REV GROUP Announces FY2023 Q1 Earnings Results for January 31, 2023.

March 25, 2023

Earnings Overview

The REV GROUP ($NYSE:REVG) released its earnings report for the first quarter of FY2023, ending January 31 2023, on March 8 2023. The overall revenue for the quarter was USD -13.5 million, a huge decrease of 1828.6% from the same period in the previous year. However, net income for the quarter was reported to have risen 8.7% to USD 583.5 million compared to the same period in the prior year.

Transcripts Simplified

Conference Call Transcript Operator: Welcome to the Rev Group Conference Call. On the call today, we have Eric Etchart, Chief Executive Officer and President; and John Kiely, Chief Financial Officer. We will begin with opening remarks from Mr. Etchart followed by a financial review from Mr. Kiely and then open the call for questions. Eric Etchart: Thank you for joining us. We continued to see strong demand in our core market segments and are executing on our key initiatives to drive profitable growth.

John Kiely: Thanks Eric. Operator: Thank you. We will now open the call for questions.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Rev Group. More…

| Total Revenues | Net Income | Net Margin |

| 2.38k | 2.4 | 0.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Rev Group. More…

| Operations | Investing | Financing |

| 88.4 | -13.4 | -65.9 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Rev Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.4k | 960.9 | 7.4 |

Key Ratios Snapshot

Some of the financial key ratios for Rev Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -0.5% | -3.6% | 1.0% |

| FCF Margin | ROE | ROA |

| 2.7% | 3.4% | 1.1% |

Share Price

On Wednesday, REV GROUP Inc. announced its first quarter earnings results for the fiscal year 2023, ending January 31, 2023. The results showed that REV GROUP’s stock opened at $13.9 and closed at $12.7, representing a 2.2% increase from the prior closing price of $12.4. This impressive growth was mainly attributed to the strong performance of its core products and services as well as its key acquisitions over the past year. REV GROUP continues to focus on its long-term goals, including expanding its portfolio of products and services, and investing in infrastructure and technology to create a competitive edge in the industry. In particular, its focus on digital transformation and cloud-based solutions has resulted in higher levels of customer satisfaction and greater efficiency.

Overall, it appears that REV GROUP’s strategy is paying off, resulting in strong financial results such as these. The company’s stock is up 2.2%, showing that investors are confident about the company’s future prospects. Investors will be monitoring the company’s next quarterly report to see if it can continue its trajectory of profitability and growth. Live Quote…

