LINDE PLC Reports Fourth Quarter FY2022 Earnings Results on February 7 2023

March 29, 2023

Earnings Overview

On February 7 2023, LINDE PLC ($BER:LIN) declared their fiscal fourth quarter 2022 results, closing on December 31 2022, showing a USD 1.3 billion revenue, a 29.1% year-over-year increase, yet a 4.8% fall in net income to USD 7.9 billion compared to the same period in the previous year.

Share Price

On Tuesday, February 7 2023, LINDE PLC reported its fourth quarter financial results for the fiscal year 2022. The stock opened at €299.2 and closed at the same price, down by 0.7% from the prior closing price of €301.4. Shares of LINDE PLC were up 0.7% in Tuesday’s trading session on the Frankfurt Stock Exchange. The company’s stock has been trading at an average price of around € 301 over the past few months and investors now anticipate that the company’s strong financial results will help boost its stock price in the coming months. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Linde Plc. More…

| Total Revenues | Net Income | Net Margin |

| 33.36k | 4.15k | 12.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Linde Plc. More…

| Operations | Investing | Financing |

| 8.86k | -3.09k | -3.09k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Linde Plc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 79.66k | 38.27k | 81.27 |

Key Ratios Snapshot

Some of the financial key ratios for Linde Plc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.7% | 25.5% | 17.3% |

| FCF Margin | ROE | ROA |

| 17.1% | 9.3% | 4.5% |

Analysis

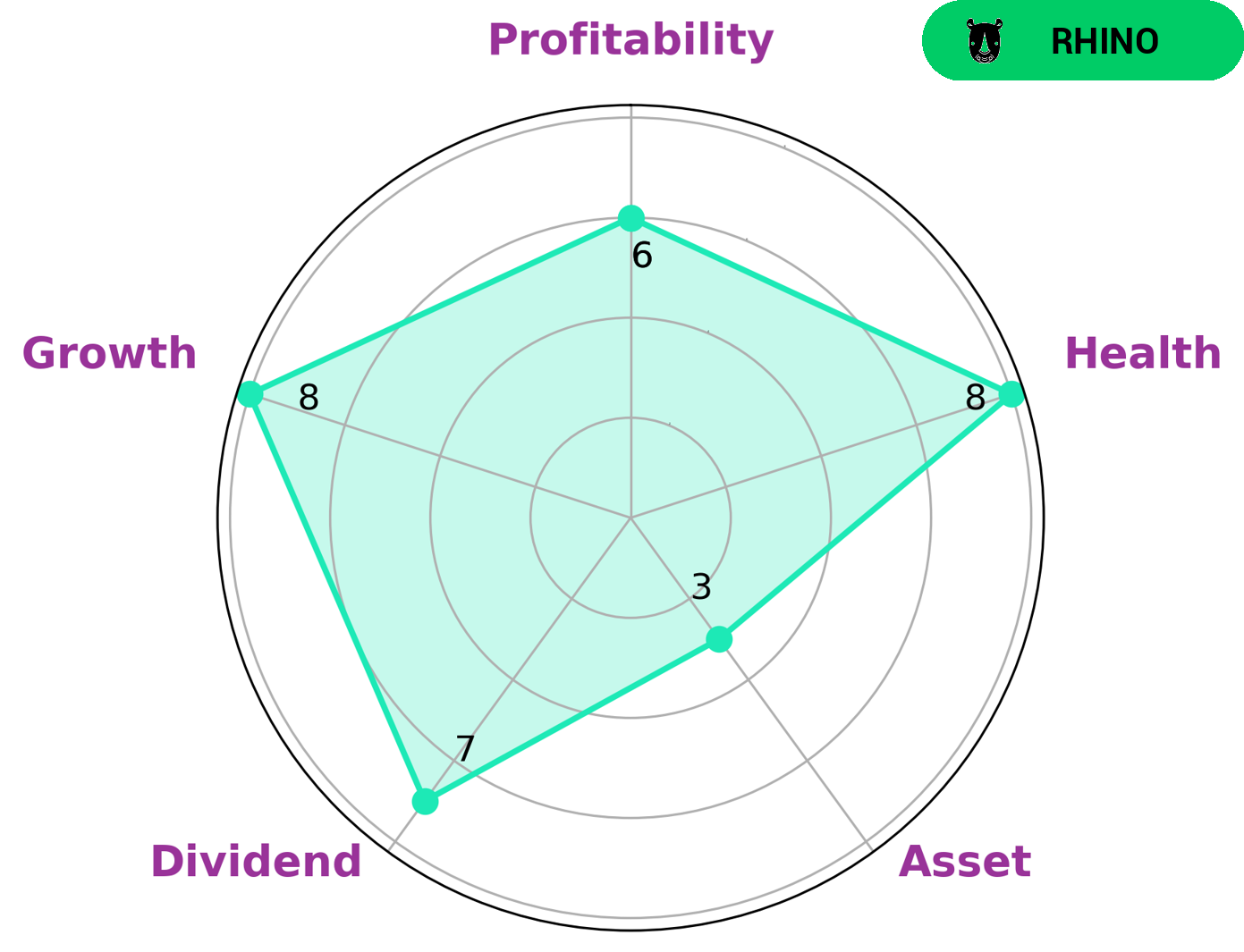

GoodWhale has conducted an in-depth analysis of LINDE PLC‘s wellbeing and performance. According to our Star Chart, LINDE PLC is classified as a ‘rhino’, a type of company we conclude has achieved moderate revenue or earnings growth. LINDE PLC is strong in dividend and growth, medium in profitability, and weak in asset. The company also has a high health score of 8/10, taking into account its cash flows and debt and its ability to sustain future operations in times of crisis. For investors looking for lower risk investments, LINDE PLC may be an attractive option. Its moderate growth potential and strong dividend make it an attractive option for those seeking a steady income stream. Additionally, its moderate profitability coupled with its high health score make it a reliable choice for those looking for a company with a strong foundation that can weather difficult markets. More…

Summary

LINDE PLC saw an impressive 29.1% year-over-year increase in revenue for their fourth quarter of FY2022, reaching USD 1.3 billion, but this was offset by a 4.8% year-over-year decrease in net income, which reached USD 7.9 billion. Although revenue was higher, it didn’t translate into profitability due to higher operating costs. Investors should assess the additional costs associated with the revenue growth and the impact it will have on future earnings. This suggests that potential investors may have to look at other metrics when evaluating LINDE PLC as an investment.

Recent Posts