J.B. Hunt Transport Services Reports Fourth Quarter Earnings Results with 16.9% Revenue Decrease and 4.4% Net Income Increase

January 30, 2023

Earnings report

J.B. ($NASDAQ:JBHT) Hunt Transport Services, Inc., commonly known as J.B. Hunt, is an American transportation and logistics company that provides transportation services to customers throughout the United States, Canada, and Mexico. On January 18, 2023, J.B. Hunt Transport Services reported their earnings results for the fourth quarter of fiscal year 2022 ending on December 31, 2022. Total revenue for the period was USD 201.3 million, a 16.9% decrease from the same quarter the previous year. Despite this revenue decrease, net income was USD 3649.6 million, a 4.4% increase from the same quarter the previous year. J.B. Hunt is optimistic despite the decrease in revenue as they strive to improve their operations and increase efficiency through cost-saving initiatives and operational improvements. The company has also taken steps to increase its presence in the online marketplace and expand its customer base with new technology solutions.

The company is also taking a proactive approach towards sustainability and environmental responsibility. J.B. Hunt is committed to reducing its carbon footprint through alternative fuel sources and initiatives such as electric vehicle fleets and renewable energy solutions. Overall, J.B. Hunt Transport Services reported strong earnings results for the fourth quarter of fiscal year 2022 despite a decrease in revenue. The company is taking measures to ensure continued success in the future with cost-saving initiatives, operational improvements, new technology solutions, and sustainability efforts.

Stock Price

J.B. Hunt Transport Services, Inc. released its fourth quarter earnings results on Wednesday, revealing a 16.9% decrease in revenue and a 4.4% increase in net income. This report was met with a positive reaction from the markets, as the stock opened at $177.0 and closed at $185.0, representing a 5.0% increase from the previous closing price of $176.3. This was due to cost-cutting measures that J.B. Hunt implemented in order to offset the decreased revenue.

Overall, the fourth quarter earnings report from J.B. Hunt Transport Services indicates that the company is taking the necessary steps to remain profitable in difficult times. The company’s stock is up 5.0% from its previous closing price and appears to be on a positive trajectory. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for JBHT. More…

| Total Revenues | Net Income | Net Margin |

| 14.81k | 969.35 | 6.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for JBHT. More…

| Operations | Investing | Financing |

| 1.61k | -877.02 | -304.63 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for JBHT. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.74k | 4.08k | 30.11 |

Key Ratios Snapshot

Some of the financial key ratios for JBHT are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.4% | 22.0% | 9.0% |

