KUAISHOU TECHNOLOGY Reports Q1 FY2023 Earnings Results on May 22

May 28, 2023

Earnings Overview

KUAISHOU TECHNOLOGY ($SEHK:01024) released its financial numbers for Q1 of FY2023, with data closing on March 31 2023, on May 22 2023. The total revenues for the period amounted to CNY 25217.0 million, representing a 19.7% year-on-year rise. Additionally, the net income was CNY -873.0 million, representing a major turn-around from the previous year’s deficit of CNY -6254.4 million.

Market Price

KUAISHOU TECHNOLOGY reported its Q1 FY2023 earnings results on May 22. The results were highly anticipated on the market as KUAISHOU TECHNOLOGY is one of the leading technology companies in the world. On Monday, KUAISHOU TECHNOLOGY stock opened at HK$50.5 and closed at HK$53.5, marking a 6.9% increase from its prior closing price of HK$50.0. The Q1 FY2023 earnings report showed a jump in both revenues and profits for the company, which is a positive indication for the future growth of the company.

Additionally, the report showed that KUAISHOU TECHNOLOGY had managed to increase its market share over the quarter, with revenue from its international business segment growing significantly. Analysts have also noted that KUAISHOU TECHNOLOGY is well-positioned to benefit from an increasingly digitalized world, and that the company has made significant investments into research and development over the last year. The strong results in the first quarter of FY2023 bode well for KUAISHOU TECHNOLOGY’s future performance, and investors are optimistic about the company’s prospects. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Kuaishou Technology. More…

| Total Revenues | Net Income | Net Margin |

| 98.33k | -8.31k | -7.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Kuaishou Technology. More…

| Operations | Investing | Financing |

| 7.18k | -6.01k | -4.53k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Kuaishou Technology. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 85.6k | 45.87k | 9.2 |

Key Ratios Snapshot

Some of the financial key ratios for Kuaishou Technology are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 34.0% | – | -8.1% |

