PBR.A Stock Fair Value Calculator – PETROLEO BRASILEIRO SA PETROBRAS Reports Earnings Results for Q4 2022 on March 2, 2023

April 7, 2023

Earnings Overview

PETROLEO ($NYSE:PBR.A): PETROBRAS closed out fiscal year 2022 on December 31, 2022, and reported its earnings results on March 2, 2023.

Share Price

On Thursday, March 2, 2023, PETROLEO BRASILEIRO SA PETROBRAS reported its earnings results for the fourth quarter of 2022. The stock opened the day at $9.5, and closed at the same price, down by 2.3% from its prior closing price of 9.7. This decrease in the value of the stock was mainly caused by the company’s weaker-than-expected performance in the fourth quarter.

Additionally, reduced production from Petrobras’ offshore fields also contributed to the decline in revenue. Despite the lower than expected results for the quarter, the company’s executives remain confident about its future prospects, citing increased investment in exploration and production activities, which are expected to lead to improved operational efficiency and profitability in the near future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for PBR.A. More…

| Total Revenues | Net Income | Net Margin |

| 124.47k | 36.62k | 31.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for PBR.A. More…

| Operations | Investing | Financing |

| 49.72k | -432 | -51.45k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for PBR.A. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 187.19k | 117.36k | 10.65 |

Key Ratios Snapshot

Some of the financial key ratios for PBR.A are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.6% | 44.4% | 45.7% |

| FCF Margin | ROE | ROA |

| 32.2% | 51.3% | 19.0% |

Analysis – PBR.A Stock Fair Value Calculator

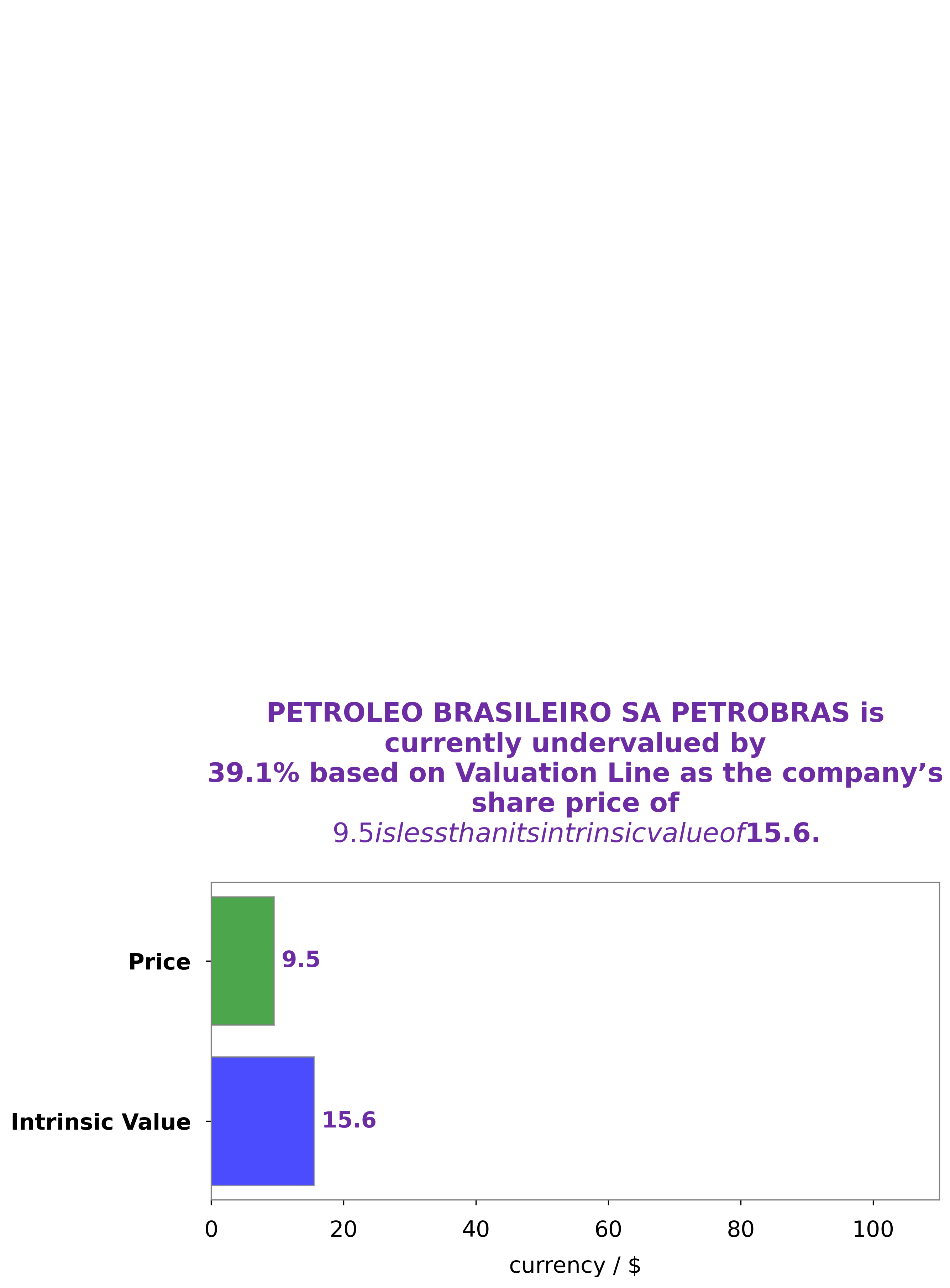

At GoodWhale, we have performed an in-depth analysis of PETROLEO BRASILEIRO SA PETROBRAS’s fundamentals. Our proprietary Valuation Line has revealed that the intrinsic value of PETROLEO BRASILEIRO SA PETROBRAS share is around $15.6. Currently, the stock is traded at $9.5, meaning that it is undervalued by 39.0%. We believe that this presents a buying opportunity for investors with a long-term perspective. More…

Summary

PETROLEO BRASILEIRO SA PETROBRAS reported strong financial results at the end of its fiscal year 2022, with total revenue increasing 46.1% to USD 8.2 billion and net income increasing 25.6% to USD 30.2 billion. Investors may be attracted to the company’s performance, as well as its diversified portfolio of oil and natural gas projects across Brazil and abroad. Its strong balance sheet, cash flows from operating activities, and leverage may provide further assurance that PETROLEO BRASILEIRO SA PETROBRAS is well-positioned to deliver long-term value. Despite potential risks such as macroeconomic and geopolitical volatility, PETROLEO BRASILEIRO SA PETROBRAS’ solid performance and prospects make it a compelling option for investors seeking to benefit from the long-term potential of oil and natural gas production.

Recent Posts