| FCF Margin | ROE | ROA |

| 1.0% | 26.7% | 10.7% |

VI Analysis

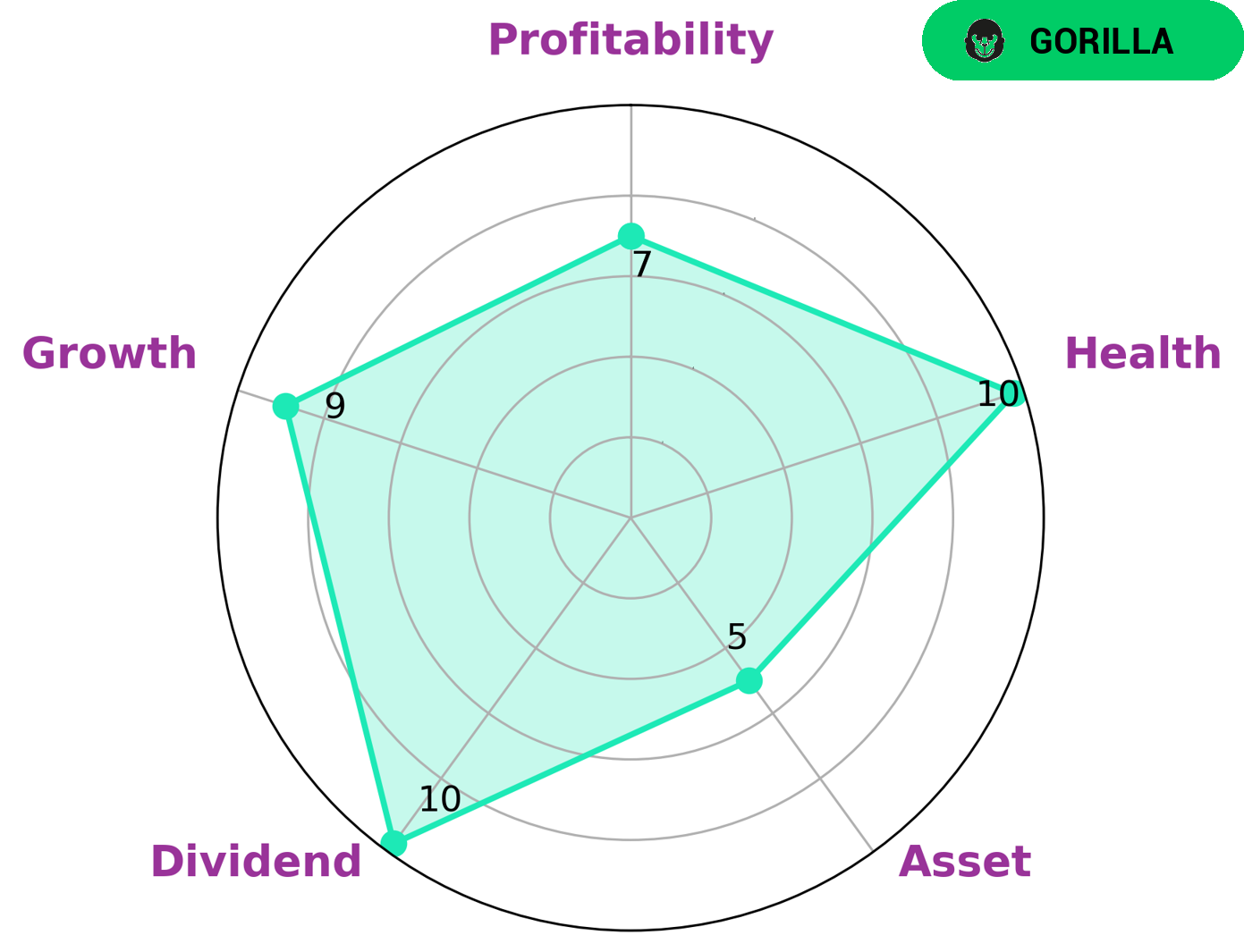

Company fundamentals are an important factor for understanding a company’s long term potential. VI app has made it easier to analyze companies’ fundamentals, and the VI Star Chart for J.B. HUNT TRANSPORT SERVICES is particularly impressive. The company is classified as a ‘gorilla’, with stable and high revenue or earning growth due to its strong competitive advantage. This makes it an attractive investment opportunity for investors seeking dividend, growth, profitability, and medium asset. Moreover, J.B. HUNT TRANSPORT SERVICES has a high health score of 10/10 with regard to its cashflows and debt, indicating that it is capable of sustaining future operations in times of crisis. The company’s fundamentals reflect its long term potential and its high health score is an indication of its ability to withstand future economic downturns. Investors looking for dividend, growth, profitability, and medium asset should definitely consider this company as a great investment option. More…

VI Peers

JB Hunt Transport Services Inc is a leading transportation provider in North America. The company operates in four segments: Intermodal (JBHT), Dedicated Contract Services (DCS), Integrated Capacity Solutions (ICS), and Truck (JBT). The company has a fleet of over 16,000 trucks and more than 48,000 trailers. JBHT offers a wide range of transportation services including intermodal, dedicated contract, and truckload. The company has a strong market position in the United States and Canada.

JBHT competes with Hub Group Inc, Yang Ming Marine Transport Corp, Rinko Corp, and other transportation companies in the United States and Canada. The company has a strong market position and a large fleet of trucks and trailers. JBHT offers a wide range of transportation services. The company has a strong financial position and is expected to grow at a fast pace in the coming years.

– Hub Group Inc ($NASDAQ:HUBG)

Hub Group is a transportation management company that provides intermodal, truck brokerage and logistics services. Hub Group’s intermodal services include rail-to-truck and truck-to-rail transloading, as well as drayage service. The company’s truck brokerage services provide full truckload, less-than-truckload and dedicated contract carriage. Hub Group’s logistics services include supply chain management and warehouse management.

As of 2022, Hub Group’s market cap is $2.59 billion. The company’s return on equity is 21.81%. Hub Group is a transportation management company that provides intermodal, truck brokerage and logistics services. The company’s intermodal services include rail-to-truck and truck-to-rail transloading, as well as drayage service. The company’s truck brokerage services provide full truckload, less-than-truckload and dedicated contract carriage. Hub Group’s logistics services include supply chain management and warehouse management.

– Yang Ming Marine Transport Corp ($TWSE:2609)

As of 2022, Yang Ming Marine Transport Corp has a market cap of 220B and a Return on Equity of 62.35%. The company is a leading provider of international ocean transportation services. It operates a modern fleet of container vessels and provides integrated logistics services. The company has a strong market position in the Far East, Europe, and the Middle East.

– Rinko Corp ($TSE:9355)

Rinko Corp is a Japanese company that manufactures and sells construction materials. The company has a market cap of 3.82B as of 2022 and a return on equity of 4.29%. Rinko Corp is a well-established company with a strong financial position. The company’s products are in high demand, and its products are used in a wide variety of applications. Rinko Corp has a strong market presence and is a market leader in its industry.

Summary

Investors in J.B. Hunt Transport Services may have been pleased to hear the company’s fourth quarter of fiscal year 2022 earnings results. Total revenue for the period was USD 201.3 million, a 16.9% decrease from the same quarter the previous year.

However, net income was USD 3649.6 million, a 4.4% increase from the same quarter the previous year. This news sent the stock price up the same day it was made public on January 18, 2023. Given these results, investors should consider adding J.B. Hunt Transport Services to their portfolios. The company’s revenue may have decreased, but its net income increased, indicating that it is still profitable despite the decrease in sales.

Additionally, the stock price’s positive reaction to the announcement shows that investors are confident in the company’s future prospects. As such, investors should consider investing in J.B. Hunt Transport Services as it may provide strong returns over the long term.

Recent Posts