RED ROBIN GOURMET BURGERS Reports Strong Second Quarter Earnings for FY2023

August 20, 2023

☀️Earnings Overview

RED ROBIN GOURMET BURGERS ($NASDAQ:RRGB) announced its financial results for the second quarter of FY2023 on August 17, 2023. Revenue for the quarter ending June 30, 2023 was USD 298.6 million, a rise of 1.6% from the same period in the previous year. Net income rose 121.9% to USD 3.9 million.

Market Price

The stock opened at $11.5 and closed at $10.9, a decrease of 4.5% from its prior closing price of $11.4. The positive earnings report reflects the strong progress that RED ROBIN GOURMET BURGERS has made in recent years. The company has continued to expand its footprint and improve its operations, helping it to remain competitive in an increasingly crowded marketplace. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for RRGB. More…

| Total Revenues | Net Income | Net Margin |

| 1.29k | -56.1 | -3.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for RRGB. More…

| Operations | Investing | Financing |

| 35.53 | -29.57 | 29.53 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for RRGB. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 798.4 | 795.37 | 0.19 |

Key Ratios Snapshot

Some of the financial key ratios for RRGB are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.7% | -54.9% | -2.6% |

| FCF Margin | ROE | ROA |

| -0.2% | -490.9% | -2.6% |

Analysis

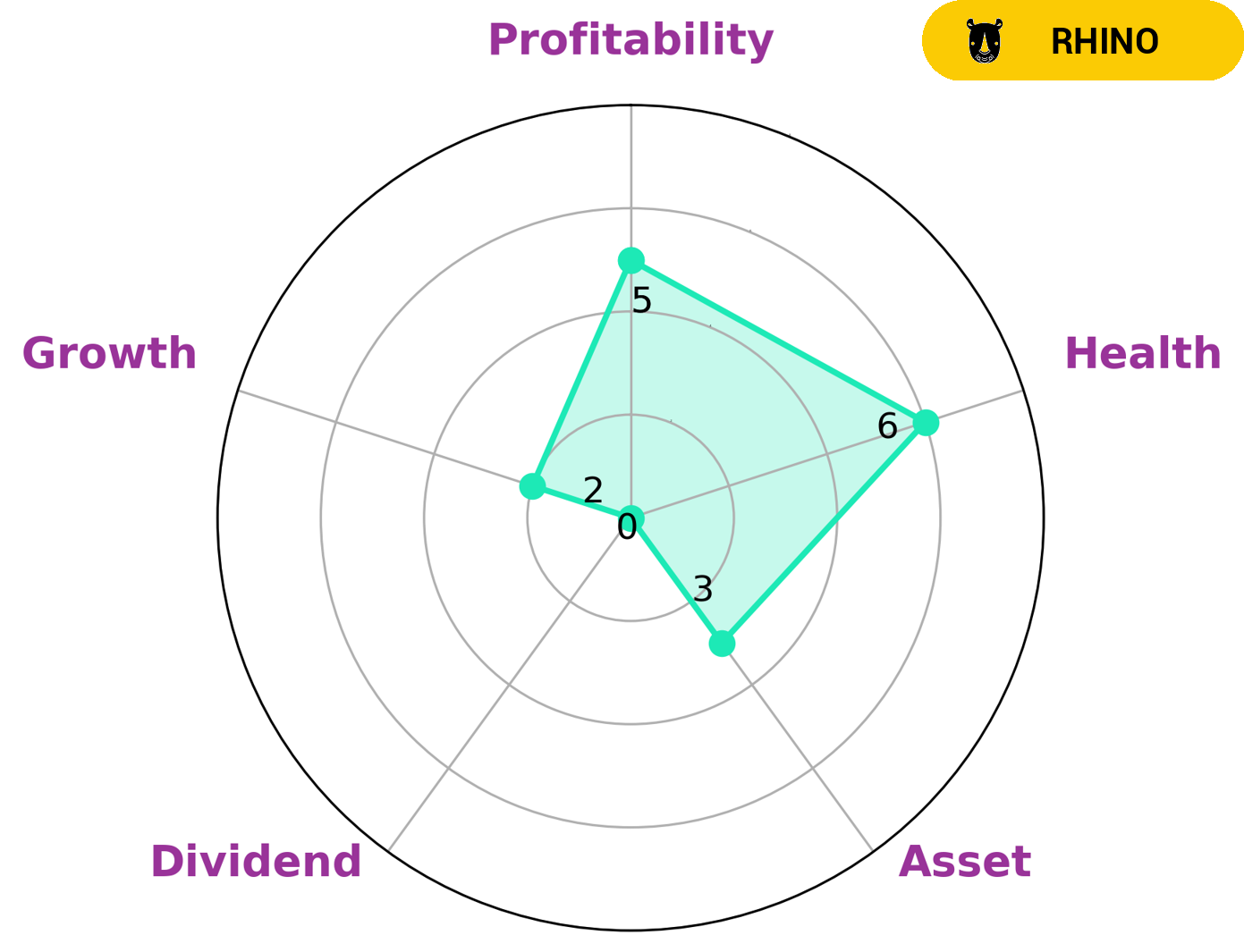

As a part of GoodWhale’s assessment of RED ROBIN GOURMET BURGERS’s wellbeing, we have classified them as ‘sloth’, meaning they have achieved revenue or earnings growth slower than the overall economy. Our Star Chart analysis reveals that RED ROBIN GOURMET BURGERS is strong in profitability and weak in asset, dividend, and growth. Additionally, they have an intermediate health score of 6/10 with regard to their cash flows and debt, suggesting that they may be able to safely ride out any crisis without the risk of bankruptcy. Given this deep dive into RED ROBIN GOURMET BURGERS’s financial standing, we believe that value investors and long-term investors may be interested in this company, as they are likely to purchase stocks at low prices and hope that the company performs better in the future. More…

Peers

