Johnson Outdoors Intrinsic Value – JOHNSON OUTDOORS Reports Third Quarter FY2023 Earnings Result on June 30, 2023

August 7, 2023

🌥️Earnings Overview

JOHNSON OUTDOORS ($NASDAQ:JOUT) reported total revenue of USD 187.1 million for the third quarter of FY2023 ending June 30 2023, a decrease of 8.2% compared to the same period in the previous year. However, net income was USD 14.8 million, which is an increase of 5.1% from the same quarter of the year before.

Price History

On June 30, 2023, JOHNSON OUTDOORS reported their third quarter fiscal year 2023 earnings result. At the close of the market on Thursday, JOHNSON OUTDOORS stock opened at $55.1 and closed at $58.4, representing an increase of 2.2% from its last closing price of 57.2. This increase in stock price is a strong indicator of the positive performance of JOHNSON OUTDOORS during this quarter. This increase in stock price can be attributed to the strong financial performance of JOHNSON OUTDOORS in the third quarter, with the company reporting an impressive year-over-year revenue growth of 8%.

These results were greeted positively by investors, with the stock price increasing by 2.2%. This reflects increased investor confidence in the company and its future prospects. Going forward, JOHNSON OUTDOORS is expected to continue to deliver strong results in upcoming quarters, providing further assurance for investors moving forward. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Johnson Outdoors. More…

| Total Revenues | Net Income | Net Margin |

| 763.89 | 45.19 | 5.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Johnson Outdoors. More…

| Operations | Investing | Financing |

| 69.48 | -51.66 | -12.61 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Johnson Outdoors. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 705.48 | 185.04 | 50.77 |

Key Ratios Snapshot

Some of the financial key ratios for Johnson Outdoors are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 12.7% | -3.8% | 7.8% |

