NGL ENERGY PARTNERS LP Reports Third Quarter Fiscal Year 2023 Earnings Results on December 31, 2022.

March 28, 2023

Earnings Overview

NGL ENERGY PARTNERS LP ($NYSE:NGL) released its earnings report for the fiscal year 2023 quarter ending February 9, 2023, on December 31, 2022. The company had total revenue of USD 58.5 million, which was an increase of 409.4% compared to the same period in the prior year. Net income for the quarter was USD 2139.2 million, a decrease of 1.5% from the same quarter of the previous year.

Transcripts Simplified

NGL Energy Partners LP reported strong fourth quarter results, increasing their Water Solutions adjusted EBITDA guidance from over $430 million to over $440 million for fiscal ’23. They repurchased $100 million of the ’23 unsecured notes, leaving a current balance of $203 million with plans to fully retire by June 30. Total liquidity at the end of the third fiscal quarter was approximately $280 million and borrowings on the ABL facility of $156 million. The process to extend the $100 million accordion feature within the ABL should be completed by mid-February.

Total leverage should be below 4.75x at the end of this fiscal year, and Water Solutions is benefiting from owning and operating the largest integrated network of large diameter-produced Water pipelines and disposal wells in the Delaware Basin. Water disposal volumes grew 32% this quarter over the same quarter a year ago and 7% versus last quarter.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for NGL. More…

| Total Revenues | Net Income | Net Margin |

| 9.18k | -61.84 | 0.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for NGL. More…

| Operations | Investing | Financing |

| 385.8 | -187.97 | -198.75 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for NGL. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.91k | 5.11k | 5.97 |

Key Ratios Snapshot

Some of the financial key ratios for NGL are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -26.7% | 9.7% | 3.5% |

| FCF Margin | ROE | ROA |

| 2.5% | 26.6% | 3.4% |

Share Price

The stock opened at $1.7 and closed at $1.7, representing a 4.9% increase from the previous days closing price of 1.6. This jump in the share price indicates that investors are optimistic about the company’s future prospects. This increase was driven by higher production and sales volumes as well as higher oil and gas prices. This increase in profits was mainly due to the company’s increased focus on their core midstream operations, which has allowed them to reduce costs while increasing their sales volumes.

Furthermore, their cost of capital investments was also reduced through the utilization of tax credits and other incentives. Overall, NGL ENERGY PARTNERS LP has reported impressive earnings for the third quarter of fiscal year 2023, indicating its strong financial performance in the current market conditions. Investors are optimistic about the company’s future prospects as they continue to focus on their core midstream operations in order to drive growth and profitability. Live Quote…

