PHREESIA Reports Q3 Earnings of USD 73.1 Million, Up 30.7% YOY

December 30, 2022

Earnings report

On December 8, 2022, PHREESIA ($NYSE:PHR) reported its earnings results for the third quarter of FY2023, ending October 31, 2022. PHREESIA is a healthcare technology company that provides cloud-based software solutions that automate the administrative and clinical tasks of physician practices. For the third quarter, PHREESIA reported total revenue of USD 40.2 million, a decrease of 10.5% compared to the same period last year.

However, its net income for the quarter was USD 73.1 million, an increase of 30.7% from the prior year. This was due to the company’s cost-cutting measures and efficiency initiatives that allowed it to reduce its operating expenses. This was driven by the company’s improved financial discipline, which allowed it to reduce its debt levels, increase its liquidity, and strengthen its balance sheet. Overall, these results demonstrate PHREESIA’s strong performance in the third quarter of FY2023 and its commitment to delivering value to its customers and shareholders. The company’s management remains confident in its ability to continue to deliver strong financial results in the current fiscal year and beyond.

Share Price

On Thursday, PHREESIA, Inc. reported its Q3 earnings of USD 73.1 million, up 30.7% from the same quarter last year. This increase in earnings was attributed to strong growth in their core solutions, as well as increased demand for their patient intake and engagement services. In response to this news, PHREESIA stock opened at $26.3 and closed at $26.7, up by 2.5% from the previous closing price of 26.0. This is a positive indication of investor faith in the company’s performance and future prospects.

In addition, PHREESIA reported strong revenue growth in both its core solutions and newer offerings. Overall, PHREESIA’s Q3 results show the company is on a path of strong growth and expansion. As more healthcare organizations continue to adopt PHREESIA’s solutions, the company is well-positioned to capitalize on the growing demand for its services. Investors seem to agree, as evidenced by the recent surge in the company’s stock price. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Phreesia. More…

| Total Revenues | Net Income | Net Margin |

| 262.34 | -184.58 | -70.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Phreesia. More…

| Operations | Investing | Financing |

| -112.2 | -60.27 | -18.33 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Phreesia. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 397.29 | 76.95 | 6.08 |

Key Ratios Snapshot

Some of the financial key ratios for Phreesia are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 30.4% | – | -69.7% |

