GLOBE LIFE Announces FY2022 Q4 Earnings Results, Ending December 31, 2022

February 10, 2023

Earnings report

GLOBE LIFE ($BER:TMJ), a multinational insurance company, recently announced its FY2022 Q4 earnings results on February 1, 2023. The financial period ended on December 31, 2022. GLOBE LIFE reported total revenue of USD 211.6 million, representing a year-over-year increase of 18.9%. This growth was driven by the company’s expansion into new markets, including the Asia Pacific region, as well as increased investments in technology and products.

Additionally, GLOBE LIFE reported a net income of USD 1322.7 million, a 2.0% year-over-year growth. The company’s strong Q4 performance is largely attributed to its strategic focus on customer service and developing innovative products for its clients. Furthermore, the company has invested in new technology, such as artificial intelligence, to better understand customer needs and drive operational efficiency. GLOBE LIFE’s shares have performed well over the past year, with significant gains despite the challenges posed by the pandemic. The company is optimistic about the future and is looking forward to continuing its growth trajectory. Additionally, GLOBE LIFE is committed to creating value for its customers and shareholders while driving innovation through technology investments. Overall, the company’s FY2022 Q4 earnings results demonstrate its commitment to delivering long-term value and growth. With the recent introduction of new products and services, as well as investments in technology and customer service, GLOBE LIFE is well positioned to capitalize on opportunities in the industry and continue its successful growth trajectory in the future.

Market Price

On Wednesday, GLOBE LIFE announced their fourth quarter earnings results for the fiscal year ending December 31, 2022. The results showed a strong performance, with their stock opening at €110.0 and closing at €110.0. This is a sign that the company is continuing to perform well and is a promising sign of continued growth and success. GLOBE LIFE also released a statement concerning the results and their outlook for the future. They stated that they were proud to report a successful fourth quarter, despite the ongoing challenges of the pandemic. The company highlighted their commitment to providing quality customer service and continually improving operations to remain competitive in their industry. The company also emphasized that they are continuously developing new ways to better serve their customers, including expanding their product offerings and improving customer support services.

Additionally, GLOBE LIFE is committed to investing in new technologies and expanding their capabilities to help them reach new markets. GLOBE LIFE’s solid performance during the fourth quarter of 2022 shows the potential of their business model and their ability to remain resilient in challenging times. With their focus on customer service, ongoing innovation and development, and commitment to reaching new markets, GLOBE LIFE is well-positioned to continue to see success in the near future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Globe Life. More…

| Total Revenues | Net Income | Net Margin |

| 5.21k | 739.7 | 14.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Globe Life. More…

| Operations | Investing | Financing |

| 1.43k | -913.37 | -523.6 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Globe Life. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 24.84k | 20.48k | 44.97 |

Key Ratios Snapshot

Some of the financial key ratios for Globe Life are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.8% | – | 19.1% |

