Limoneira Company Intrinsic Value Calculation – LIMONEIRA COMPANY Reports Third Quarter Earnings Results for FY2023

September 9, 2023

🌥️Earnings Overview

For the third quarter of FY2023, ending July 31 2023, LIMONEIRA COMPANY ($NASDAQ:LMNR) reported a total revenue of USD 52.5 million – a 10.9% decrease from the same period in the previous year. Net income for the quarter was USD -1.2 million, compared to 7.4 million in Q3 of the previous year.

Share Price

On Thursday, LIMONEIRA COMPANY reported their third quarter earnings results for FY2023. The company opened at $15.1 per share and closed at the same rate, representing a 0.3% increase from the previous closing price of $15.1. During the quarter, LIMONEIRA COMPANY made strong gains in both their top-line and bottom-line.

The strong performance was driven by strong performance across all divisions of the company. With a strong outlook for the remainder of FY2023, LIMONEIRA COMPANY is well positioned to deliver on its promise of driving long-term value to shareholders. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Limoneira Company. More…

| Total Revenues | Net Income | Net Margin |

| 178.13 | 9.7 | -7.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Limoneira Company. More…

| Operations | Investing | Financing |

| -8.68 | 117.09 | -98.35 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Limoneira Company. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 312.67 | 106.47 | 10.84 |

Key Ratios Snapshot

Some of the financial key ratios for Limoneira Company are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.3% | 34.1% | 9.2% |