| FCF Margin | ROE | ROA |

| 5.7% | 7.3% | 5.3% |

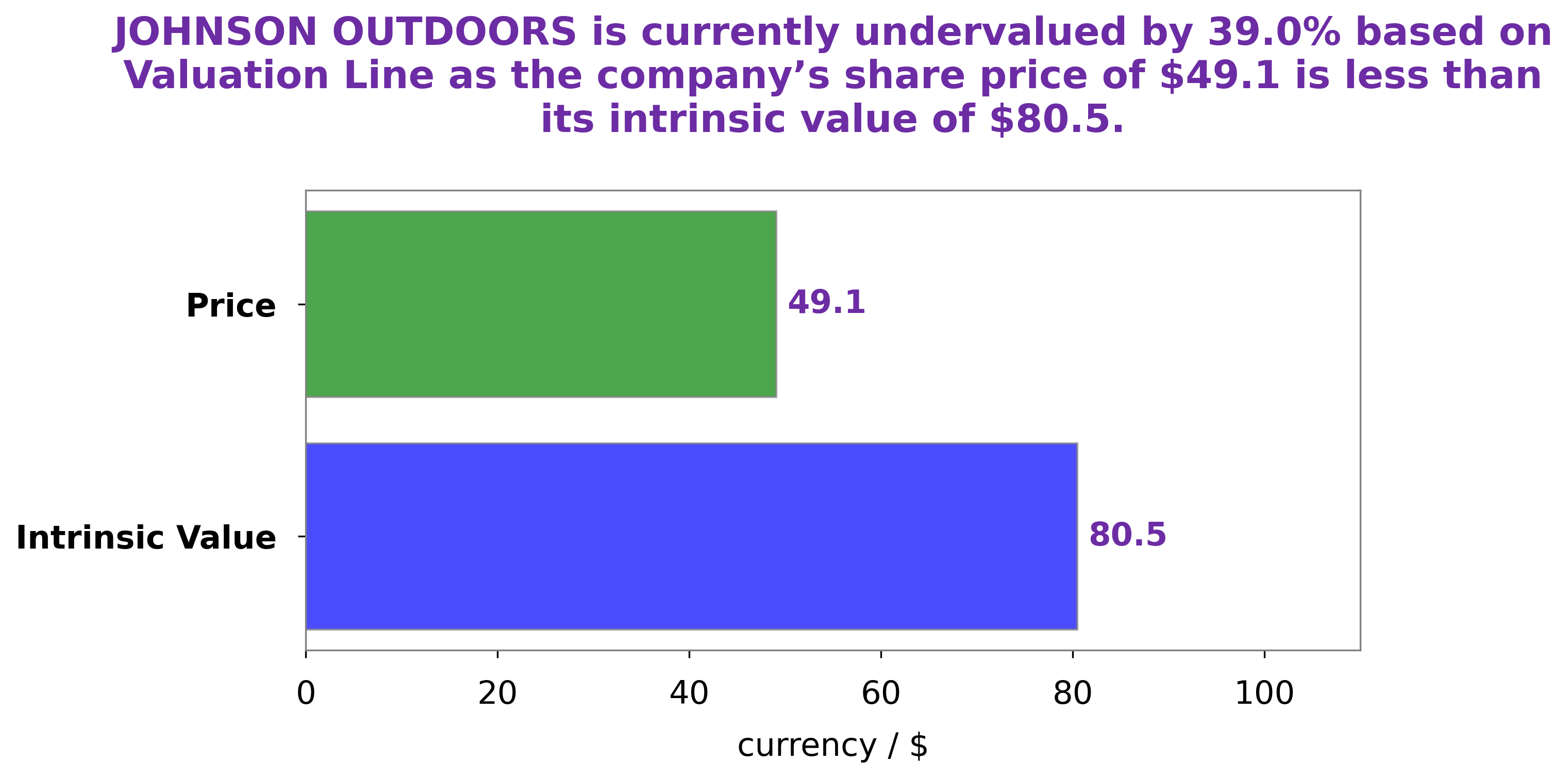

Analysis – Johnson Outdoors Intrinsic Value

We at GoodWhale have conducted an in-depth analysis of JOHNSON OUTDOORS‘s wellbeing. Based on our proprietary Valuation Line, we have determined that the intrinsic value of JOHNSON OUTDOORS share lies around $91.0. This suggests that the stock is currently undervalued by 35.8%, as it is presently traded at $58.4. We believe that this discrepancy provides an opportunity to investors looking for a discount price for JOHNSON OUTDOORS stock. More…

Peers

Johnson Outdoors Inc is one of the leading outdoor recreation companies in the world, known for its cutting-edge products and innovative designs. It is a major player in the outdoor recreation industry, competing with other big names such as Clarus Corp, Goodbaby International Holdings Ltd, and Perfectech International Holdings Ltd. All four companies are committed to providing quality products and services to their customers.

– Clarus Corp ($NASDAQ:CLAR)

Clarus Corporation is a provider of outdoor equipment and apparel products. Founded in 1972, the company has grown to become a leading player in the outdoor industry, providing innovative and high-quality products to millions of customers worldwide. The company has a current market capitalization of 290.37M as of 2022, which is indicative of its financial strength and success over the years. Additionally, Clarus Corporation has a Return on Equity of 4.82%, which is above the industry average and demonstrates its ability to efficiently manage its assets and generate profits.

– Goodbaby International Holdings Ltd ($SEHK:01086)

Goodbaby International Holdings Ltd is a leading manufacturer and distributor of juvenile products in the Asia-Pacific region. The company has a market capitalization of 1.05 billion dollars as of 2022. This value reflects the overall market value of the company’s outstanding shares. Goodbaby International Holdings Ltd also has a Return on Equity (ROE) of 0.8%. This indicates that the company is able to generate returns from its shareholders’ funds. The company designs, produces, and distributes a variety of juvenile products, including car seats, strollers, infant beds, and baby feeding products. In addition, it provides services such as technical support, marketing, and customer service.

– Perfectech International Holdings Ltd ($SEHK:00765)

Perfectech International Holdings Ltd is a Hong Kong-based company that primarily manufactures and sells precision industrial machinery and equipment. As of 2022, the company had a market capitalization of 209.23M, indicating the total value of its outstanding shares. Furthermore, its Return on Equity (ROE) was -0.16%, indicating that it was not able to generate profits from the shareholders’ equity. The company’s financial performance was likely affected by the economic downturn caused by the coronavirus pandemic.

Summary

JOHNSON OUTDOORS reported total revenue of USD 187.1 million for the third quarter of FY2023, a decrease of 8.2% compared to the same period in the previous year. Despite this, reported net income increased by 5.1% year over year to USD 14.8 million. From an investing perspective, JOHNSON OUTDOORS appears to be managing its costs well and is experiencing improved profitability. The company will need to continue to monitor its revenues closely in order to ensure that further growth occurs in the future.

Recent Posts