Jacobs Solutions Intrinsic Value Calculator – JACOBS SOLUTIONS Reports Third Quarter FY2023 Earnings on August 8 2023

August 14, 2023

☀️Earnings Overview

JACOBS SOLUTIONS ($NYSE:J) released its earnings report for the third quarter of FY2023 (ending June 30 2023) on August 8 2023. Total revenue reached USD 4186.7 million, representing a 9.4% growth from the prior year. Nonetheless, the reported net income dropped by 16.2% to USD 164.2 million compared to that of the previous year.

Share Price

The stock opened at $127.6 and closed at $134.4, up by 4.6% from its prior closing price of 128.5. Overall, JACOBS SOLUTIONS‘ third quarter FY2023 earnings report reflects strong operational performance, indicating the company is on track to achieve its long-term growth objectives. The stock closed at an all-time high and has delivered strong returns to its shareholders. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Jacobs Solutions. More…

| Total Revenues | Net Income | Net Margin |

| 15.94k | 741.6 | 4.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Jacobs Solutions. More…

| Operations | Investing | Financing |

| 1.03k | -153.61 | -911.94 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Jacobs Solutions. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 14.94k | 7.72k | 51.81 |

Key Ratios Snapshot

Some of the financial key ratios for Jacobs Solutions are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.9% | 21.8% | 7.0% |

