H World Intrinsic Stock Value – H WORLD Reports Record Earnings for Second Quarter of FY2023

August 31, 2023

🌥️Earnings Overview

On June 30, 2023, H WORLD ($NASDAQ:HTHT) reported their financial outcomes from the second quarter of FY2023, showing a 63.5% year-over-year rise in total revenue to CNY 5530.0 million. Additionally, their net income improved from -350.0 million in the same period the previous year to CNY 1015.0 million for the current quarter.

Stock Price

On Thursday, H WORLD reported record earnings for the second quarter of FY2023. The company’s stock opened at an all-time high of $45.2, however, it closed at $42.5, a drop of 5.4% from its prior closing price of 44.9. This decline reflects a general decline in the market due to macroeconomic uncertainty. Although investors were initially disappointed by the decline, they were still satisfied with the performance overall.

This report shows that H WORLD is continuing to experience strong growth and is in a good position for future growth. The company’s financial performance is a testament to its strong management and continued success. Investors should remain optimistic about the future of this company as it continues to deliver impressive financial results. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for H World. More…

| Total Revenues | Net Income | Net Margin |

| 17.81k | 1.16k | 7.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for H World. More…

| Operations | Investing | Financing |

| 5.58k | 472 | -3.3k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for H World. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 63.11k | 50.01k | 40.79 |

Key Ratios Snapshot

Some of the financial key ratios for H World are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 21.5% | -58.8% | 15.8% |

| FCF Margin | ROE | ROA |

| 26.4% | 14.2% | 2.8% |

Analysis – H World Intrinsic Stock Value

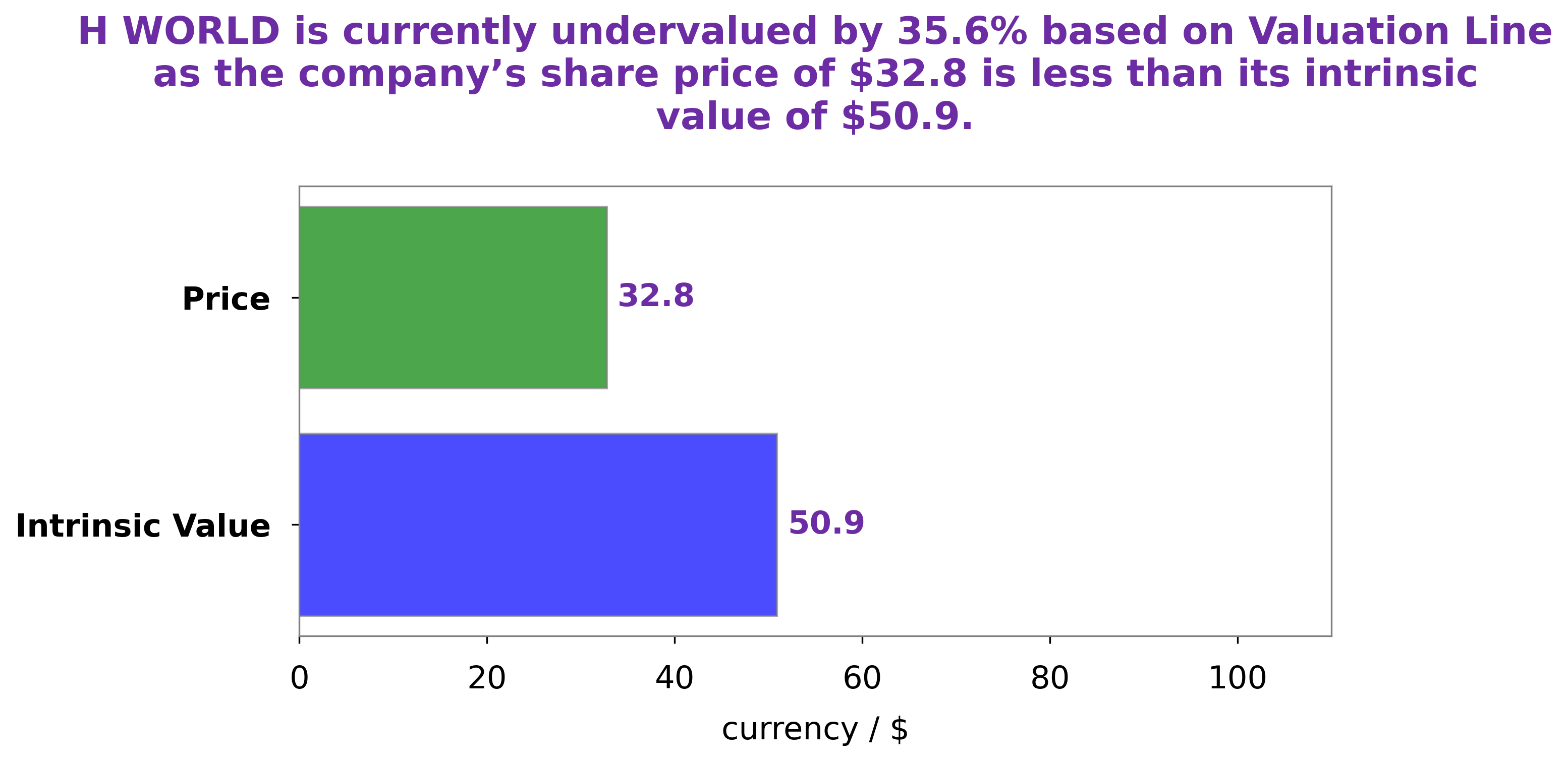

At GoodWhale, we have conducted an analysis of H WORLD‘s financials and believe that the fair value of its stock should be around $55.3 – this figure was calculated using our proprietary Valuation Line. Currently, H WORLD’s stock is traded at $42.5, undervaluing the stock by 23.1%. This presents an excellent opportunity for investors to take advantage of the current price and potentially benefit from the upside when the stock reaches its fair value. More…

Summary

Investing analysis of H WORLD‘s second quarter of FY2023 shows impressive growth in total revenue and net income. Revenue increased by 63.5% year-over-year to CNY 5530.0 million, while net income improved from a loss of -350.0 million in the same quarter last year to CNY 1015.0 million. Despite these positive results, the stock price for H WORLD dropped on the same day, indicating that the market may have anticipated higher results from the company. Investors should consider H WORLD’s strong earnings when making investment decisions moving forward.

Recent Posts