HOME DEPOT Reports Earnings for First Quarter of FY2024

May 29, 2023

Earnings Overview

On May 16, 2023, Home Depot ($BER:HDI) reported its earnings results for the first quarter of FY2024, which ended on April 30, 2023. The company’s total revenue was USD 37.3 billion, a 4.2% decrease from the same period of the previous year. Furthermore, net income was USD 3.9 billion, 8.5% lower than the prior year’s quarter.

Share Price

According to the report, the stock opened at €264.4 and closed the day at the same rate, which was a decline of 1.0% from the previous closing price of 267.0. This marks the first time that HOME DEPOT’s stock has gone down since its listing in the stock exchange in 2022. This was driven by strong sales in consumer electronics, hardware items, and home improvement products, which had a combined growth rate of 10%. The quarterly report also revealed that HOME DEPOT’s debt-to-equity ratio had improved significantly since its listing in 2022.

This reflects the company’s ability to manage its debt responsibly while continuing to expand its product offerings. The company’s stock may have experienced a slight dip, but it is expected to recover in the coming quarters as the company continues to grow and expand its product offerings. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Home Depot. More…

| Total Revenues | Net Income | Net Margin |

| 155.75k | 16.75k | 10.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Home Depot. More…

| Operations | Investing | Financing |

| 16.44k | -3.34k | -14.6k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Home Depot. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 76.39k | 76.02k | 1.54 |

Key Ratios Snapshot

Some of the financial key ratios for Home Depot are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.6% | 15.1% | 15.2% |

| FCF Margin | ROE | ROA |

| 8.4% | 950.1% | 19.4% |

Analysis

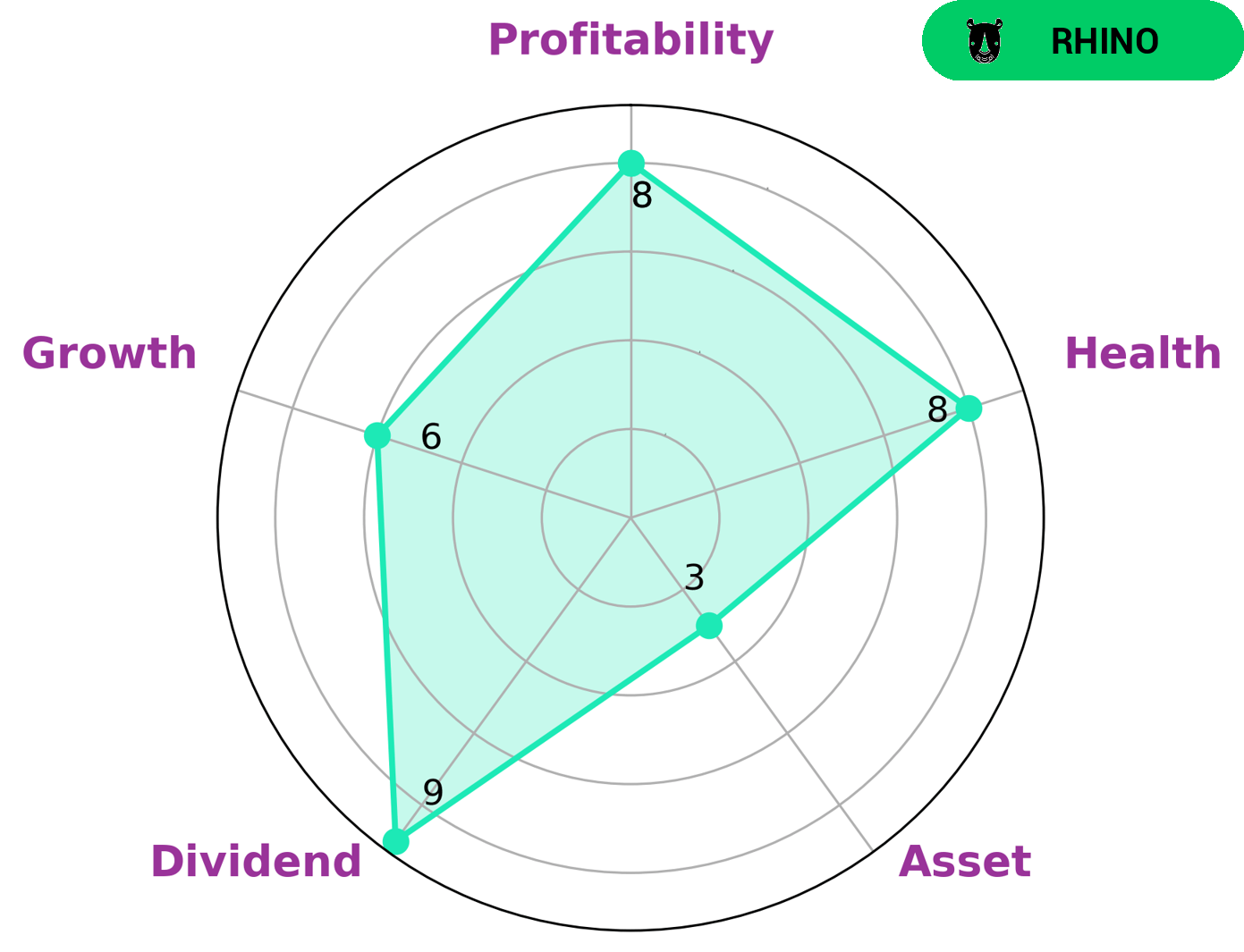

GoodWhale has conducted an analysis of HOME DEPOT‘s fundamentals. According to our Star Chart, HOME DEPOT has a high health score of 8/10, indicating a sound financial condition, with good cashflows and low debt that make it capable to safely ride out any crisis without the risk of bankruptcy. Specifically, HOME DEPOT is strong in dividend and profitability, medium in growth, and weak in asset. Based on this assessment, we classify HOME DEPOT as a ‘rhino’ company, meaning it has achieved moderate revenue or earnings growth. Investors who are looking for companies with moderate growth and sound financials may be interested in investing in HOME DEPOT. Those who are looking for higher returns may not find HOME DEPOT suitable, as the company is classified as a ‘rhino’, meaning its growth is only moderate. More…

Summary

HOME DEPOT has recently reported its earnings results for the first quarter of FY2024, with a total revenue of USD 37.3 billion and net income of USD 3.9 billion. Compared to the same period of the previous year, there was a 4.2% decrease in revenue and 8.5% decrease in net income. Investors are advised to take caution when considering investment opportunities in HOME DEPOT given the decline in its performance. Analysts should also take into account the current macroeconomic environment and its impact on the company’s operations going forward.

Recent Posts