GRAND CITY PROPERTIES SA Reports Earnings Results for First Quarter of FY2023

May 26, 2023

Earnings Overview

GRAND CITY PROPERTIES SA ($BER:GYCD) reported their earnings results for the first quarter of Fiscal Year 2023, which ended on March 31 2023. Total revenue for the period was EUR 101.4 million, representing a year over year growth of 4.5%. However, net income for the quarter was EUR -7.5 million, compared to EUR 36.2 million in the same quarter of the previous year.

Market Price

The company saw its stock open at €7.3 and close at €7.3, representing a 1.2% decline from its last closing price of €7.4. The financial performance of GRAND CITY PROPERTIES SA in the first quarter of the year was largely in line with analyst expectations. Overall, GRAND CITY PROPERTIES SA had a positive first quarter of the year and is continuing to demonstrate its focus on long-term growth and profitability. The company is well-positioned to capitalize on opportunities in the coming quarters and is poised to deliver strong returns for its shareholders in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for GYCD. More…

| Total Revenues | Net Income | Net Margin |

| 400.35 | 84.13 | 49.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for GYCD. More…

| Operations | Investing | Financing |

| 215.54 | -137.71 | 57.01 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for GYCD. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 11.2k | 5.31k | 30.37 |

Key Ratios Snapshot

Some of the financial key ratios for GYCD are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -10.4% | 0.7% | 50.6% |

