FRANKLIN COVEY Reports Record Quarterly Earnings for FY2023, Revenue Up 22.6% Year-Over-Year

January 12, 2023

Earnings report

FRANKLIN COVEY ($NYSE:FC), a leading provider of organizational and productivity solutions, recently announced its fiscal year 2023 first quarter earnings report. The report showed a 22.6% year-over-year increase in total revenue, to USD 4.7 million, and a 13.2% year-over-year increase in net income to USD 69.4 million. This is the company’s highest quarterly revenue and income yet, and reflects the continued success of their leadership and business strategies. FRANKLIN COVEY is a publicly traded company on the NASDAQ and specializes in providing productivity tools and solutions for businesses and individuals. They focus on helping people create more productive organizations, teams, and individuals by developing products that simplify complex tasks and help organizations achieve their goals. Their products include training and consulting services, as well as software solutions, such as the popular FranklinCovey PlanPlus. The stellar performance of the company in this quarter is largely attributed to their strong focus on customer experience and product innovation. They have been continuously investing in customer service and product development, which has resulted in better customer loyalty and higher sales.

Additionally, they have also been able to leverage their digital capabilities to expand their market reach and introduce new products to the market. This quarter’s success is a testament to the company’s ability to adapt to the changing needs of their customers and the market. As the company continues to invest in customer experience and product innovation, they are well-positioned to capitalize on future growth opportunities.

Stock Price

On Thursday, FRANKLIN COVEY reported record quarterly earnings for FY2023 with revenue up 22.6% from the same period last year. Despite this strong performance, the company’s stock opened at $47.9 and closed at $46.1, down 4.1% from its last closing price of 48.1. The positive earnings report is a welcome sign for the company, which has been struggling to meet the financial expectations set by analysts and investors in the past few years. The company’s strong performance was attributed to increased demand for its products and services, as well as its ability to effectively manage costs. FRANKLIN COVEY has been focusing on growth in recent years, investing in new markets and expanding its product offerings.

This strategy has paid off, as the company has seen its market share increase significantly over the past year. The company’s stock may be down in the short term, but with its solid performance this quarter and its commitment to innovation and growth, FRANKLIN COVEY is in a good position for the long term. Investors should keep an eye on the company’s future performance to get a better understanding of the potential of this stock. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Franklin Covey. More…

| Total Revenues | Net Income | Net Margin |

| 270.95 | 19.29 | 7.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Franklin Covey. More…

| Operations | Investing | Financing |

| 52.25 | -5.33 | -32.67 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Franklin Covey. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 237.43 | 147.81 | 6.45 |

Key Ratios Snapshot

Some of the financial key ratios for Franklin Covey are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.6% | 98.2% | 9.1% |