Analysis

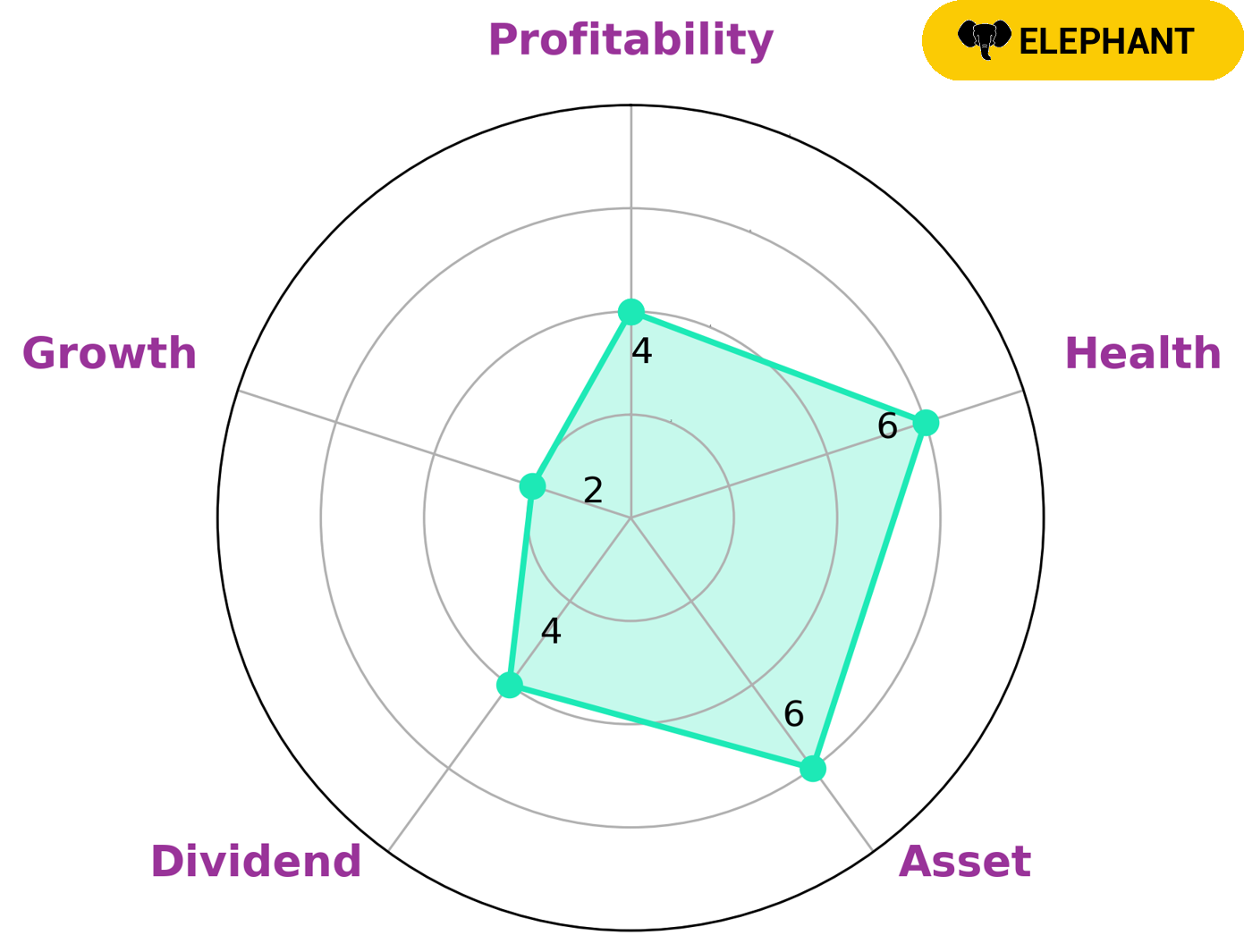

At GoodWhale, we recently conducted an analysis of REV GROUP‘s wellbeing. Our findings are shown through our Star Chart, which reveals that REV GROUP has an intermediate health score of 6/10 when considering its cashflows and debt. This score suggests that REV GROUP is likely to sustain future operations in times of crisis. We classified REV GROUP as an ‘elephant’ – a type of company that is rich in assets after deducting off liabilities. Looking at the individual components of the Star Chart, we concluded that REV GROUP is strong in assets, medium in dividend, profitability and weak in growth. Based on these results, we believe that REV GROUP would be of particular interest to investors looking for a company with a solid balance sheet and steady cashflow. These investors may be looking for a more secure long-term investment, which REV GROUP provides. More…

Peers

The competition between REV Group Inc and its competitors, Buhler Industries Inc, The Shyft Group Inc and Ashok Leyland Ltd, is fierce. Each company is striving to outdo the other in terms of product quality, customer service, and innovation. With such strong competition, the industry is constantly evolving and providing customers with the latest products and services.

– Buhler Industries Inc ($TSX:BUI)

Buhler Industries Inc is a publicly traded company based in Winnipeg, Manitoba, Canada. It is primarily engaged in the design, manufacture, and sale of agricultural equipment and related products. The company has a market cap of 47.5M as of 2022, with a Return on Equity (ROE) of 12.01%. This indicates that the company is performing well financially, as the ROE is relatively high compared to other companies in the industry. Buhler Industries Inc also offers a wide range of services and products, such as grain handling, material handling, hay and forage equipment, as well as small engine power products. The company also has a strong presence in the North American market, with a strong customer base and an extensive dealer network.

– The Shyft Group Inc ($NASDAQ:SHYF)

The Shyft Group Inc is a leading provider of digital identity, compliance, and employment verification services. The company has a market capitalization of 867.65M as of 2022, which indicates that it is a well-established player in the industry. Furthermore, its Return on Equity (ROE) of 11.13% indicates that the company is able to generate strong profits from its investments. The Shyft Group Inc’s digital identity and compliance offerings enable customers to securely manage and share identity information and verify worker credentials at a fraction of the cost and time of traditional methods. The company is also well-positioned to capitalize on the increasing demand for digital identity solutions in the global markets.

– Ashok Leyland Ltd ($BSE:500477)

Ashok Leyland Ltd is an Indian automobile manufacturing company that was founded in 1948. It is the second largest commercial vehicle manufacturer in India and the fourth largest manufacturer of buses in the world. The company has a market cap of 404.6 billion as of 2022 and a Return on Equity (ROE) of 21.98%. This shows that the company has been successful in delivering returns to its shareholders and has a strong capital structure. Ashok Leyland Ltd produces a wide range of commercial vehicles including trucks, buses, light commercial vehicles, and defense vehicles. It also provides spare parts and other services for their vehicles. The company has a strong presence in India, Africa, Asia, and the Middle East.

Summary

Investors should take note of REV GROUP‘s performance in FY2023 Q1. The company reported total revenue of USD -13.5 million, a steep year-over-year decline of 1828.6%. Despite the decrease in revenue, the company still reported net income of USD 583.5 million, an 8.7% increase compared to the previous year.

This suggests that REV GROUP is performing well despite the overall economic downturn, and is well positioned to weather any future market volatility. Investors should keep an eye on this company as they look for potential investments.

Recent Posts