INTUITIVE SURGICAL Reports Q4 FY2022 Earnings of USD 1655.0 million, Revenues Down 14.6% YoY

February 13, 2023

Earnings report

On January 24, 2023, INTUITIVE SURGICAL ($NASDAQ:ISRG) reported their earnings results for the fourth quarter of FY2022 ending December 31, 2022. INTUITIVE SURGICAL is a medical technology company that produces minimally invasive robotic-assisted surgical systems for use in a variety of specialty areas. Their products include da Vinci Surgical Systems and instruments from da Vinci Xi, to da Vinci X and da Vinci X/S. For the fourth quarter ending December 31, 2022, INTUITIVE SURGICAL reported total revenue of USD 324.9 million, representing a decrease of 14.6% compared to the same period the previous year. This decline was primarily due to lower procedure volumes in the quarter. Net income was reported at USD 1655.0 million, up 6.7% year over year. Despite the decline in revenue, INTUITIVE SURGICAL remained firm in its commitment to innovation and customer service. The company has continued to introduce new products and services to support its customer base.

For example, they recently launched the da Vinci Xe Surgical System which provides increased precision and control during minimally invasive procedures. INTUITIVE SURGICAL also continues to invest in research and development activities to drive innovation in the medical field. They recently announced a collaboration with Carnegie Mellon University to develop artificial intelligence-driven robotic surgery systems. This collaboration will have a significant impact on the medical field and could lead to improved outcomes for patients. Overall, INTUITIVE SURGICAL’s Q4 FY2022 earnings report demonstrates their commitment to delivering innovative solutions that enable better patient care. Despite a decline in revenue, the company has maintained its focus on customer service and technology advancements to ensure continued growth.

Share Price

On Tuesday, INTUITIVE SURGICAL reported its Q4 FY2022 earnings of USD 1655.0 million, down 14.6% from the same period last year. The company’s stock opened at $254.6 and closed at $258.0, representing a 0.8% increase from its prior closing price of $256.0. Despite this, the company reported positive progress on its product innovation initiatives, with the recent launch of their da Vinci SP robotic-assisted surgical system in the US, which is designed to enable surgeons to perform complex procedures with greater precision and control. Despite the challenging environment, INTUITIVE SURGICAL has managed to successfully pivot its business to focus on new market opportunities and product innovations. To further strengthen its position, the company has been actively investing in developing new products and services, including the da Vinci X robotic-assisted surgical system, which is designed to provide enhanced capabilities and greater visualization for surgeons.

The company also reported that they have made significant progress on their strategic partnerships with healthcare providers and distributors, and are working to expand their global reach. INTUITIVE SURGICAL’s Q4 FY2022 results demonstrate that despite the challenges posed by the pandemic, the company is continuing to move forward in its mission to improve patient outcomes through robotic-assisted surgical systems and technologies. With a strong focus on innovation and strategic partnerships, the company is poised to remain at the forefront of the industry in the coming years. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Intuitive Surgical. More…

| Total Revenues | Net Income | Net Margin |

| 6.22k | 1.32k | 21.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Intuitive Surgical. More…

| Operations | Investing | Financing |

| 1.62k | -2.46k | 43 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Intuitive Surgical. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 12.97k | 1.86k | 32.59 |

Key Ratios Snapshot

Some of the financial key ratios for Intuitive Surgical are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.6% | 4.7% | 25.3% |

