LUNA INNOVATIONS Reports Second Quarter Earnings Results for Fiscal Year 2023

August 13, 2023

🌥️Earnings Overview

LUNA INNOVATIONS ($NASDAQ:LUNA) reported their second quarter earnings results ending August 10 2023, showing a year-over-year increase in total revenue of 11.5% to USD 29.2 million. However, their net income decreased from -2.4 million in the same period of the previous fiscal year to -1.6 million on June 30 2023.

Market Price

On Thursday, LUNA INNOVATIONS reported its second quarter earnings results for Fiscal Year 2023. The stock opened at $8.8 and closed at $8.7, a decrease of 2.0% from the prior closing price of 8.8. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Luna Innovations. More…

| Total Revenues | Net Income | Net Margin |

| 115.06 | -1.39 | -0.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Luna Innovations. More…

| Operations | Investing | Financing |

| -11.96 | -1.56 | 11.68 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Luna Innovations. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 155.13 | 60.26 | 2.84 |

Key Ratios Snapshot

Some of the financial key ratios for Luna Innovations are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 16.1% | -52.1% | 0.6% |

| FCF Margin | ROE | ROA |

| -12.6% | 0.5% | 0.3% |

Analysis

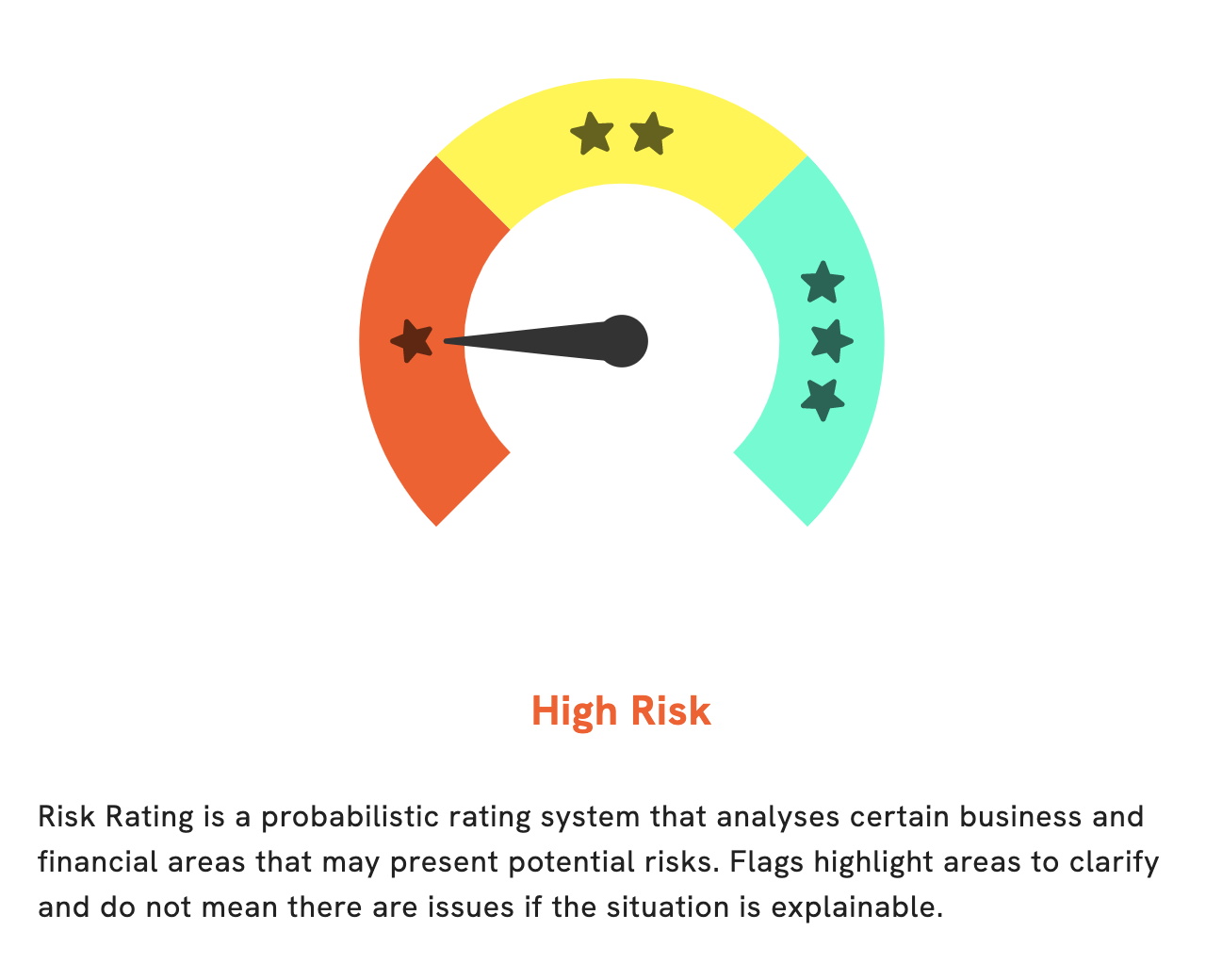

At GoodWhale, we have conducted an analysis of LUNA INNOVATIONS‘ wellbeing. According to our Risk Rating, LUNA INNOVATIONS is a high risk investment in terms of its financial and business aspects. Our GoodWhale system has detected 4 risk warnings in the income sheet, balance sheet, cashflow statement and financial journal. If you would like to delve further into these risks and find out more, you are welcome to register with us and access our analysis. We are confident that with our insights, you will be able to make an informed decision about LUNA INNOVATIONS’ investments. More…

Peers

Headquartered in Roanoke, Virginia, Luna has about 200 employees and operates in over 30 countries. Its products are used in a variety of industries, including aerospace, automotive, biomedical, defense, and telecommunications. Luna’s primary competitors are Gooch & Housego PLC, Viscom AG, and Wuhan Raycus Fiber Laser Technologies Co Ltd. These companies are all based in Europe and Asia, respectively.

– Gooch & Housego PLC ($LSE:GHH)

Gooch & Housego PLC is a leading international provider of advanced photonic solutions. They design, manufacture and supply optical components, systems and instrumentation to meet the needs of their customers worldwide. Gooch & Housego has a market cap of 119.45M as of 2022 and a Return on Equity of 3.16%. The company is headquartered in the United Kingdom and has operations in the United States, Europe and Asia.

– Viscom AG ($LTS:0GED)

Vcom AG is a German company that provides software for the visual inspection of products. Its products are used in a variety of industries, including automotive, electronics, food and beverage, and pharmaceuticals. The company has a market cap of 71.97 million as of 2022 and a return on equity of 4.98%.

– Wuhan Raycus Fiber Laser Technologies Co Ltd ($SZSE:300747)

Raycus is a Chinese company that manufactures fiber lasers. It is headquartered in Wuhan, China and was founded in 2007. The company went public on the Shenzhen Stock Exchange in 2014. As of 2022, Raycus has a market cap of 15.78B and a ROE of 2.49%. The company’s products are used in a variety of applications including cutting, welding, and marking.

Summary

LUNA INNOVATIONS reported their second quarter earnings for the fiscal year ending August 10 2023, with a 11.5% year-over-year increase in total revenue to USD 29.2 million. Although net income decreased from -2.4 million to -1.6 million, investors may find the growth in total revenue encouraging. As such, investors may find the current share valuation of LUNA INNOVATIONS appealing.

Recent Posts