MERCER INTERNATIONAL Reports Second Quarter FY2023 Earnings of USD 529.9 Million, 7.4% Decrease from Last Year

August 24, 2023

🌥️Earnings Overview

MERCER INTERNATIONAL ($NASDAQ:MERC)’s second quarter of FY2023, ending June 30 2023, saw total revenue of USD 529.9 million, a 7.4% decline from the same period in the previous year. Net income for the quarter was reported as USD -98.3 million, compared to USD 71.4 million the year before.

Analysis

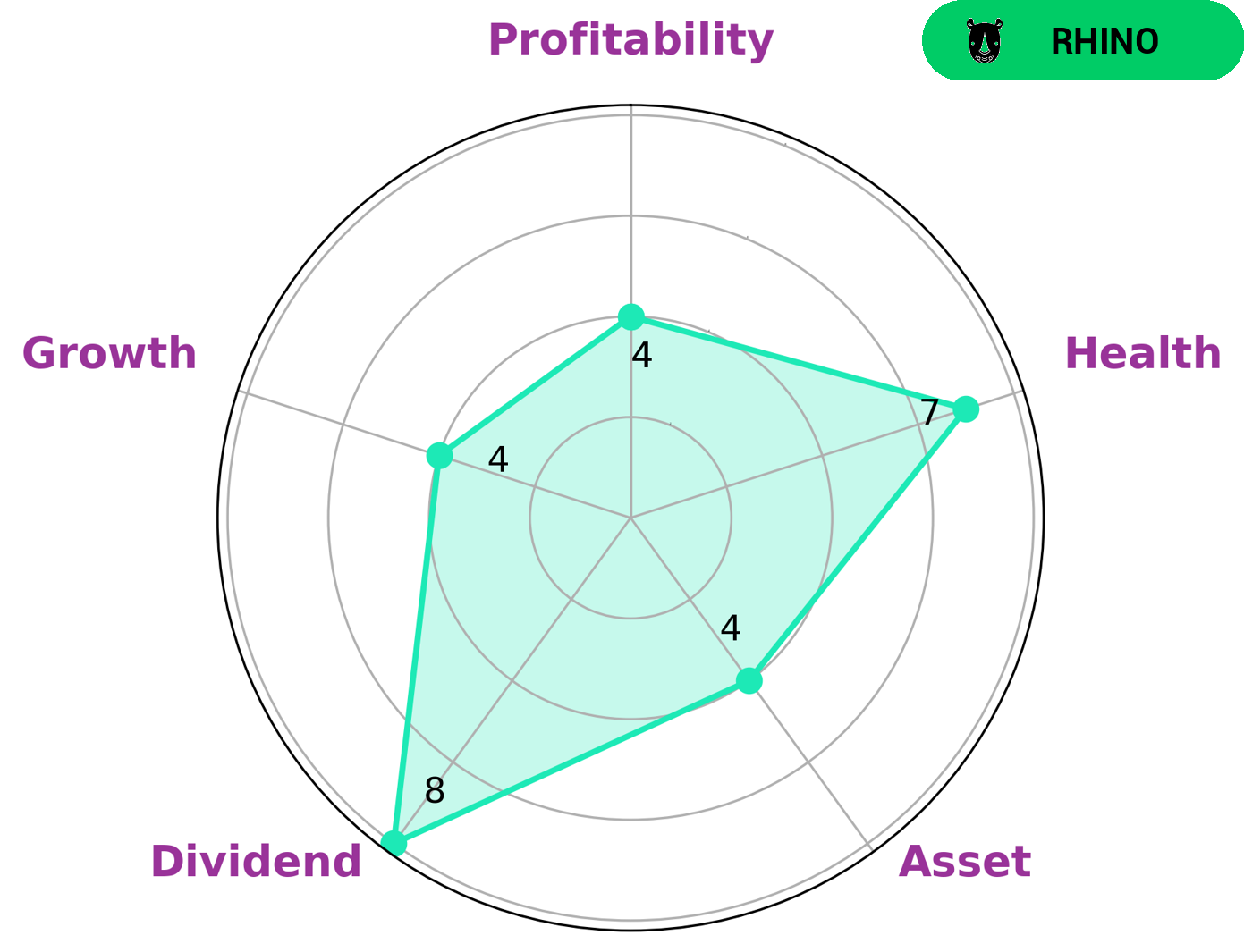

Analyzing MERCER INTERNATIONAL‘s financials with GoodWhale reveals that the company has been labeled as a ‘rhino’ by the Star Chart. This classification suggests that the company has achieved moderate revenue or earnings growth. This type of company may be of particular interest to investors that are looking for moderate yet consistent returns. Moreover, MERCER INTERNATIONAL has a high health score of 7/10 with regard to its cashflows and debt, which is an indicator that the company is capable to sustain future operations in times of crisis. From a financial standpoint, the company is strong in dividend and medium in asset, growth, and profitability. These attributes could make MERCER INTERNATIONAL an attractive option for investors looking for steady returns with a lower level of risk. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Mercer International. More…

| Total Revenues | Net Income | Net Margin |

| 2.17k | -42.11 | -2.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Mercer International. More…

| Operations | Investing | Financing |

| 102.36 | -427.71 | 122.19 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Mercer International. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.63k | 1.9k | 11.04 |

Key Ratios Snapshot

Some of the financial key ratios for Mercer International are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.5% | 67.2% | 1.9% |

| FCF Margin | ROE | ROA |

| -3.2% | 3.3% | 1.0% |

Peers

The pulp and paper industry is highly competitive, with firms vying for market share in multiple global markets. All four companies are major players in the global pulp and paper industry, and all are striving to maintain and grow their market share.

– Resolute Forest Products Inc ($NYSE:RFP)

