MASTEC Reports Fourth Quarter Earnings Results for FY2022 on February 24 2023.

March 8, 2023

Earnings Overview

MASTEC ($NYSE:MTZ) announced their financial results for the fourth quarter of the 2022 fiscal year, ending December 31 2022, on February 24 2023. Total revenue for the quarter was USD 3.2 million, which represented a 95.8% decrease from the same period the previous year. Net income, in contrast, increased by 66.3% year over year and amounted to USD 3008.4 million.

Transcripts Simplified

Mastec reported strong fourth quarter and full year results in 2022, with revenue up 66 per cent year-over-year in the fourth quarter and up 23 per cent year-over-year for the full year. Adjusted EBITDA was $258 million in the fourth quarter and $781 million for the full year. Mastec has repositioned itself to be a leader in some of the most dynamic and robust industries over the last two years, increasing its presence on the electrical grid market, entering the clean energy space through the acquisition of IEA, and growing its Communications segment at a double digit rate.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Mastec. More…

| Total Revenues | Net Income | Net Margin |

| 9.78k | 33.35 | 0.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Mastec. More…

| Operations | Investing | Financing |

| 352.3 | -821.18 | 480.9 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Mastec. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.3k | 6.55k | 33.65 |

Key Ratios Snapshot

Some of the financial key ratios for Mastec are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.8% | -40.0% | 1.6% |

| FCF Margin | ROE | ROA |

| 3.6% | 3.8% | 1.0% |

Price History

On Friday, the stock opened at $92.1 and closed at $97.2, up 0.3% from the previous closing price of $96.9. The company reported record revenue with a 4% increase year-over-year and a 10% jump in earnings per share compared to the same quarter last year. The company’s total revenue was driven by strong demand for its services in the communications, energy, and utility sectors. Investors will be watching closely for further updates on the company’s financial performance in the upcoming quarters. Live Quote…

