Humana Reports Fourth Quarter Financial Results for Fiscal Year 2022

February 20, 2023

Earnings Overview

Humana Inc ($NYSE:HUM) reported their financial performance for the fourth quarter of fiscal year 2022 (ending December 31, 2022) on February 1, 2023. There was a 7.1% decrease in total revenue, reaching USD -15.0 million in comparison to the same period in the prior year. Meanwhile, net income grew 6.6% from the prior year, reaching USD 22439.0 million.

Transcripts Simplified

Humana reported fourth quarter adjusted EPS of $1.62, above internal expectations and consensus estimates. Total medical costs in their Medicare Advantage business were above previous expectations due to higher flu and covid costs, reimbursement rates for 340B eligible drugs, but excluding those items, the costs were modestly below expectations. Their Medicaid business performed well, with lower-than-anticipated medical costs. Primary care organizations improved the operating performance in their wholly owned centers and de novo center count increased by 18%.

Home health admissions were up 9.1% year-over-year, and they expanded their value-based model to cover 15% of their Humana MA members. Finally, mail order penetration was 38.6%.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Humana Inc. More…

| Total Revenues | Net Income | Net Margin |

| 92.87k | 2.81k | 2.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Humana Inc. More…

| Operations | Investing | Financing |

| 4.59k | -1.01k | -1.91k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Humana Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 43.05k | 27.68k | 122.51 |

Key Ratios Snapshot

Some of the financial key ratios for Humana Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 12.7% | – | 4.3% |

| FCF Margin | ROE | ROA |

| 3.7% | 15.7% | 5.8% |

Market Price

The stock opened at $506.1 and closed at $513.3, representing a 0.3% increase from the previous closing price of $511.7. This increase was primarily driven by increased membership and higher commercial premiums, as well as higher government premiums.

In addition, Humana also reported strong performance in its Medicare Advantage business, which saw an increase of 8% in revenue during the quarter. This increase was driven by higher Medicare Advantage enrollment, as well as higher premiums and fees. Overall, Humana Inc had a positive quarter and its financial results show that it is continuing to grow and remain competitive in the health insurance sector. Investors remain optimistic that the company will continue to report strong financial results in the coming quarters as well. Live Quote…

