NEW ORIENTAL EDUCATION & TECHNOLOGY Reports FY2023 Q4 Earnings Results for Period Ending May 31 2023

August 15, 2023

🌥️Earnings Overview

On July 26 2023, NEW ORIENTAL EDUCATION & TECHNOLOGY ($NYSE:EDU) reported their fourth quarter earnings results for the period ending May 31 2023. Total revenue for the quarter increased significantly by 64.2% year-on-year, totaling USD 860.6 million. As a result, net income also rose to USD 29.0 million, a 115.3% growth compared to the same time last year.

Share Price

NEW ORIENTAL EDUCATION & TECHNOLOGY reported its fourth quarter earnings report on Wednesday, with the stock opening at $48.1 and closing at $51.5, up 3.3% from its previous closing price of 49.9. This marks the company’s fourth consecutive quarterly earnings report with a positive result. Furthermore, NEW ORIENTAL EDUCATION & TECHNOLOGY continues to be a global market leader in the field of education and technology, boasting an impressive portfolio of products and services. The company credits much of its success to its integrated online-offline learning platform, which has enabled it to reach out to more students than ever before. With its growing influence in the educational arena, NEW ORIENTAL EDUCATION & TECHNOLOGY is looking to expand its reach in the near future.

Moreover, the company has implemented several cost-cutting initiatives over the past few quarters and is slowly transitioning into a more efficient and profitable business model. This has enabled the company to further strengthen its financial standing and improve operational efficiency. Overall, NEW ORIENTAL EDUCATION & TECHNOLOGY has delivered a solid financial performance for the fourth quarter, laying a strong foundation for continued success in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for EDU. More…

| Total Revenues | Net Income | Net Margin |

| 3k | 177.34 | 5.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for EDU. More…

| Operations | Investing | Financing |

| 971.01 | -37.41 | -246.87 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for EDU. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.39k | 2.58k | 21.21 |

Key Ratios Snapshot

Some of the financial key ratios for EDU are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -5.7% | -21.9% | 6.3% |

| FCF Margin | ROE | ROA |

| 32.4% | 3.2% | 1.9% |

Analysis

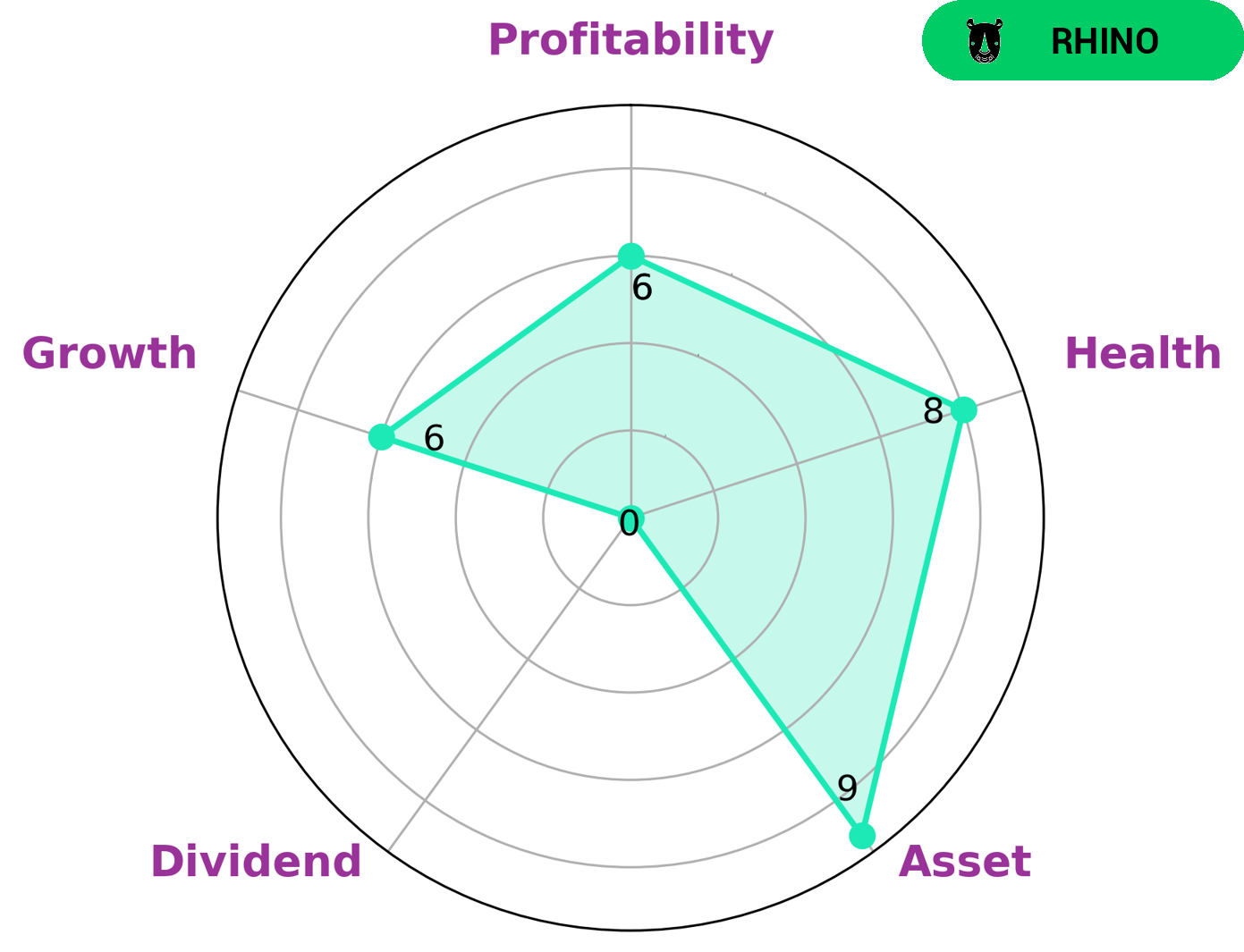

As GoodWhale, we have analyzed NEW ORIENTAL EDUCATION & TECHNOLOGY’s financials and the results are encouraging. Our Star Chart analysis showed that NEW ORIENTAL EDUCATION & TECHNOLOGY has a high health score of 8/10 with regard to its cashflows and debt, which suggests that it is capable of safely riding out any crisis without the risk of bankruptcy. In addition, NEW ORIENTAL EDUCATION & TECHNOLOGY is strong in asset, medium in profitability and weak in dividend, growth. Finally, based on our classification, NEW ORIENTAL EDUCATION & TECHNOLOGY is an ‘elephant’, a type of company that is rich in assets after deducting off liabilities. Considering these results, investors who are seeking steady and reliable long-term investments may be interested in NEW ORIENTAL EDUCATION & TECHNOLOGY as it has demonstrated healthy financials and a strong asset position. More…

Summary

Investors interested in NEW ORIENTAL EDUCATION & TECHNOLOGY should be encouraged by its strong Q4 earnings results for FY2023, which were released on July 26 2023. Total revenue for the quarter increased by 64.2%, compared to the same time last year, reaching USD 860.6 million. Net income also increased significantly, up 115.3% to USD 29.0 million.

Following the announcement, the stock price moved up, indicating that investors are optimistic about the company’s performance. Overall, NEW ORIENTAL EDUCATION & TECHNOLOGY appears to be a promising investment opportunity in the near future.

Recent Posts