Analysis

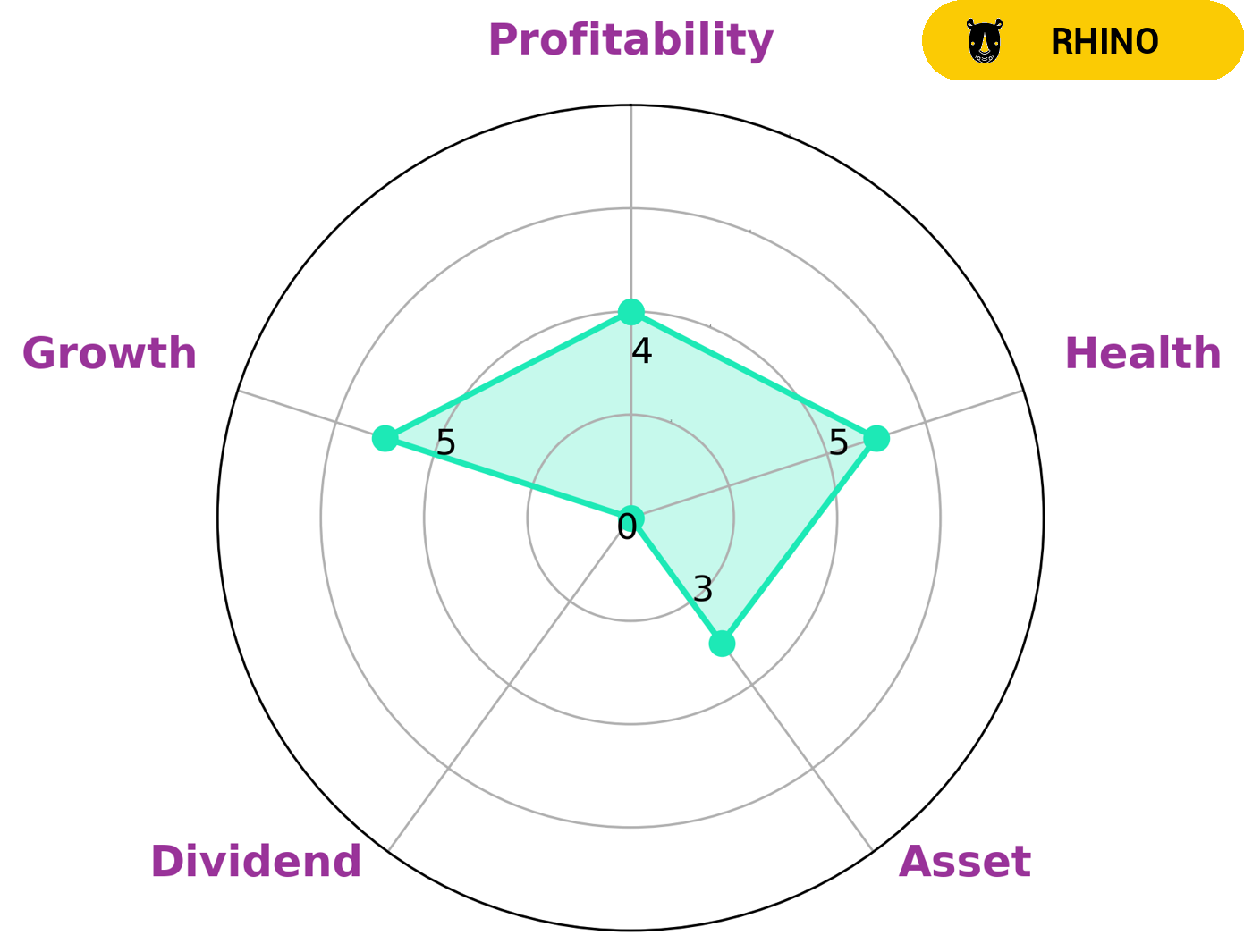

GoodWhale has conducted an analysis of NGL ENERGY PARTNERS LP’s wellbeing. According to our Star Chart, NGL ENERGY PARTNERS LP has an intermediate health score of 5/10 with regard to its cashflows and debt, suggesting that it is likely to safely ride out any crisis without the risk of bankruptcy. We classify NGL ENERGY PARTNERS LP as a ‘rhino’, a type of company we conclude has achieved moderate revenue or earnings growth. Investors who are looking for a company with a stable and reliable money-making capacity may be interested in NGL ENERGY PARTNERS LP, as it is strong in cashflows and debt, and medium in growth, profitability and weak in asset, dividend. This is due to NGL ENERGY PARTNERS LP’s ability to generate consistent cash flows and its low debt levels. Investors who are looking for a company with strong growth prospects may not find NGL ENERGY PARTNERS LP to be an attractive option. More…

Peers

The Partnership’s operations are primarily conducted through its wholly owned subsidiaries. NGL Energy Partners LP is one of the largest providers of midstream energy services in North America. The Partnership has a diversified portfolio of assets that provide services to producers and end users of natural gas liquids (“NGLs”), crude oil, refined products and petrochemicals. The Partnership’s assets include: natural gas liquids pipelines, storage facilities, fractionators, railcars, barges, trucks, and related transportation and logistics assets.

– Energy Transfer LP ($NYSE:ET)

Energy Transfer LP is a publicly traded limited partnership that owns and operates energy infrastructure assets in the United States. The company has a market capitalization of $38.68 billion as of 2022 and a return on equity of 14.71%. Energy Transfer’s business segments include natural gas, natural gas liquids, crude oil, and refined products. The company’s natural gas segment includes interstate and intrastate natural gas transportation and storage assets, as well as natural gas gathering and processing assets. Energy Transfer’s natural gas liquids segment consists of natural gas liquids transportation, storage, and fractionation assets. The company’s crude oil segment includes crude oil transportation and storage assets, as well as crude oil gathering and marketing assets. Energy Transfer’s refined products segment includes refined products transportation and storage assets.

– Kinetik Holdings Inc ($NASDAQ:KNTK)

Kinder Morgan Inc is one of the largest energy infrastructure companies in North America. They own an interest in or operate approximately 84,000 miles of pipelines and about 180 terminals. The company transports natural gas, crude oil, refined petroleum products, and CO2. They also store and handle petroleum products, chemicals, and other bulk liquids.

Summary

NGL Energy Partners LP reported strong results for the third quarter of its 2023 fiscal year, ending February 9, 2023. Total revenue was up 409.4% year-on-year, at USD 58.5 million. Despite this strong performance, net income decreased 1.5% year-on-year to USD 2139.2 million. In response to the news, stock prices moved up on the same day.

Investors should consider the company’s performance, as well as its long-term prospects, when deciding whether to invest in NGL Energy Partners LP. Given the company’s impressive revenue growth and stable income, this may be a worthwhile opportunity for investors who are willing to take a long-term view.

Recent Posts