| FCF Margin | ROE | ROA |

| 17.3% | 8.6% | 7.6% |

Analysis

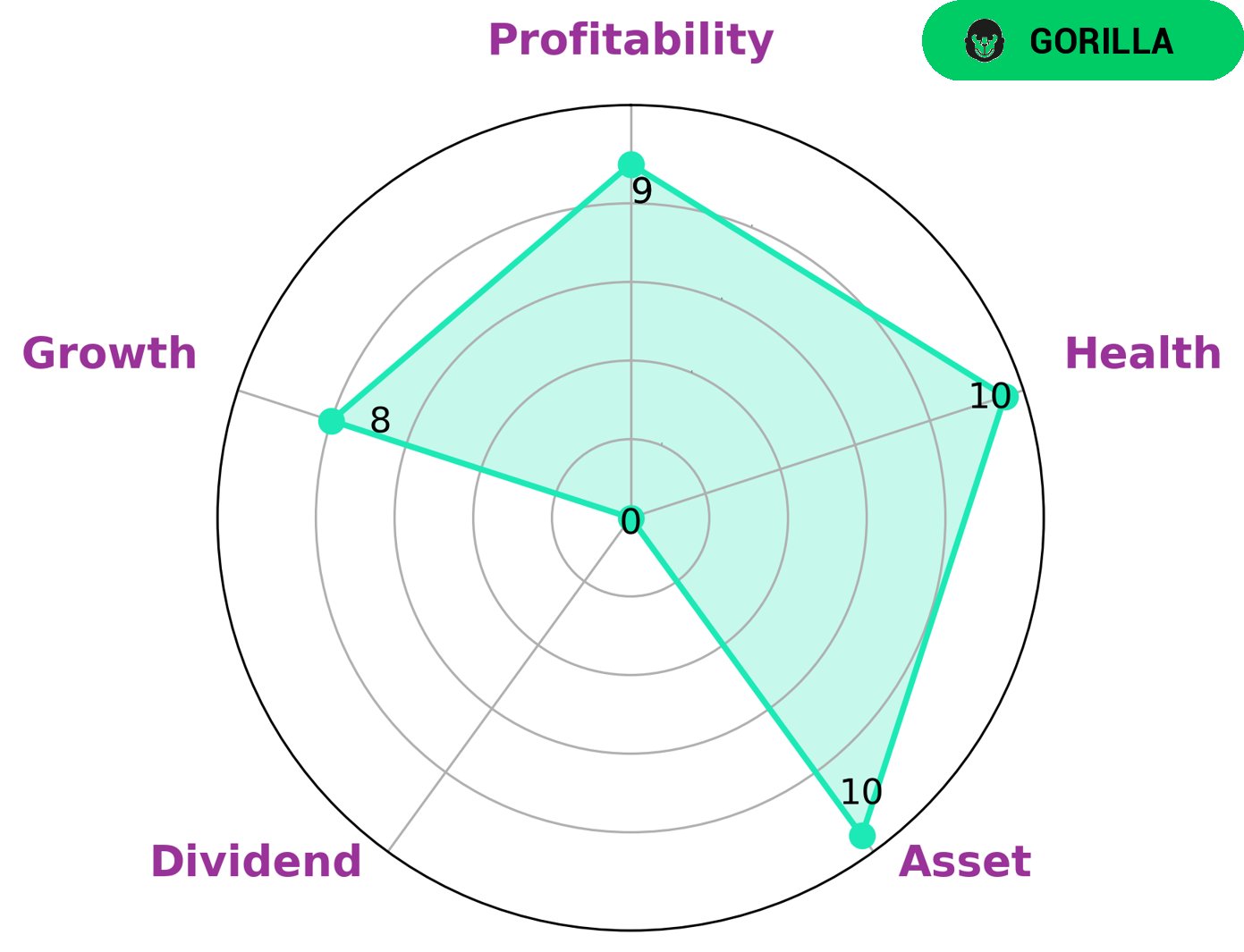

GoodWhale conducted an analysis of INTUITIVE SURGICAL‘s wellbeing, and the Star Chart indicates that INTUITIVE SURGICAL is strong in asset, growth, and profitability, and weak in dividend. This classification as ‘gorilla’ company denotes that it has achieved stable and high revenue or earning growth due to its strong competitive advantage. Such a company would be attractive to investors seeking capital appreciation. INTUITIVE SURGICAL is also seen to have a relatively high health score of 10/10, which is based on its cashflows and debt and indicates that it is capable of sustaining future operations in times of crisis. Investors looking for companies with a strong financial foundation that can withstand market downturns may also be interested. INTUITIVE SURGICAL also has a wide reach in the field of surgical robotics, making it a prime candidate for investors who are looking to diversify their portfolio. With a strong presence in the healthcare industry, the company is well placed to benefit from any changes in the sector, making it an attractive option to those seeking long-term growth. More…

Peers

The company’s da Vinci surgical system consists of a surgeon’s console, a patient-side cart and a vision system. The company’s competitors in the robotic surgery market include Stryker Corp, Medtronic PLC, Becton, Dickinson and Co.

– Stryker Corp ($NYSE:SYK)

With a market capitalization of $84.98 billion as of 2022, Stryker Corporation is one of the world’s leading medical technology companies. Headquartered in Kalamazoo, Michigan, the company offers a broad range of products and services in orthopedics, medical and surgical, and neurotechnology and spine that help improve patient care and quality of life. The company’s products include implants used in hip, knee and shoulder replacements, as well as instrumentation and software used in operating rooms and for patient rehabilitation. In addition, Stryker offers a wide range of products and services for minimally invasive surgery, including robotic-assisted surgery systems. The company’s return on equity was 10.79% as of 2022.

– Medtronic PLC ($NYSE:MDT)

Medtronic PLC is a medical technology company that develops and produces a variety of medical devices and software products. The company has a market capitalization of 112.31 billion as of 2022 and a return on equity of 7.49%. Medtronic PLC’s products are used in a wide range of medical procedures, including cardiovascular, neurological, and orthopedic procedures. The company’s products are sold in over 150 countries around the world.

– Becton, Dickinson and Co ($NYSE:BDX)

Becton, Dickinson and Co is a medical technology company that manufactures and sells medical devices, laboratory equipment, and diagnostic products. The company has a market cap of 64.37B as of 2022 and a return on equity of 6.42%. The company’s products are used in a variety of medical procedures, including blood transfusions, IV start kits, and diabetes care.

Summary

INTUITIVE SURGICAL reported strong earnings for the fourth quarter of FY2022, with total revenue of USD 324.9 million, down 14.6% year over year. Net income for the period was USD 1655.0 million, up 6.7% from the same period in the prior year. These results indicate a healthy outlook for the company, despite the decrease in revenue. Investors should take note that despite the decrease in revenue, the company’s net income increased year over year. This suggests that INTUITIVE SURGICAL is able to maintain its profitability despite difficult market conditions, and that there are potential opportunities for growth in the future.

Investors may also want to look into the company’s underlying financials, such as its cash flow statement and balance sheet, to gain a better understanding of its overall financial health. Overall, INTUITIVE SURGICAL’s fourth quarter earnings results suggest that the company is in a stable financial position and has potential for future growth. Investors should continue to monitor the company’s financials to determine if the company is a good fit for their portfolios.

Recent Posts