REPLIGEN CORPORATION Reports Positive Financial Results for 2nd Quarter of FY2023

August 14, 2023

☀️Earnings Overview

On August 2 2023, REPLIGEN CORPORATION ($NASDAQ:RGEN) announced their financial results for the second quarter of FY2023, ending on June 30 2023. Total revenue for the quarter was USD 159.2 million, a decrease of 23.3% year on year. Net income for the quarter was USD 20.1 million, representing a decrease of 59.8% compared to the same quarter of the previous year.

Market Price

The company opened at a market price of $165.3 and closed at $170.5 for the day, up 2.0% from its prior closing price of $167.1. This reflects a strong performance by the company and confidence in its future prospects. It has a wide product portfolio including drugs approved by the FDA and active clinical trials for new products. The company also received positive results in the previous quarter, indicating a consistent trend in its financial performance.

Investors have responded positively to the stock’s performance, demonstrating their confidence in the company’s future prospects. With its robust product portfolio, strong financial positions and promising pipeline of products, REPLIGEN CORPORATION is well-positioned for continued success in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Repligen Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 729.33 | 138.03 | 14.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Repligen Corporation. More…

| Operations | Investing | Financing |

| 160.12 | -233.24 | -13.34 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Repligen Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.55k | 578.08 | 34.85 |

Key Ratios Snapshot

Some of the financial key ratios for Repligen Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 34.1% | 44.2% | 22.3% |