Analysis

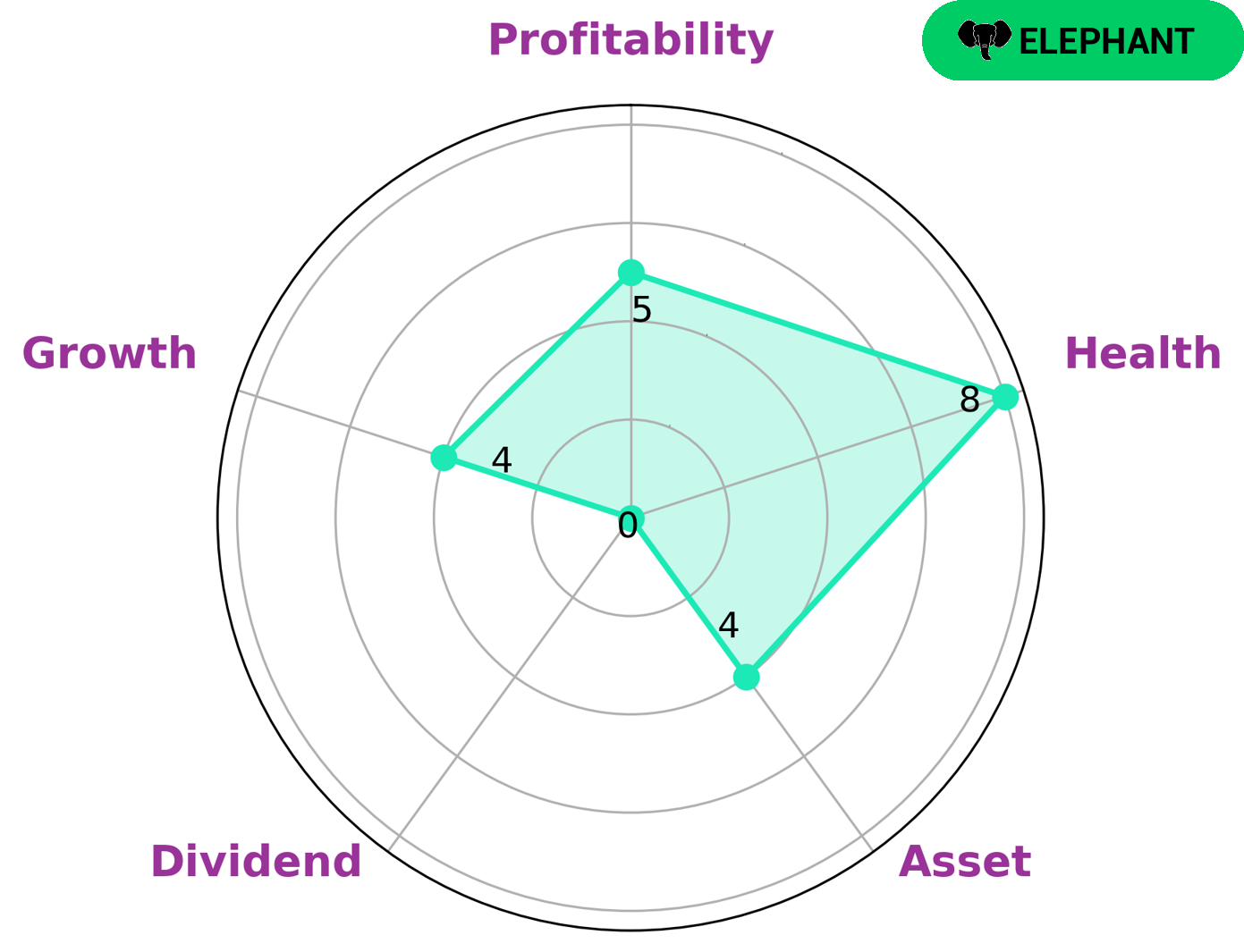

GoodWhale’s analysis of MASTEC‘s financials reveals that the company is strong in asset, growth, profitability and weak in dividend. The Star Chart classifies MASTEC as an ‘elephant’ – a type of company that is rich in assets after deducting off liabilities. This makes MASTEC an attractive investment for investors looking for long-term capital appreciation. Additionally, MASTEC has a high health score of 8/10 with regard to its cashflows and debt, indicating that it is capable to safely ride out any crisis without the risk of bankruptcy. Overall, MASTEC looks like a good investment opportunity for those looking for long-term capital appreciation. More…

Peers

In the engineering and construction services industry, MasTec Inc faces competition from Assystem SA, Quanta Services Inc, and Elecnor SA. These companies are all large, international competitors with significant market share. While MasTec Inc has a strong presence in the United States, these companies have a strong international presence and are able to compete on a global scale.

– Assystem SA ($LTS:0OA7)

Assystem SA is a French engineering and consulting company. It was founded in 1966 and has since grown to become one of the largest engineering firms in the world. The company has a market capitalization of 547.52 million as of 2022 and a return on equity of 8.74%. Assystem SA provides engineering and consulting services to a variety of industries, including aerospace, defense, energy, transportation, and construction. The company has a strong presence in Europe, North America, and Asia.

– Quanta Services Inc ($NYSE:PWR)

Quanta Services, Inc. provides specialty contracting services in the United States, Canada, Australia, South America, and select other international markets. The company operates through Electric Power Infrastructure Services and Pipeline Infrastructure Services segments. The Electric Power Infrastructure Services segment engages in the installation, upgrade, repair, and maintenance of electric power transmission and distribution infrastructure, including substations, underground and overhead conductor systems, and wireless and fiber optic communication systems. This segment also provides asset management services; and turnkey installation and maintenance services for solar power generation systems. The Pipeline Infrastructure Services segment engages in the construction, upgrade, repair, maintenance, and decommissioning of natural gas and oil pipelines, natural gas gathering systems, and other pipeline infrastructure; and provides asset management services. This segment also offers horizontal directional drilling services for the installation of pipelines and conduit systems. The company was founded in 1997 and is headquartered in Houston, Texas.

– Elecnor SA ($LTS:0K97)

Electricnor SA is a Spanish engineering and construction company. It focuses on the development, design, and construction of renewable energy projects, mainly wind farms. As of 2022, it has a market capitalization of 850.99 million dollars and a return on equity of 18.71%.

Summary

MASTEC’s fourth quarter of FY2022 (ending December 31 2022) saw a significant decrease in revenue of 95.8% when compared to the previous year. However, the company managed to beat expectations with a 66.3% year-over-year increase in net income, reaching USD 3008.4 million. This strong performance could make MASTEC an attractive investment opportunity for those looking for a potential turnaround stock. Investors should take note of the company’s financials and consider the possibility of a long-term growth story.

Recent Posts