PETROLEO BRASILEIRO SA PETROBRAS Reports Q4 FY2022 Earnings Results on December 31, 2022.

March 15, 2023

Earnings Overview

On December 31, 2022, PETROLEO BRASILEIRO SA PETROBRAS ($NYSE:PBR.A) announced their earnings results for the fourth quarter of FY2022, which ended on that day. Total revenue for the quarter was reported as USD 8.2 billion, a 46.1% increase compared to the same period of the previous year. Moreover, the company reported net income of USD 30.2 billion for the quarter, a 25.6% increase from the same period of the previous year.

Share Price

The stock opened at $9.5, and closed the day at the same price, down by 2.3% from the previous closing price of 9.7. This indicates a decrease in the company’s performance compared to the same period last year. This decrease in revenue is likely due to the challenging economic environment and global pandemic, which have caused disruption and volatility in global markets and the oil and gas industry more broadly. Despite the decrease in revenue year-over-year, PETROLEO BRASILEIRO SA PETROBRAS reported a growth in cost control expenses, which decreased by 9.7% due to efficient management and cost cutting initiatives. Overall, PETROLEO BRASILEIRO SA PETROBRAS has demonstrated strong financial performance during this challenging period for the oil and gas industry and global markets more broadly. Despite the decrease in revenue year-over-year, their efficient cost-control initiatives have enabled them to increase their profit margins and reduce their net debt significantly.

Additionally, their continued investments in expanding production capacity have provided them with a competitive edge in the highly competitive energy market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for PBR.A. More…

| Total Revenues | Net Income | Net Margin |

| 124.47k | 36.62k | 31.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for PBR.A. More…

| Operations | Investing | Financing |

| 49.72k | -432 | -51.45k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for PBR.A. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 187.19k | 117.36k | 10.56 |

Key Ratios Snapshot

Some of the financial key ratios for PBR.A are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.6% | 44.4% | 45.7% |

| FCF Margin | ROE | ROA |

| 32.2% | 51.3% | 19.0% |

Analysis

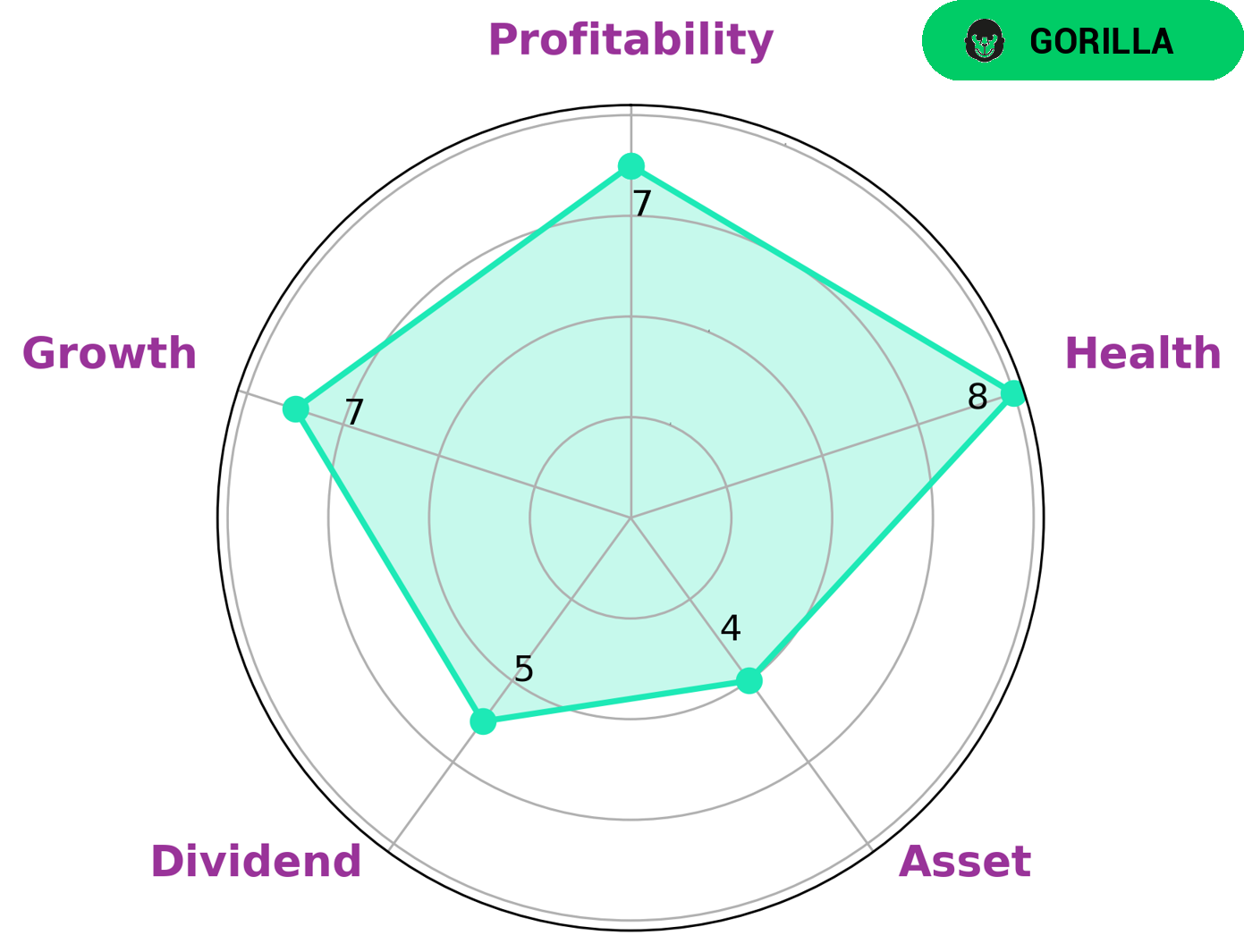

GoodWhale recently conducted an analysis of PETROLEO BRASILEIRO SA PETROBRAS’s wellbeing and found that it is strong in growth, profitability, and medium in asset, dividend on Star Chart. PETROLEO BRASILEIRO SA PETROBRAS has a high health score, rated 8/10, considering its cashflows and debt, indicating that it is capable to sustain future operations in times of crisis. Furthermore, PETROLEO BRASILEIRO SA PETROBRAS is classified as a ‘gorilla’, a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. We believe investors interested in long term investments may find PETROLEO BRASILEIRO SA PETROBRAS attractive due to its strong financial performance, and secure future outlook. More…

Summary

Investors in PETROLEO BRASILEIRO SA PETROBRAS (PETROBRAS) may be pleased with the strong financial results seen in the fourth quarter of FY2022. Total revenue for the quarter was USD 8.2 billion, up 46.1% from the same period in the prior year. Net income for the quarter was even higher, coming in at USD 30.2 billion, a 25.6% increase from the previous year.

These results suggest that PETROBRAS is performing well and that there may be positive opportunities for investors. Analysts will be closely monitoring the company’s progress to determine whether these strong quarterly results can be sustained in the long term.

Recent Posts