| FCF Margin | ROE | ROA |

| 6.2% | 5.2% | 4.0% |

Analysis

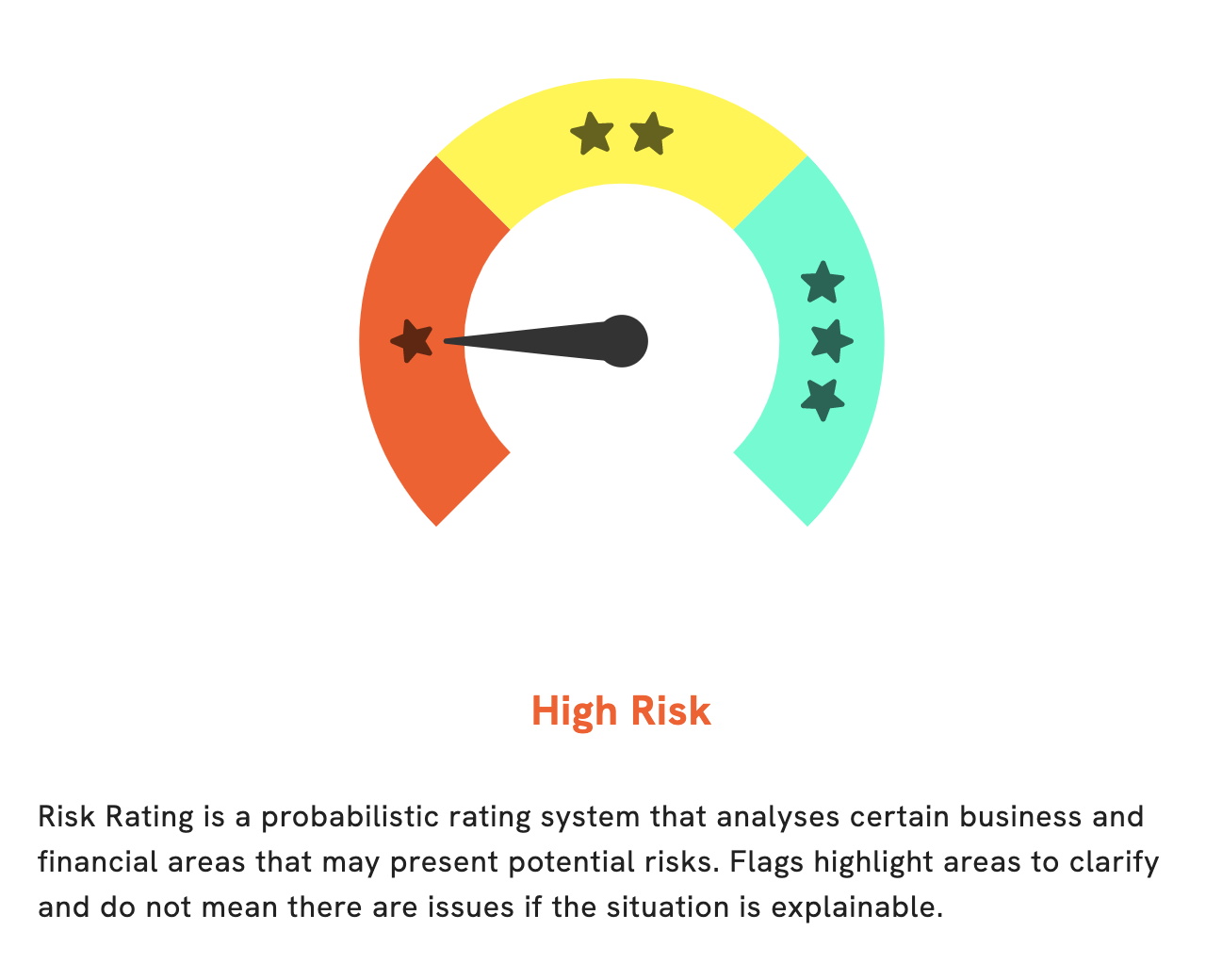

At GoodWhale, we have analysed the wellbeing of REPLIGEN CORPORATION and have concluded that it is a high risk investment with regards to its financial and business aspects. Our Risk Rating system has detected 3 risk warnings in their income sheet, balance sheet and cashflow statement. If you would like to know more about these warnings, please register on our website, goodwhale.com, for detailed information. More…

Peers

The company’s products include proteins and antibodies for the treatment of cancer, central nervous system disorders, and infectious diseases. ReGen Biologics Inc, Tecan Group AG, Stevanato Group SPA are all competitors in the market for developing and commercializing therapeutics.

– ReGen Biologics Inc ($OTCPK:RGBOQ)

Regen Biologics, Inc. is a biotechnology company, which focuses on the development, commercialization, and marketing of products in the orthopedic regenerative medicine field. The company’s products include collagen-based scaffolds for use in orthopedic and sports medicine indications. It operates in the United States, Europe, and Asia. The company was founded by David A. Jay and Stephen J. Sacks in 1997 and is headquartered in Laguna Niguel, CA.

– Tecan Group AG ($OTCPK:TCHBF)

Tecan Group AG is a Swiss-based manufacturer of laboratory instruments and solutions for the life sciences sector. The company has a market cap of 4.54B as of December 2020 and a Return on Equity of 6.13%. Tecan Group AG’s products are used in academic and commercial research laboratories, as well as in clinical diagnostic laboratories. The company’s instruments are used for a variety of applications, including drug discovery and development, biopharmaceutical production, food safety testing, and environmental monitoring.

– Stevanato Group SPA ($NYSE:STVN)

Stevanato Group is a leading provider of integrated solutions for the pharmaceutical and biotech industry. The Group offers a complete range of services, from design and development to manufacturing and packaging of finished products. The Group’s products are used in a wide range of therapeutic areas, including cancer, immunology, infectious diseases and neurology.

Summary

Repligen Corporation‘s second quarter of FY2023 financial results show a decrease in total revenue and net income year over year. Total revenue for the quarter was USD 159.2 million, a 23.3% decline compared to the same quarter of the previous year, while net income was USD 20.1 million, representing a 59.8% decrease. For investors, this signals a potential dip in the company’s performance and suggests that the stock may be a risky investment at this time. It is important to note that these results are for a single quarter and may not represent the company’s overall performance for the entire fiscal year.

Recent Posts