| FCF Margin | ROE | ROA |

| -52.6% | -34.2% | -28.8% |

VI Analysis

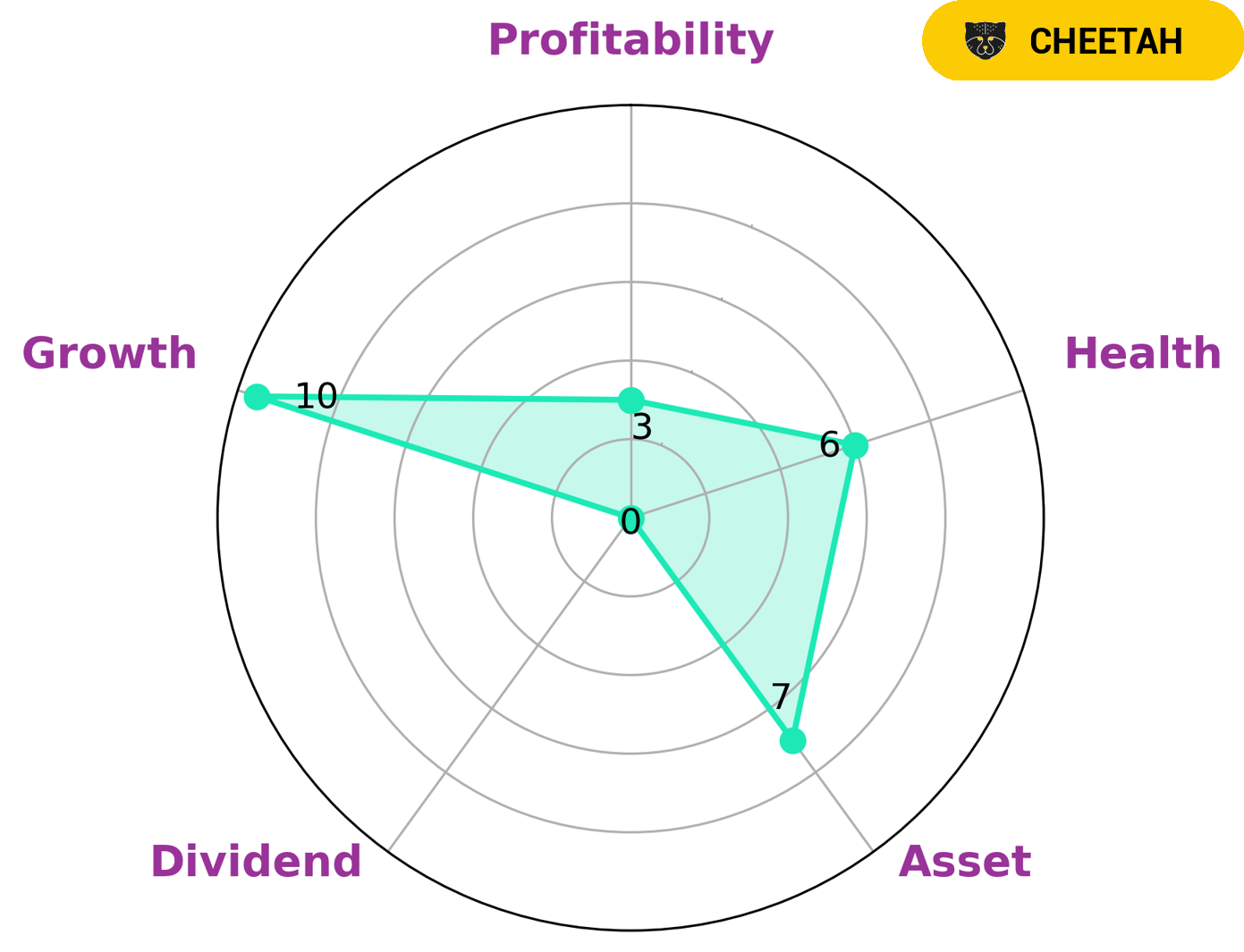

Company fundamentals are essential for investors to evaluate a company’s long-term potential. VI app has simplified the analysis of these fundamentals for PHREESIA by providing a VI Star Chart. The VI Star Chart shows that PHREESIA has an intermediate health score of 6/10 in terms of its cashflows and debt, suggesting that it could potentially ride out any economic crisis without the risk of bankruptcy. The fundamentals of PHREESIA are strong in assets and growth, but weak in dividend and profitability. This makes PHREESIA a ‘cheetah’ company, which is defined as one that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Given the characteristics of PHREESIA, investors who may be interested in such a company are those who have an appetite for higher risk investments that are potentially more rewarding. These investors may be interested in opportunities for capital gains rather than income from dividends, as well as opportunities for growth that may not be available in other, more stable companies. More…

VI Peers

Its competitors include Sharecare Inc, Aclarion Inc, and Cloud DX Inc.

– Sharecare Inc ($NASDAQ:SHCR)

Sharecare is a digital health company that allows users to manage their health and wellness in one place. The company has a wide range of products and services, including a social media platform, a health information database, and a mobile app. The company also offers a variety of health and wellness products and services, including fitness tracking, nutrition counseling, and stress management.

– Aclarion Inc ($NASDAQ:ACON)

Aclarion Inc is a publicly traded company with a market cap of 6.36M as of 2022. The company has a Return on Equity of -186.66%. Aclarion is a provider of cloud-based software solutions for the management of enterprise content. The company’s products and services include content management, document management, records management, and compliance management. Aclarion’s solutions are used by organizations in a variety of industries, including healthcare, financial services, government, and education.

– Cloud DX Inc ($TSXV:CDX)

A market cap is the total value of all a company’s shares of stock. Market cap is calculated by multiplying a company’s shares outstanding by the current market price of one share. The return on equity is a financial ratio that measures the profitability of a company in relation to the equity. The company’s equity is the difference between its total assets and total liabilities. The company’s ROE is its net income divided by its equity.

The company’s market cap is 10.81M as of 2022. The company’s ROE is 111.76%. The company’s net income is its total assets minus its total liabilities. The company’s market cap is its shares outstanding multiplied by the current market price of one share.

Summary

Investors interested in PHREESIA should take note of its third-quarter earnings results for FY2023. The company reported total revenue of USD -40.2 million, down 10.5% from the prior year, but net income was up 30.7% to USD 73.1 million. Despite the decline in revenue, investors should still consider the strong year-over-year growth in net income, which reflects the underlying strength of the company’s operations.

Additionally, investors should evaluate the company’s cash flow and balance sheet, as well as its competitive position in the industry, to determine if PHREESIA is a good fit for their portfolio. Long-term investors should be sure to research the company’s future growth prospects, as well as its ability to manage risks associated with the current economic environment. Overall, PHREESIA appears to be a good investment option for those looking to diversify their portfolio and take advantage of the company’s potential for long-term growth.

Recent Posts