| FCF Margin | ROE | ROA |

| 5.6% | 10.8% | 4.7% |

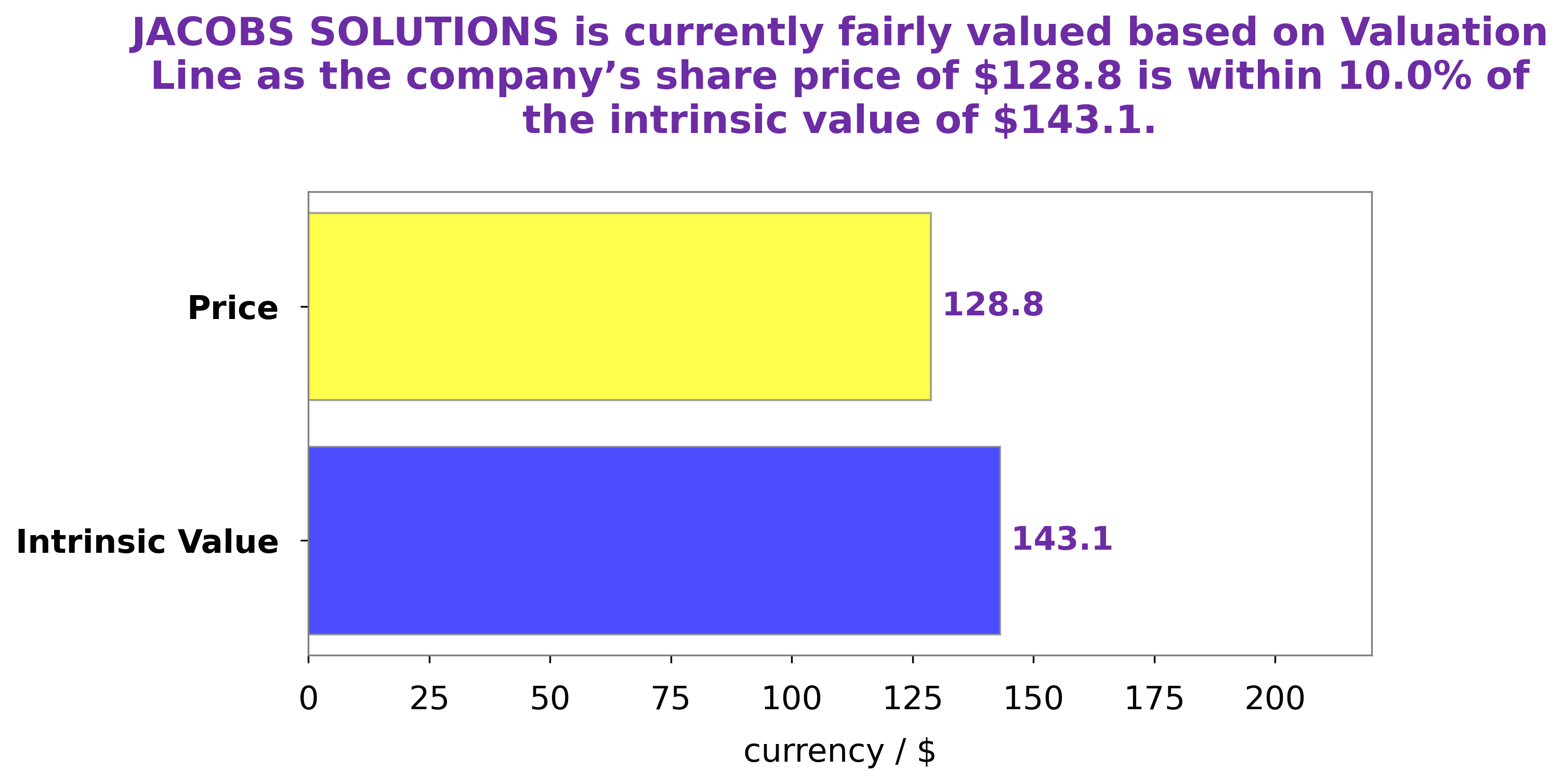

Analysis – Jacobs Solutions Intrinsic Value Calculator

At GoodWhale, we recently conducted an analysis of JACOBS SOLUTIONS‘s wellbeing. After extensive due diligence, our proprietary Valuation Line revealed that JACOBS SOLUTIONS’s intrinsic value lies around $138.3. Interestingly, the current market price of JACOBS SOLUTIONS share is $134.4 – a figure that is significantly lower than our suggested intrinsic value, and in fact, is undervalued by a margin of 2.8%. Therefore, we believe that JACOBS SOLUTIONS shares are a great investment opportunity at their current price. More…

Peers

In the engineering services industry, Jacobs Engineering Group Inc. competes against a number of companies, including Baran Group Ltd, Henan Communications Planning and Design Institute Co Ltd, and Mold-Tek Technologies Ltd. While each company has its own strengths and weaknesses, Jacobs Engineering Group Inc. has been able to maintain a competitive advantage through its focus on innovation and customer service.

– Baran Group Ltd ($OTCPK:BRANF)

Baran Group Ltd is a diversified holding company with interests in a range of businesses, including real estate, construction, hospitality, and healthcare. The company has a market capitalization of 58.73 million as of 2022 and a return on equity of 4.03%. The company’s real estate portfolio includes residential and commercial properties in the United States, Europe, and Asia. The company’s construction business focuses on the construction of high-end residential and commercial properties. The company’s hospitality business operates a portfolio of luxury hotels and resorts. The company’s healthcare business provides healthcare services to a network of hospitals and clinics.

– Henan Communications Planning and Design Institute Co Ltd ($SZSE:300732)

The company provides engineering consulting and design services in the telecommunications industry in China. As of 2022, it had a market capitalization of $3.02 billion and a return on equity of 9.33%.

– Mold-Tek Technologies Ltd ($BSE:526263)

Mold-Tek Technologies is an Indian company that specializes in injection molding and mold making. It is headquartered in Hyderabad, Telangana. The company has a market cap of 2.61B as of 2022 and a return on equity of 15.67%. Mold-Tek was founded in 1976 and has since grown to become one of the leading providers of injection molding and mold making services in India. The company has a strong presence in the automotive, consumer goods, and electronics industries.

Summary

Investors of JACOBS SOLUTIONS were pleased with the company’s performance in the third quarter of FY2023, which saw total revenue rise by 9.4% to USD 4186.7 million. However, net income decreased 16.2% from the previous year to USD 164.2 million. Despite this, the stock price reacted positively to the news as investors remain confident in the company’s long-term prospects. This indicates that JACOBS SOLUTIONS is still viewed as a favorable investment opportunity for those looking for strong returns and a secure future.

Recent Posts