NETSTREIT CORP Reports Strong Q4 Earnings, Surpassing Analysts’ Estimates

April 28, 2023

Trending News ☀️

NETSTREIT CORP ($NYSE:NTST), a publicly-traded real estate investment trust (REIT) based in Dallas, Texas, reported strong fourth quarter earnings that exceeded analysts’ estimates. NETSTREIT reported a Funds From Operations (FFO) of $0.30 per share, which was $0.02 above the expected amount, and revenue of $28.47M, higher than anticipated by $0.34M. This strategy enabled NETSTREIT to capitalize on opportunities in the real estate market and deliver strong returns for shareholders. This quarter’s results are a testament to NETSTREIT’s commitment to delivering value for its investors. The company’s portfolio of strategic investments and strong balance sheet allowed it to capitalize on current market trends and execute its growth plans.

Looking ahead, NETSTREIT is well positioned to continue to capitalize on growth opportunities in the real estate sector and deliver returns for its shareholders. With an experienced management team in place, the company is confident in its ability to navigate the ever-changing landscape of the real estate market. Going forward, NETSTREIT hopes to continue to deliver strong results and exceed analysts’ expectations.

Market Price

The stock opened Wednesday at $17.3 and closed at the same price, down slightly by 0.7% from the previous closing price of $17.4. Despite this slight decrease, investors are still confident in NETSTREIT CORP’s performance and the positive outlook for the future. With an increasing demand for its products and services, the company is well-positioned to continue to deliver strong results in the coming quarters. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Netstreit Corp. More…

| Total Revenues | Net Income | Net Margin |

| 96.28 | 8.12 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Netstreit Corp. More…

| Operations | Investing | Financing |

| 50.65 | -468.36 | 480.65 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Netstreit Corp. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.61k | 547.27 | 18.07 |

Key Ratios Snapshot

Some of the financial key ratios for Netstreit Corp are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 16.1% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

