Irobot Corporation Intrinsic Value Calculator – IROBOT CORPORATION Reports Positive Q2 FY2023 Earnings Results

August 28, 2023

☀️Earnings Overview

On August 8 2023, IROBOT CORPORATION ($NASDAQ:IRBT) reported their earnings results for Q2 of FY2023, which had ended on June 30 2023. Total revenue for the quarter was USD 236.6 million, a 7.4% decrease from the previous year. Net income for the quarter was -80.8 million, a decrease from the prior year’s -43.4 million.

Stock Price

IROBOT CORPORATION‘s CEO Colin Angle stated that they were pleased with the results of the quarter, saying that the company was able to “deliver double-digit revenue growth while managing the continued supply-chain challenges posed by the pandemic.” They had a strong performance in many of their products, with sales increased for both their iRobot Roomba and Braava robotic vacuums as well as their Mirra pool-cleaning robot. This earnings report demonstrates IROBOT CORPORATION’s ability to handle the challenges of operating during the pandemic, and investors remain hopeful that it will continue to perform well in the future. With its focus on innovation, the company is well positioned to take advantage of the current technological trends and continue to grow its presence in the robotics industry. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Irobot Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 1.03k | -374.38 | -36.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Irobot Corporation. More…

| Operations | Investing | Financing |

| 38.38 | -9.82 | -35.35 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Irobot Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 634.14 | 308.72 | 11.75 |

Key Ratios Snapshot

Some of the financial key ratios for Irobot Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -4.6% | 26.3% | -29.6% |