| FCF Margin | ROE | ROA |

| 52.6% | 2.4% | 1.1% |

Analysis

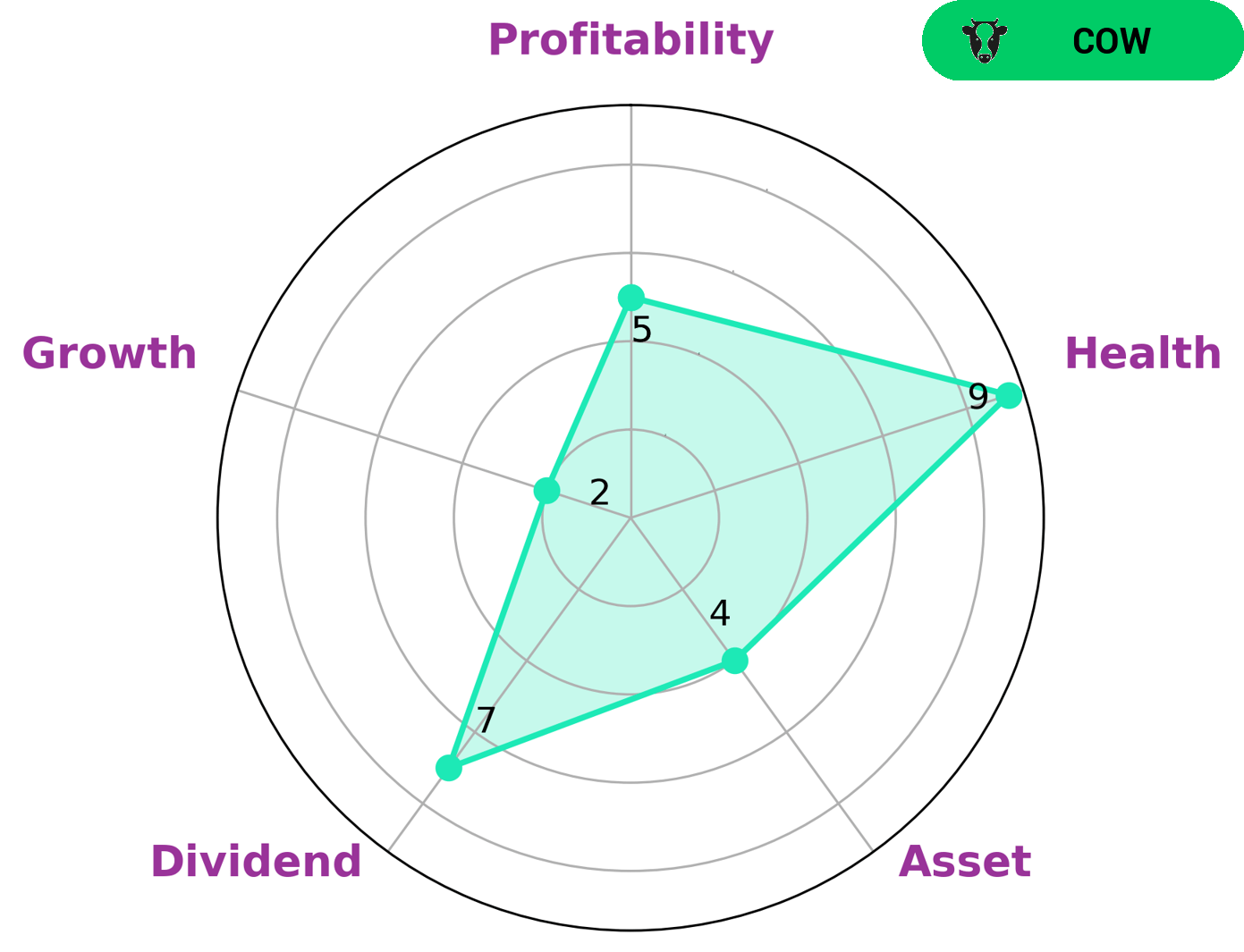

As GoodWhale, we conducted an analysis of GRAND CITY PROPERTIES SA’s fundamentals. According to Star Chart GRAND CITY PROPERTIES SA is classified as ‘cow’, a term indicating that it has the track record of paying out consistent and sustainable dividends. This type of company is likely to be of interest to dividend-seeking investors, as well as investors looking for a steady and reliable investment option. In terms of overall health, GRAND CITY PROPERTIES SA has a high score of 9/10. This is due to its solid cashflows and debt levels, proving that it is capable of paying off debt and funding future operations. Additionally, GRAND CITY PROPERTIES SA is strong in dividend, medium in asset, profitability and weak in growth. This demonstrates that while the company is reliable in terms of dividend payments, there may not be significant growth opportunities in the short term. More…

Peers

Grand City Properties SA is one of the leading companies in the real estate industry, providing investors with reliable and quality services. They are a public company listed on the Frankfurt Stock Exchange and are often compared to other Real Estate firms such as Investors House Oyj, Taylor Consulting Inc, and Swiss Prime Site AG. All of these firms strive to provide investors with high-quality services and facilities, making them all major players in the real estate industry.

– Investors House Oyj ($LTS:0G4W)

Investors House Oyj is a Finnish financial services company operating in the Nordic and Baltic countries. It specializes in offering banking, asset management and wealth management services to corporations, institutional investors and private individuals. The company’s market capitalization is 31.24M as of 2023 and its Return on Equity (ROE) is 7.69%. This indicates that the company has been able to utilize investors’ money efficiently and generate returns. The company has been able to effectively manage its operations to maximize efficiency and generate stronger returns on shareholders’ investments.

– Taylor Consulting Inc ($OTCPK:TAYO)

Taylor Consulting Inc is a professional services firm providing consulting and business services to its clients across the globe. Based in New York, the company has a market capitalization of 93.56k as of 2023, reflecting the value of its outstanding shares. Taylor Consulting Inc’s strong financial performance is highlighted by an impressive Return on Equity (ROE) of 18823.57%. This high ROE indicates that the company has been able to generate returns that are much higher than the cost of capital invested in the business, thereby providing its shareholders with higher returns on their investments. The company has been able to achieve this impressive ROE level through efficient management of revenue and expenses. The company’s focus on customer satisfaction and its ability to identify and capitalize on opportunities have also been key drivers of its success.

– Swiss Prime Site AG ($OTCPK:SWPRF)

Swiss Prime Site AG is a real estate investment company based in Zurich, Switzerland. The company is engaged in the acquisition, development, sale, rental and management of office and retail properties, as well as hotels and residential properties. As of 2023, it has a market cap of 6.47 billion Swiss Francs and a Return on Equity of 5.38%. This reflects its strong performance in the real estate market and ability to generate profits from its investments. The company is an attractive investment option due to its diversified portfolio and solid financial performance.

Summary

GRAND CITY PROPERTIES SA reported an overall 4.5% increase in revenue for the first quarter of Fiscal Year 2023 compared to the same period of the prior year.

However, the company incurred a net loss of EUR -7.5 million this quarter, compared to profits of EUR 36.2 million during the same period of the prior year. Investors should carefully analyze the company’s financials to determine if GRAND CITY PROPERTIES SA is a good investment opportunity. Factors to consider include the company’s revenue growth, competitive landscape, and cost structure.

Additionally, investors should assess the management team’s ability to navigate current market conditions and successfully execute their strategic vision.

Recent Posts