Match Group Stock Fair Value Calculator – MATCH GROUP Reports Q2 FY2023 Earnings Results on August 1 2023

August 7, 2023

🌥️Earnings Overview

On August 1 2023, MATCH GROUP ($NASDAQ:MTCH) reported its earnings for the second quarter of FY2023, with a June 30 2023 ending date. Total revenue for the quarter totaled USD 829.5 million, up 4.4% year-over-year, and net income was USD 137.3 million, a marked improvement from a loss of USD 31.9 million in the same quarter of the prior year.

Share Price

Stock in the publicly traded company opened that morning at $45.7 and closed with a price of $46.2, a decrease of 0.8% from the prior closing price of $46.5. MATCH GROUP is the parent company of popular global dating app, Tinder, and other popular online dating services such as Match.com, OkCupid, and Hinge. The company is globally engaged in providing online dating products and services through its portfolio of brands. Overall, MATCH GROUP’s Q2 FY2023 earnings results show that the company continues to be successful in providing a valuable service to its users and generating strong financial results for its shareholders. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Match Group. More…

| Total Revenues | Net Income | Net Margin |

| 3.21k | 471.43 | 18.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Match Group. More…

| Operations | Investing | Financing |

| 835.59 | -83.55 | -487.55 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Match Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.34k | 4.52k | -0.64 |

Key Ratios Snapshot

Some of the financial key ratios for Match Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -13.1% | 11.8% | 23.0% |

| FCF Margin | ROE | ROA |

| 24.2% | -180.3% | 10.6% |

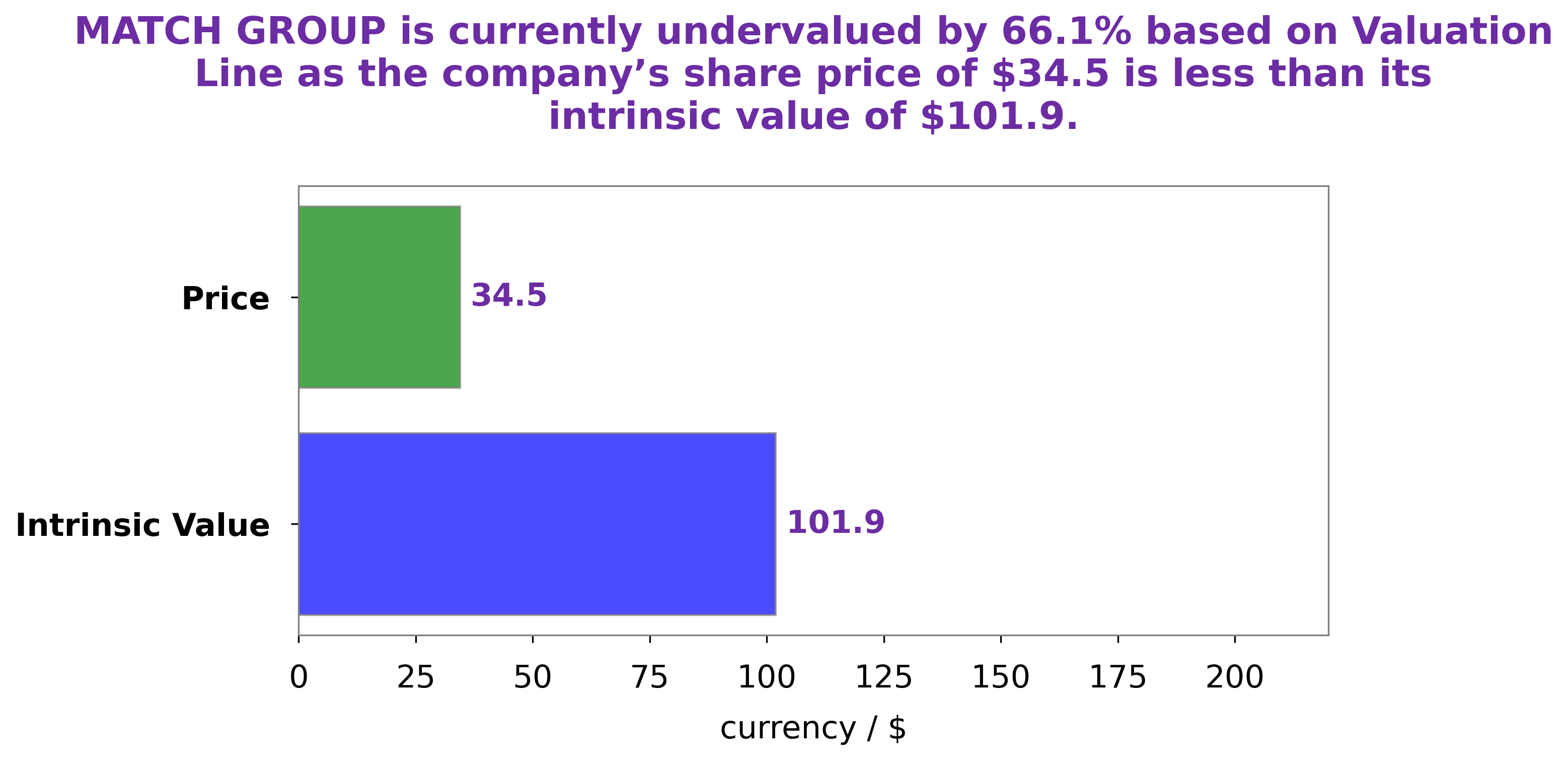

Analysis – Match Group Stock Fair Value Calculator

At GoodWhale, we conducted a thorough analysis of the fundamentals of MATCH GROUP. After doing so, our proprietary Valuation Line determined that the fair value of MATCH GROUP share is around $107.9. However, the stock is currently being traded at $46.2. This means that the stock is currently undervalued by 57.2%. Our research has shown that investors may gain handsomely from buying the MATCH GROUP stock at its current price. More…

Peers

– Baltic Classifieds Group PLC ($LSE:BCG)

Baltic Classifieds Group PLC is a leading digital classifieds business in the Baltic and Nordic region. The company operates some of the region’s most popular and successful websites, including Skelbiu, Osta.ee and City24. It has a market capitalization of 670.58M as of 2022. Its Return on Equity (ROE) is 4.84%, which is an indicator of the company’s performance and ability to generate profits from its shareholders’ investments. The company continues to grow through acquisitions and expansion into new markets, as well as developing new products and services for its customers.

– Bylog Group Corp ($OTCPK:BYLG)

Darelle Online Solutions Inc is a software development and technology consulting firm headquartered in California. It has a market cap of 552.81k as of 2022, which reflects its financial performance and potential for further growth. The company’s Return on Equity (ROE) stands at 11.04%, which is an impressive figure that highlights the efficiency of capital management within the firm. Darelle Online Solutions Inc specializes in offering IT solutions to organizations in the fields of e-commerce, automation, analytics, cloud computing, and more. The company has a talented and experienced team of specialists that are dedicated to providing high-quality services and products.

Summary

MATCH GROUP delivered strong financial results for the second quarter of FY2023, with total revenue increasing 4.4% year-over-year to USD 829.5 million and net income improving significantly from a loss of USD 31.9 million in the same quarter of the prior year to USD 137.3 million. Analysts are generally positive on the company due to its growth prospects and solid financial performance. Investors may want to consider allocating some funds to the stock, as it has shown consistent growth and has a great potential for further expansion.

Recent Posts