| FCF Margin | ROE | ROA |

| 2.8% | -53.0% | -30.1% |

Analysis – Irobot Corporation Intrinsic Value Calculator

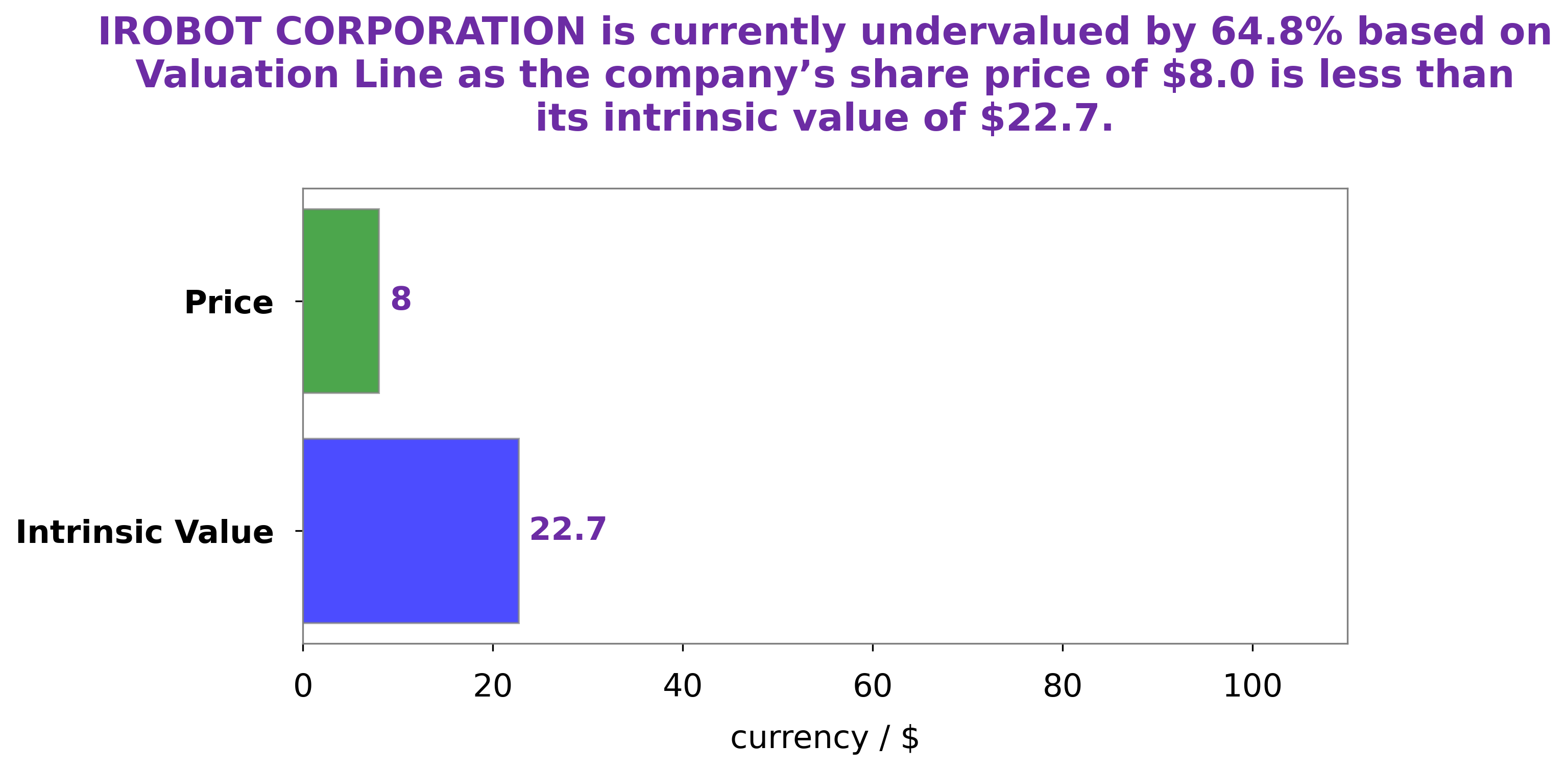

At GoodWhale, we conducted an analysis of IROBOT CORPORATION‘s wellbeing. Through our proprietary Valuation Line, we calculated the intrinsic value of IROBOT CORPORATION’s stock to be around $35.5. Currently, the stocks of IROBOT CORPORATION are being traded at $38.7, which is a 9.1% overvaluation from the intrinsic value. More…

Peers

The competition among iRobot Corp and its competitors is fierce. All of the companies are striving to be the best in the industry and to provide the best products and services to their customers. Each company has its own strengths and weaknesses, and it is up to the customer to decide which company is the best fit for their needs.

– Aterian Inc ($NASDAQ:ATER)

Aterian Inc is a publicly traded company with a market capitalization of $85 million as of 2022. The company has a negative return on equity of 53.71%.

Aterian Inc is a provider of engineering and manufacturing solutions. The company offers a range of services, including design, prototyping, and manufacturing. Aterian Inc also provides supply chain management and logistics services.

– Sleep Number Corp ($NASDAQ:SNBR)

Sleep Number Corporation is an American manufacturing company that produces and sells Sleep Number beds. The company was founded in 1987 and is headquartered in Minneapolis, Minnesota. The company’s products are available in the United States, Canada, and China. Sleep Number Corporation operates through two segments: Direct and Retail. The Direct segment sells its products through the company’s website and call center. The Retail segment sells its products through company-owned and -operated stores, as well as through third-party retailers.

– PLBY Group Inc ($NASDAQ:PLBY)

LPLBY Group Inc. is a holding company that provides investment banking, asset management, and other financial services through its subsidiaries. The company has a market capitalization of 147.84 million as of 2022 and a return on equity of -8.2%. The company’s investment banking subsidiary provides services such as mergers and acquisitions, capital markets, and corporate finance advisory. Its asset management subsidiary provides portfolio management, research, and investment advisory services. The company’s other financial services include insurance, private banking, and wealth management.

Summary

IROBOT CORPORATION reported their second quarter earnings for the fiscal year ending June 30 2023, showing a decrease in both total revenue and net income. Total revenue decreased 7.4% to USD 236.6 million, while net income decreased to -80.8 million from -43.4 million from the same period last year. This suggests that the company may have encountered some financial difficulty due to the still-uncertain economic environment. Investors should pay close attention to IROBOT CORPORATION’s performance and outlook in order to gauge if the company can make a full recovery.

Recent Posts