Analysis

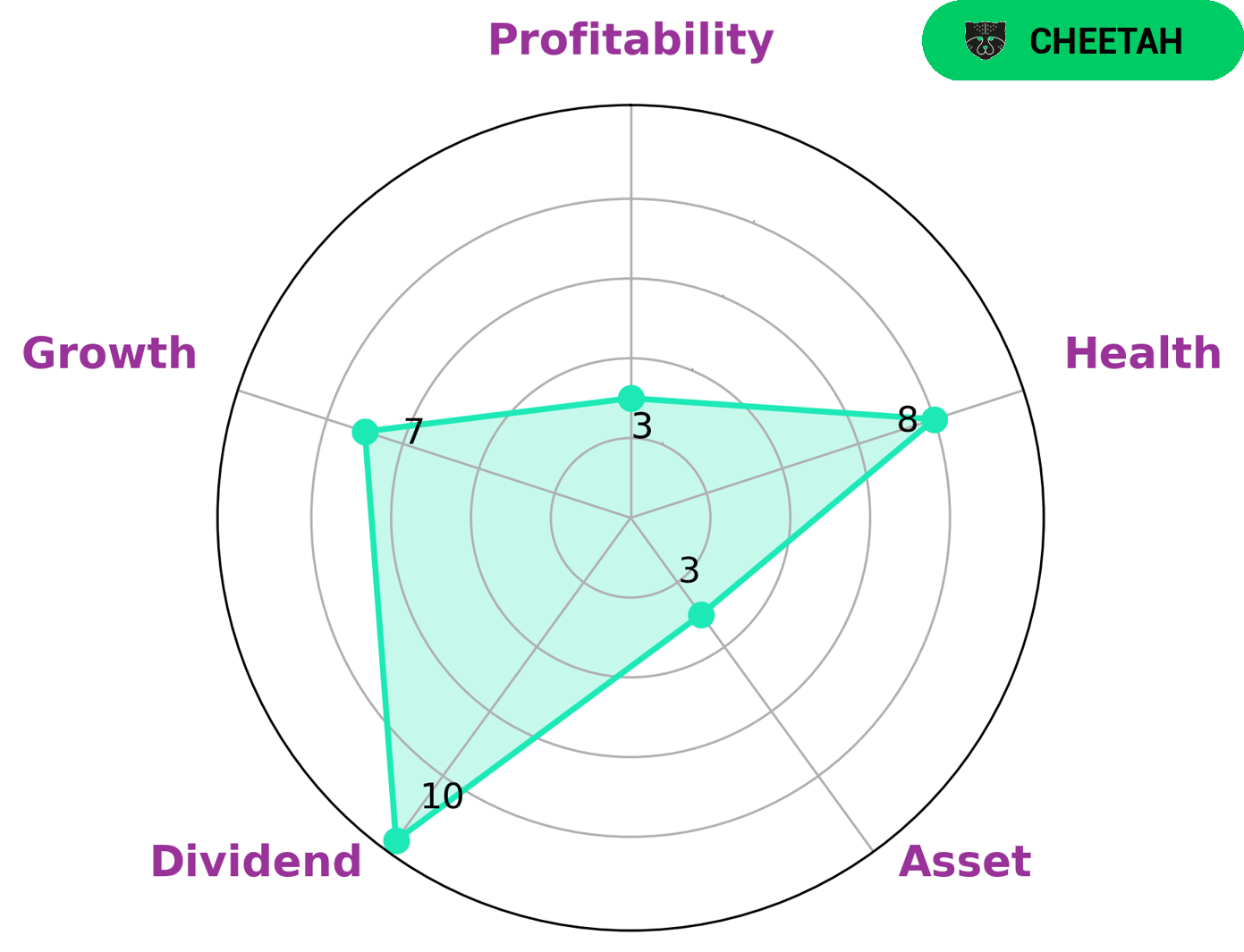

GoodWhale’s analysis of HUMANA INC‘s wellbeing shows that it is strong in dividend and growth, but weak in asset and profitability. HUMANA INC has a high health score of 8/10 considering its cashflows and debt, which indicates it is capable to safely ride out any crisis without the risk of bankruptcy. Therefore, HUMANA INC is classified as ‘cheetah’, a type of company that achieved high revenue or earnings growth but is considered less stable due to lower profitability. This type of company may be attractive to investors who are looking for high-growth opportunities but may be willing to take on the risk associated with the lower profitability of such companies. More…

Peers

In the ever-changing world of healthcare, Humana Inc. has been a leader in providing quality services to its customers. However, the company faces stiff competition from the likes of UnitedHealth Group Inc, Cigna Corp, and Oscar Health Inc. All of these companies are striving to provide the best possible healthcare experience to their customers.

– UnitedHealth Group Inc ($NYSE:UNH)

UnitedHealth Group Inc. is an American for-profit managed health care company based in Minnetonka, Minnesota. It is the largest healthcare company in the world by revenue, with 2019 revenue of $242.2 billion. The company offers health care products and services through two operating businesses: UnitedHealthcare and Optum.

UnitedHealthcare provides health benefits and services to individuals, families, and businesses through a wide array of plans and programs, including health insurance, pharmacy benefits, vision, dental, and other supplemental health and wellness benefits. Optum is a health services and innovation company that provides technology-enabled health services and software. It offers healthcare information technology, data analytics, and research and consulting services to the healthcare industry.

The company has a market capitalization of $488.16 billion as of April 2021 and a return on equity of 21.75%.

– Cigna Corp ($NYSE:CI)

Cigna Corp is a health services company with a market cap of 88.46 billion as of 2022. The company has a return on equity of 11.01%. Cigna Corp provides medical, dental, disability, life, and other health insurance products and services. The company also offers pharmacy benefit management services.

– Oscar Health Inc ($NYSE:OSCR)

Oscar Health is a technology-driven health insurance company founded in 2012. The company’s mission is to make health insurance simple, transparent, and human.

Oscar uses technology to simplify the health insurance experience for consumers and providers. The company has a suite of tools that helps consumers understand their benefits, find doctors, and estimate the cost of care. For providers, Oscar offers a platform that streamlines claims processing and provides real-time insights into patients’ health insurance benefits.

Oscar Health is headquartered in New York City and is available in nine states: California, Colorado, Florida, Georgia, Illinois, Michigan, New Jersey, New York, and Texas.

Summary

HUMANA INC‘s stock performance in the fourth quarter of fiscal year 2022 has been relatively positive, with total revenue decreasing by 7.1% and net income increasing by 6.6%, compared to the previous year. Despite the revenue drop, HUMANA has seen an increase in profitability, indicating better financial management. This is a promising sign for investors, who may see the company’s stock price rise as a result.

Furthermore, HUMANA’s performance indicates that their strategic positioning and cost controls are working, which may indicate potential future growth. Investors should therefore consider HUMANA a strong option for long-term investments.

Recent Posts