop that same day. The company’s revenue increase of 15.1% year-over-year was offset by a loss of -176.4 million in the comparable quarter last year. Investors may want to take this into consideration when making investing decisions regarding ROBLOX CORPORATION. Given the second-quarter results, a closer examination of the company’s finances and strategy may be necessary to determine if the stock is worth investing in.

Recent Posts