Alsea SAB de CV, Arcos Dorados Holdings Inc, and Papa John’s International Inc are all companies that specialize in different types of food, but all three are competitors of Red Robin Gourmet Burgers Inc.

– Alsea SAB de CV ($OTCPK:ALSSF)

Alsea SAB de CV is a Mexico-based company engaged in the food and beverage industry. It operates through four segments: Restaurants, Food Service, Retail and Others. The Company’s restaurant brands include Starbucks, Domino’s Pizza, Burger King, The Cheesecake Factory, California Pizza Kitchen, among others. The Food Service segment provides food service to companies and institutions. The Retail segment offers a range of food and non-food products through stores, such as Walmart, Soriana, Chedraui, Comercial Mexicana, Costco and Sam’s Club, among others. The Others segment comprises of Alsea’s Digital business, which provides e-commerce and technology solutions, as well as its Fresh business, which supplies fresh food products to restaurants and food service customers.

– Arcos Dorados Holdings Inc ($NYSE:ARCO)

Arcos Dorados Holdings Inc is a holding company for McDonald’s restaurants in Latin America and the Caribbean. The company has a market cap of 1.48B as of 2022 and a Return on Equity of 60.96%. Arcos Dorados operates over 2,200 McDonald’s restaurants in 20 countries and territories in Latin America and the Caribbean.

– Papa John’s International Inc ($NASDAQ:PZZA)

Papa John’s International Inc is a pizza chain with over 3,300 locations in 44 countries. The company was founded in 1984 and is headquartered in Louisville, Kentucky. Papa John’s has a market cap of $3.08 billion and a return on equity of -26.94%. The company’s revenue and net income have both declined in recent years, and its stock price has been volatile.

Summary

RED ROBIN GOURMET BURGERS released its earnings report for the second quarter of FY2023 on August 17, 2023. Revenue for the quarter ending June 30, 2023 rose 1.6% year-on-year to USD 298.6 million and net income increased 121.9% to USD 3.9 million. Despite these positive figures, stock prices fell on the day the report was released.

The investor should pay attention to this discrepancy as it could suggest potential risks that could affect the company’s prospects in the near future. Therefore, investors should conduct further research into the company’s operations before making any investing decisions.

Recent Posts