Resolute Forest Products Inc is a publicly traded company with a market cap of 1.58B as of 2022. The company has a return on equity of 17.62%. Resolute Forest Products Inc is a forest products company that owns or operates a number of timberlands and wood products manufacturing facilities in the United States and Canada. The company’s product line includes lumber, wood chips, paper, and biomass. Resolute Forest Products Inc is headquartered in Montreal, Canada.

– The Navigator Co SA ($LTS:0KLO)

Navigator Co SA is a Portugal-based company engaged in the shipping industry. The Company offers liner and logistic services, operating a fleet of approximately 70 vessels. It provides containership and multipurpose transportation services under long-term, fixed-rate contracts with global charterers, including Maersk Line, MSC, CMA CGM, COSCO, Evergreen, Hyundai, Zim and Hapag-Lloyd. The Company’s vessels transport a range of cargoes, including forest products, such as pulp, paper and lumber; Steel products; RoRo cargoes, such as cars and trucks; Refrigerated cargoes, such as foodstuffs; Dry bulks, such as grains and minerals, and General cargoes. It operates through a network of offices located in Europe, North America, South America and Asia.

– Canfor Pulp Products Inc ($TSX:CFX)

Canfor Pulp Products Inc is a global leader in the production of market pulp. The company has a market cap of 315.73M as of 2022 and a ROE of -19.68%. Canfor Pulp Products Inc produces a wide range of bleached and unbleached market pulps, which are used in a variety of applications, including printing and writing papers, tissue products, and specialty papers. Canfor Pulp Products Inc’s products are sold to customers in more than 30 countries around the world.

Summary

MERCER INTERNATIONAL reported total revenue of USD 529.9 million for the second quarter of FY2023, ending June 30 2023, which was a 7.4% decrease from the same period in the prior year. Net income was reported as USD -98.3 million, compared to USD 71.4 million in the prior year. This suggests that investors should take a careful look at MERCER INTERNATIONAL before investing in the company. With the current financial results indicating a decrease in revenue and an overall net loss, it appears that caution is warranted when considering any potential investments in the company.

Recent Posts