| FCF Margin | ROE | ROA |

| -11.2% | 5.2% | 3.3% |

Analysis – Limoneira Company Intrinsic Value Calculation

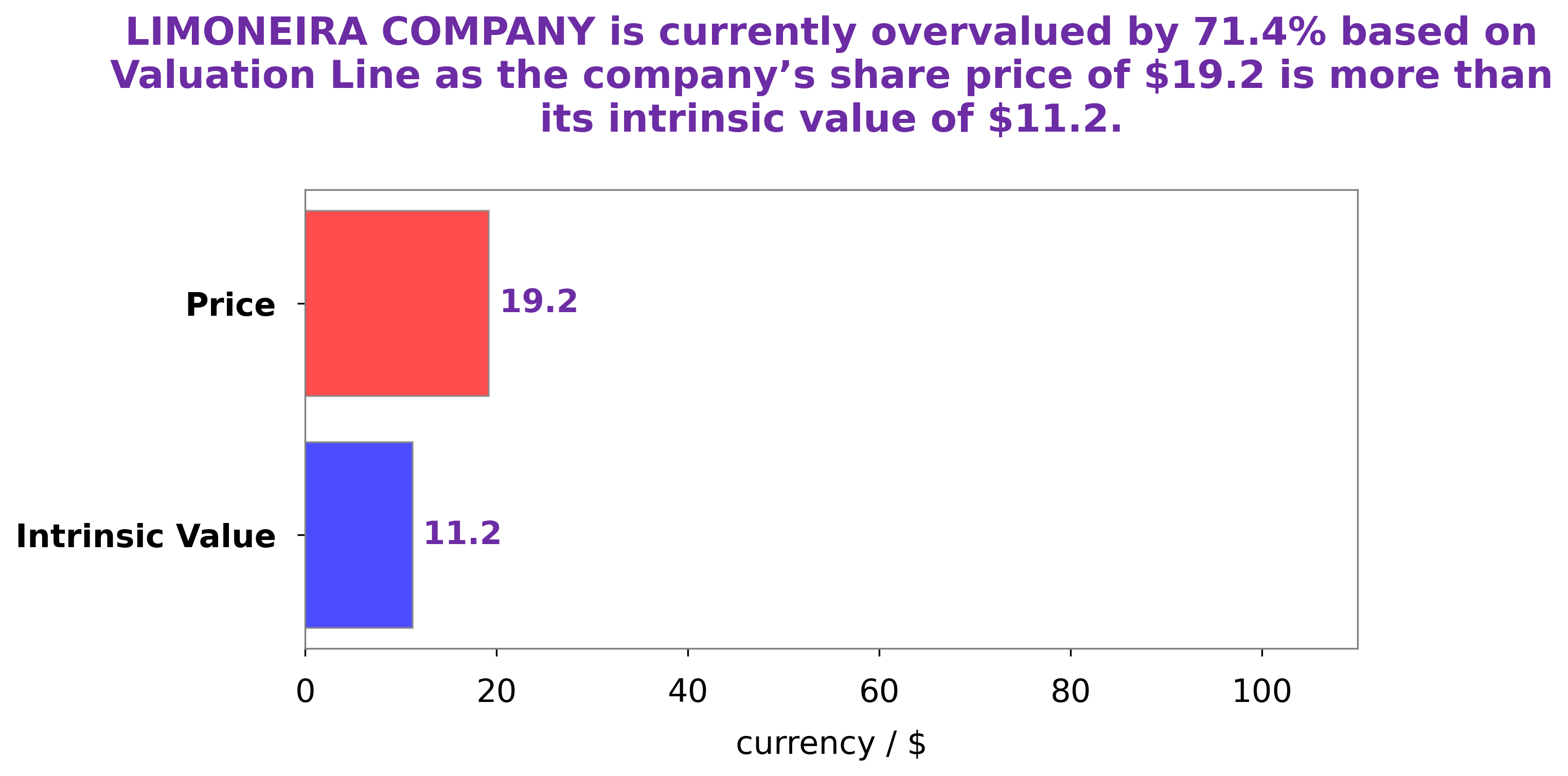

At GoodWhale, we have conducted an analysis of LIMONEIRA COMPANY‘s wellbeing and found the fair value of their stock to be around $15.4, calculated by our proprietary Valuation Line. We believe that this price point is a fair value and that the current trading price of $15.1 is an indication of an undervalued stock by 2.2%. We recommend keeping an eye on the stock, as it may be potentially ripe for good returns in the near future. More…

Peers

It operates in the US, Mexico, and Brazil and competes with leading companies such as Dole PLC, Kaveri Seed Co Ltd, and B&A Ltd. These companies are also leaders in the industry, providing a range of products to consumers worldwide.

– Dole PLC ($NYSE:DOLE)

Dole PLC is a leading food and beverage company that provides fresh and packaged products to customers worldwide. The company has a market capitalization of 926.21M as of 2022 which puts it in a strong financial position. It also has an impressive Return on Equity (ROE) of 4.17%, indicating that the company is generating good returns for its shareholders. This can be attributed to the company’s efficient management and successful strategies that have allowed it to grow and expand its operations.

– Kaveri Seed Co Ltd ($BSE:532899)

Kaveri Seed Co Ltd is an agribusiness company focused on the development and marketing of hybrid seeds in India. As of 2022, the company has a market cap of 27.99B and a Return on Equity (ROE) of 11.49%. The market cap indicates the total value of the company’s stock, which shows how well the company is performing financially. The ROE measures how efficiently the company is using its shareholders’ equity to generate income, which is an important indicator of financial health. Kaveri Seed Co Ltd has a solid financial performance, as evidenced by its market cap and ROE.

– B&A Ltd ($BSE:508136)

B&A Ltd is a global business solutions provider, offering services in enterprise resource planning, customer relationship management, marketing, analytics, and financial management. Their market capitalization of 967.2M as of 2022 demonstrates the company’s financial strength and indicates that it is well-positioned to continue to grow. The company’s Return on Equity (ROE) of 20.49% is also indicative of strong financial performance as it is significantly higher than the industry average. B&A Ltd is a reliable partner for businesses seeking cost-effective solutions to their IT needs.

Summary

LIMONEIRA COMPANY’s third quarter of FY2023, ending July 31 2023, saw total revenue decline by 10.9%, with net income falling from 7.4 million to -1.2 million. This represents a significant decline in earnings and investors should carefully consider the risks and rewards of investing in LIMONEIRA COMPANY. The company may offer potential due to their agricultural holdings, but investors should be aware of the overall financial health of LIMONEIRA COMPANY before deciding whether to invest. A thorough analysis of the company’s financials and operations is necessary to evaluate the potential for successful investment.

Recent Posts