| FCF Margin | ROE | ROA |

| 2.6% | -12.5% | -5.8% |

Analysis

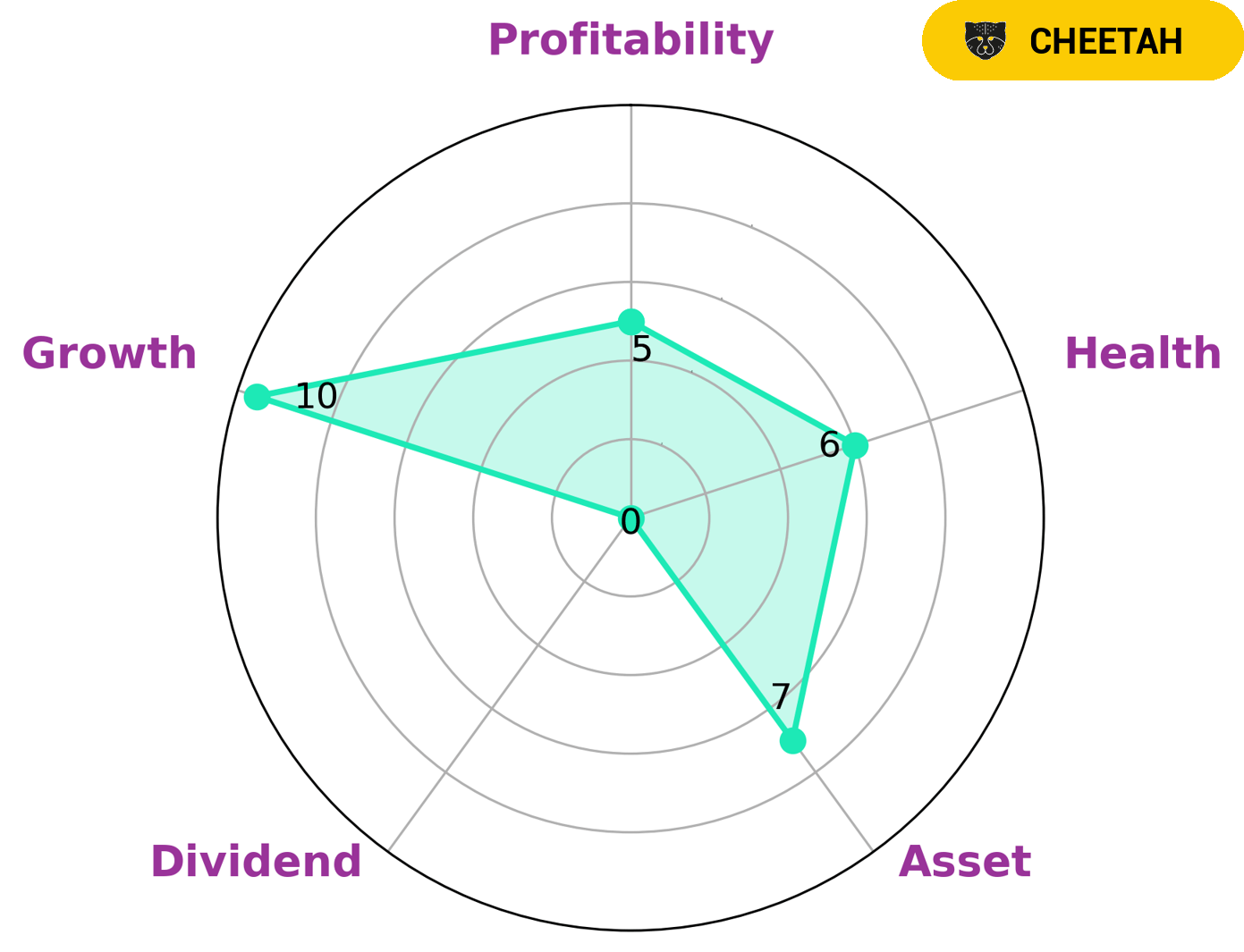

GoodWhale has conducted an analysis of KUAISHOU TECHNOLOGY‘s financials. Our Star Chart shows that KUAISHOU TECHNOLOGY is strong in asset and growth and medium in profitability, but weak in dividend. Based on these financials, we have classified KUAISHOU TECHNOLOGY as a ‘cheetah’ company – a type of company that has achieved high revenue or earnings growth, but is considered less stable due to lower profitability. This type of company would likely appeal to investors that are looking for an opportunity to capitalize on high growth, but are willing to accept the risk associated with lower profitability. Additionally, KUAISHOU TECHNOLOGY has an intermediate health score of 6/10 considering its cashflows and debt, indicating that it may be able to safely ride out any crisis without the risk of bankruptcy. More…

Peers

With its focus on short-form videos, Kuaishou Technology is a major competitor to Lizhi Inc, Creatd Inc, and IndiaMART InterMESH Ltd. All four companies have their own unique offerings in the market and are constantly striving for innovation and disruption.

– Lizhi Inc ($NASDAQ:LIZI)

Lizhi Inc is a leading online audio entertainment platform in China, providing music, audio, and video content for its users. As of 2023, the company has a market capitalization of 41.49M, positioning it as one of the major players in the industry. Furthermore, Lizhi Inc boasts a Return on Equity of 16.22%, indicating that the company is effectively managing its resources. With innovative solutions and a commitment to providing quality content, Lizhi Inc is well-positioned to capitalize on the growing demand for online audio entertainment in the years to come.

– Creatd Inc ($BSE:542726)

IndiaMART InterMESH Ltd is a leading B2B e-commerce company in India that caters to the needs of small and medium businesses. With a market cap of 170.18B and a Return on Equity of 12.05%, the company is well-positioned to take advantage of the growth opportunities in the Indian market. The company, which has been in business for more than twenty years, offers a wide range of services, including online marketplace, online payments, and digital marketing. IndiaMART InterMESH Ltd also hosts a wide variety of products, from apparel and accessories to industrial machinery and electronics. Its strong market cap and ROE are evidence of the company’s financial strength and potential for continued growth.

Summary

KUAISHOU TECHNOLOGY has reported strong earnings for the first quarter of FY2023, with total revenue reaching CNY 25217.0 million, representing an increase of 19.7% year-over-year. The net income was also positive at CNY -873.0 million, which is an improvement from the previous year’s loss of CNY -6254.4 million. As a result, the stock price rose on the same day, showing investors’ confidence in the company’s ability to continue its growth trajectory. With solid financial results and a forward-looking outlook, KUAISHOU TECHNOLOGY is an attractive investment opportunity for those looking for growth potential in the tech sector.

Recent Posts