| FCF Margin | ROE | ROA |

| 26.9% | 14.3% | 2.5% |

Analysis

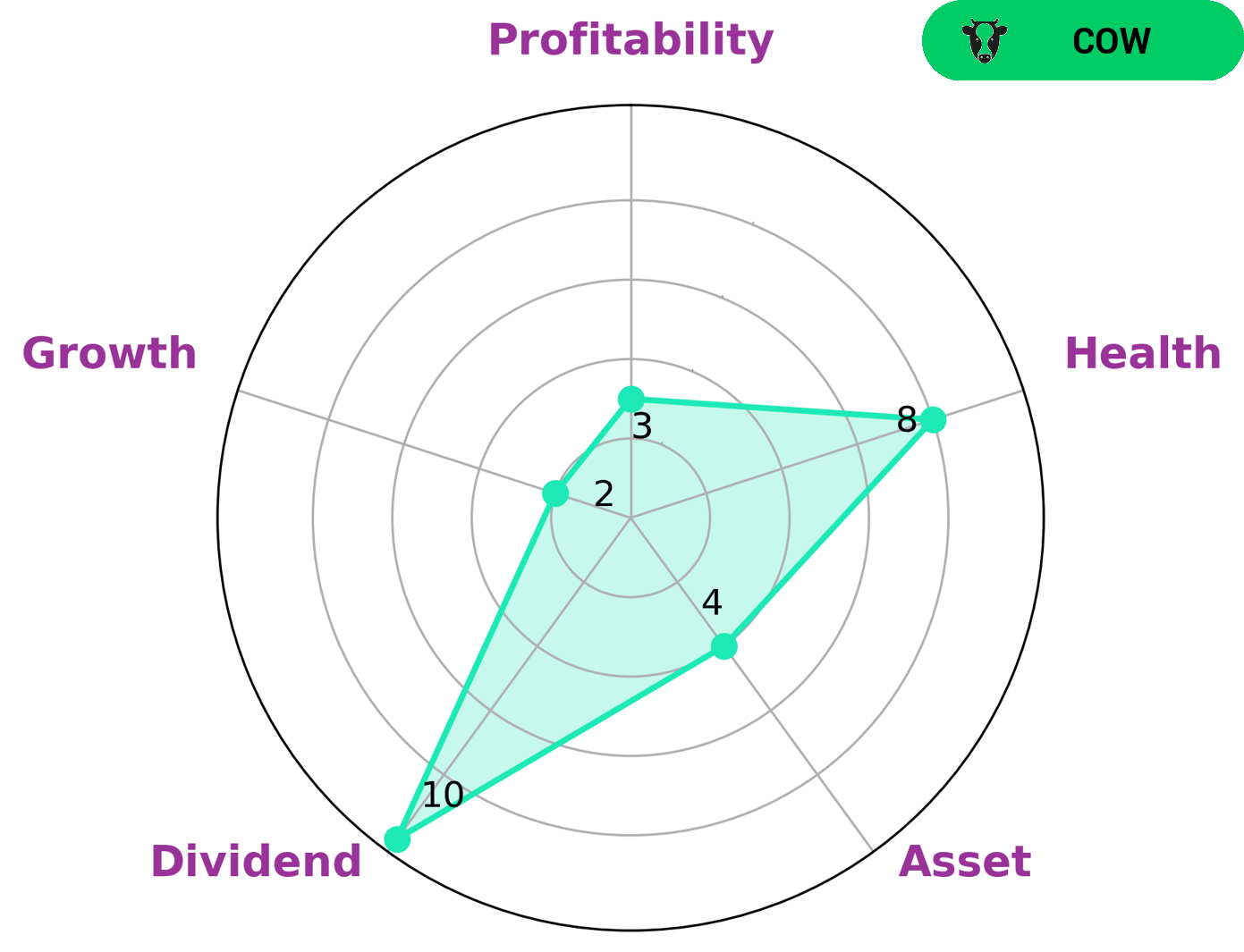

GLOBE LIFE is a company with strong fundamentals, making it an attractive option for investors. GoodWhale analysis of GLOBE LIFE has revealed a high health score of 8/10, indicating that the company is capable of sustaining future operations in times of crisis. Additionally, GLOBE LIFE is classified as a “cow”, referring to companies that have the track record of paying out consistent and sustainable dividends. An analysis of GLOBE LIFE’s Star Chart reveals the company is strong in dividend, medium in asset and weak in growth and profitability. This could be attractive to income investors, as the company’s dividend combines a high yield and stability. Investors who are looking for income investments may be interested in GLOBE LIFE, as the potential for returns is promising. Furthermore, investors who are seeking long-term investments may like the company’s stability and its track record of paying out consistent dividends. Considering its fundamentals, GLOBE LIFE would be a good option for conservative investors who are looking to add it to their portfolios. In conclusion, GLOBE LIFE has proven to be an attractive investment option due to its strong fundamentals, healthy cashflows and debt, and a consistent dividend payout. The company is sure to appeal to income investors, as well as conservative investors who are looking for long-term investments with a potential for returns. More…

Summary

Investing in Globe Life has been a promising decision for shareholders, as evidenced by the company’s impressive FY2022 Q4 earnings results. Total revenue increased by 18.9% year-over-year, reaching USD 211.6 million. Net income also saw a growing trend with a 2.0% year-over-year increase to USD 1322.7 million. While Globe Life’s revenue growth is encouraging, investors may be more interested in the company’s cash flow and profitability. Globe Life has made some strategic investments to help fuel the company’s growth, such as investing in technology and expanding its product portfolio.

With an impressive balance sheet and strong cash flow, Globe Life appears to be in a good financial position to further invest in its operations and capitalize on potential opportunities. Overall, Globe Life looks to be well-positioned for continued success in the coming years. The company has a solid foundation to build upon, which bodes well for shareholders who are looking for consistent returns. As the market continues to shift and evolve, Globe Life may be able to capitalize on its strengths and deliver value to shareholders.

Recent Posts