| FCF Margin | ROE | ROA |

| 17.3% | 17.8% | 6.5% |

VI Analysis

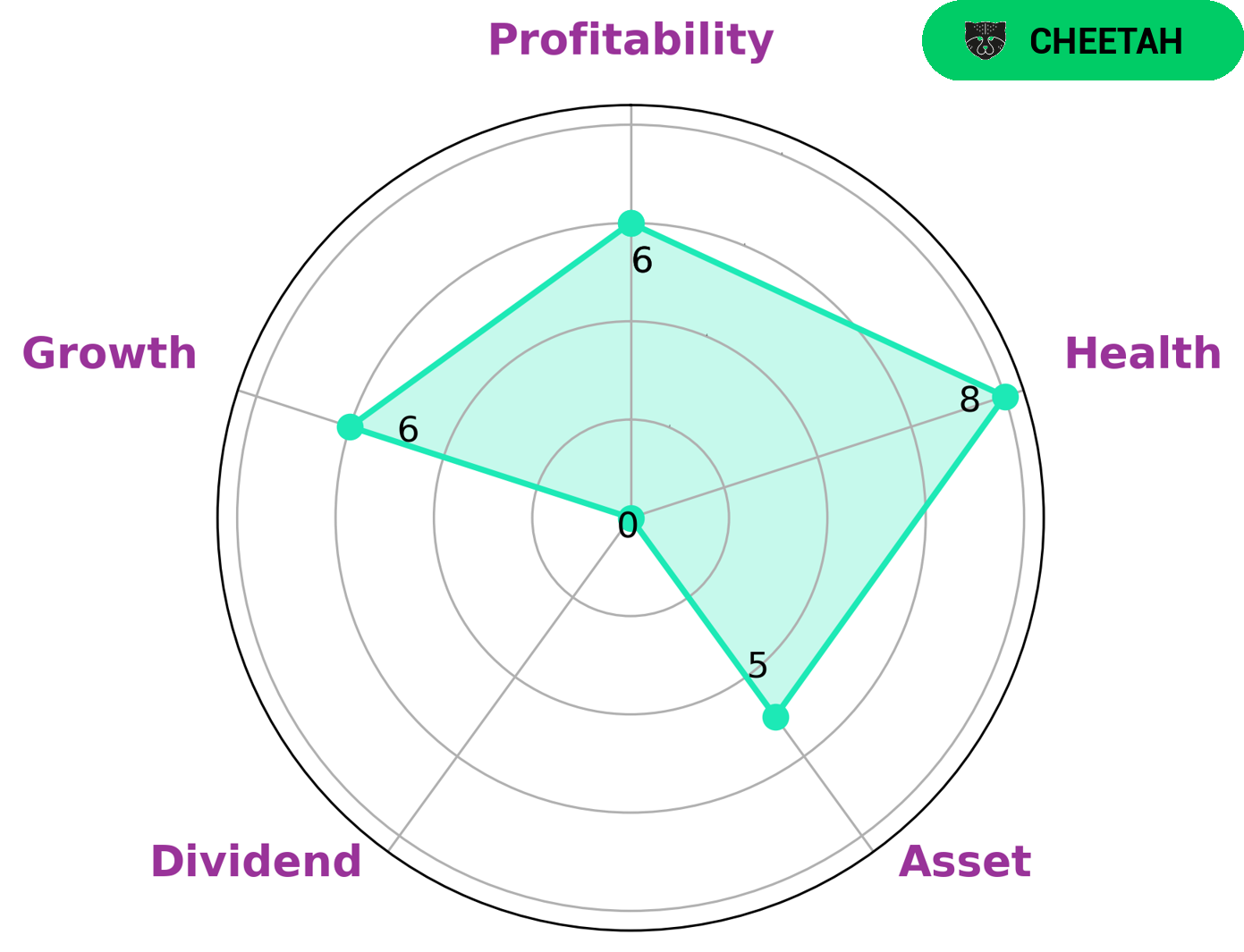

Investors seeking to capitalize on long-term potential should consider the fundamentals of a company. The VI app provides a simple breakdown of the key factors related to Franklin Covey—a company specializing in helping businesses improve their productivity and performance. According to their VI Star Chart, Franklin Covey is strong in liquidity, medium in asset, growth, and profitability, and weak in dividend. Despite its weak dividend score, Franklin Covey has a high health score of 8/10, indicating that it has sufficient cash flow and debt levels to sustain future operations during times of crisis. This makes it a suitable choice for investors looking for long-term gains. Furthermore, Franklin Covey is classified as a “cheetah”—a type of company that has achieved high revenue or earnings growth, but is considered less stable due to lower profitability. Investors who are willing to take on a higher risk profile may be interested in Franklin Covey’s potential. However, those who are more risk-averse should take extra precaution when investing in this type of company. It is important to assess all the factors surrounding the company’s fundamentals before making any investment decisions. More…

VI Peers

Franklin Covey Co. competes with American Education Center Inc, Sportsfield Co Ltd, and PageGroup PLC in the market for educational and training services. The company offers a variety of services, including online and offline courses, as well as customized programs for businesses and organizations. Franklin Covey Co. has a strong brand and a loyal customer base, which gives it a competitive advantage in the market.

– American Education Center Inc ($OTCPK:AMCT)

American Education Center Inc is a for-profit corporation that provides educational services. It offers a variety of programs and services to students, including English language classes, academic advising, and cultural activities. The company was founded in 1992 and is headquartered in New York, NY.

– Sportsfield Co Ltd ($TSE:7080)

Field Co Ltd is a sports equipment company that manufactures and sells a variety of products, including baseballs, basketballs, footballs, and other sports equipment. The company has a market cap of 3.67B as of 2022 and a return on equity of 40.91%. Field Co Ltd is a publicly traded company listed on the New York Stock Exchange.

– PageGroup PLC ($LSE:PAGE)

PLC Group is a leading provider of integrated solutions for the design, development, manufacture, and support of high-performance products and systems. We serve a variety of industries, including aerospace and defense, medical device, semiconductor, and others. We have a long history of providing innovative solutions to our customers’ most challenging problems. Our team of highly skilled engineers, scientists, and technicians work together to provide the best possible products and services to our customers.

Summary

FRANKLIN COVEY recently released its earnings results for the first quarter of FY2023, which ended on November 30, 2022. The company reported total revenue of USD 4.7 million, a 22.6% increase from the previous year, and net income of USD 69.4 million, a 13.2% increase year-over-year. Despite the strong financial performance, the stock price moved down the same day, leaving investors uncertain of how to approach this stock. When considering FRANKLIN COVEY as an investment opportunity, investors should take into account the company’s strong performance in the past quarter, its potential for continued growth, and the current market conditions. FRANKLIN COVEY has proven its ability to generate revenue and profits on a consistent basis, and its record of steady growth suggests that it is well-positioned for future success.

Furthermore, despite the recent decline in stock price, investors should consider the current market conditions and any potential opportunities that may be presented in the near future. Overall, FRANKLIN COVEY has demonstrated strong financial performance in recent quarters and offers investors a long-term opportunity with potential for future growth. Investors should carefully consider their own risk tolerance and objectives when evaluating this stock and decide whether it is a worthwhile investment for them.

Recent Posts