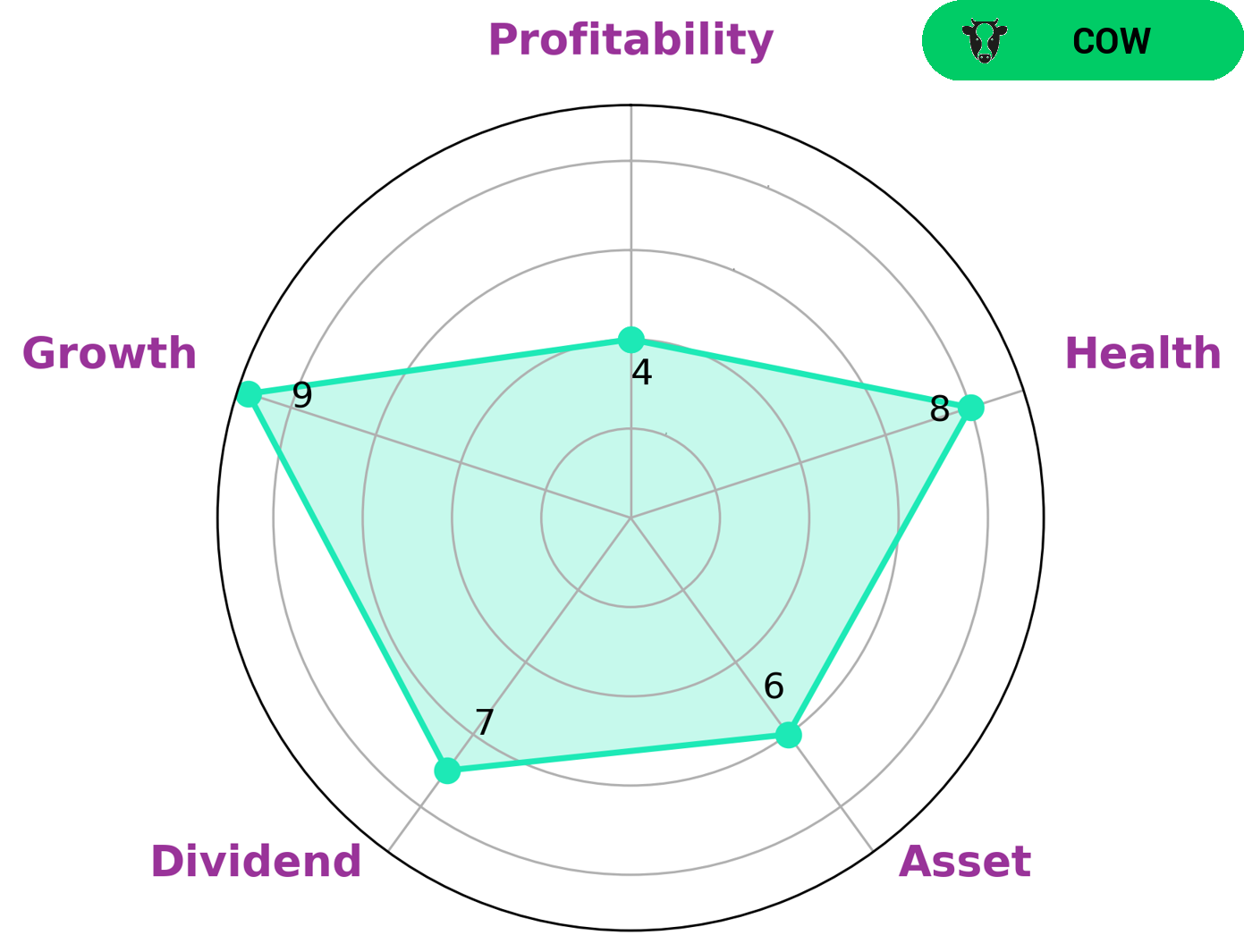

GoodWhale has recently conducted an analysis of NETSTREIT CORP‘s financials. Our Star Chart shows that NETSTREIT CORP is strong in dividend, growth, and medium in asset, profitability. We have classified NETSTREIT CORP as a ‘cow’, meaning that it has a track record of paying out consistent and sustainable dividends. This indicates that investors who are looking for steady income from dividend payments may be interested in this company. In addition, our analysis shows that NETSTREIT CORP has a high health score of 8/10 with regard to its cashflows and debt. This means that the company is capable of paying off debt and funding future operations. Ultimately, this makes NETSTREIT CORP a viable option for investors who are looking for long-term investments that can provide steady returns. More…

Peers

The competition between Netstreit Corp and its competitors is intense. Each company is striving to be the best in the industry and to provide the best products and services to their customers. This competition is good for the consumer because it allows them to choose from a variety of companies that offer different products and services. It also keeps the prices of the products and services down because the companies are always trying to outdo each other.

– Sasseur REIT ($SGX:CRPU)

Sasseur REIT is a Singapore-based real estate investment trust that owns and operates a portfolio of four premium outlet malls in China. The company’s market cap as of 2022 is 822.66M. The company’s outlets are located in the cities of Hangzhou, Hefei, Chongqing and Kunming, and cater to a range of international brands.

– BHG Retail REIT ($SGX:BMGU)

BHG Retail REIT is a real estate investment trust that owns, operates, and develops retail properties in the United States. As of December 31, 2020, the company owned and operated a portfolio of 84 retail properties, consisting of 65 shopping centers, 15 freestanding stores, and 4 development projects. The company was founded in 2010 and is headquartered in Boston, Massachusetts.

– Partners Real Estate Investment Trust ($OTCPK:PTSRF)

Partners Real Estate Investment Trust is a Canadian company that owns and operates a portfolio of income-producing real estate assets. The company has a market capitalization of $23.5 million as of March 2022. Partners REIT’s portfolio consists of retail, office, and industrial properties located across Canada.

Summary

NETSTREIT CORP recently reported quarterly earnings that exceeded expectations. Their Funds from Operations (FFO) was $0.30, exceeding the expected amount by $0.02.

Additionally, the company’s revenue was reported at $28.47M, beating the forecast by $0.34M. These numbers are favorable indicators of the company’s financial performance and suggest a positive outlook for investors. With these results in hand, it may be wise to consider NETSTREIT CORP as a potential investment opportunity.

Recent Posts