Franklin Covey Reports Record Q1 Earnings, Exceeding Analyst Estimates by $3 Million

January 17, 2023

Trending News 🌥️

Franklin Covey ($NYSE:FC) is a publicly traded company that specializes in providing educational materials, time-management tools, and organizational products. Revenue of $312 million also beat the analyst consensus estimate of $309 million. The company’s success can be attributed to a number of factors, including its continued focus on providing timely and relevant content to its customers and leveraging technology to deliver an exceptional customer experience. Franklin Covey’s leadership team also deserves credit for their ability to quickly adapt to the changing environment and provide investors with a safe and reliable source of income. The company’s success has been driven by its commitment to delivering high-quality products and services, as well as its commitment to innovating and staying ahead of the curve.

These efforts have resulted in strong financial performance and solid growth prospects going forward. Overall, Franklin Covey’s impressive first quarter earnings are a testament to the company’s leadership and resilience in the face of a challenging economic environment. The strong performance indicates that the company is well-positioned for continued success in the coming years, and investors can expect further upside in the stock price as the company continues to execute its long-term growth strategy.

Price History

On Friday, Franklin Covey released its quarterly earnings report for the first quarter of the year. This impressive performance was met with some skepticism by investors, as the stock opened at $43.0 and closed at $44.0, a 4.5% decrease from the prior closing price of 46.1. The company’s solid first quarter results demonstrate its ability to adapt to the challenging economic climate and remain profitable. While some investors may have been surprised by the lower stock price, the company’s strong financial performance is a sign of future success. Franklin Covey’s leadership team also credited the company’s strategic planning and operational execution for the successful quarter. The team has been focused on cost-cutting initiatives and improving customer service, which have resulted in impressive results.

The company has also been actively working on expanding its customer base and increasing its presence in new markets. This strategy has proven to be successful, as the company’s global presence continues to grow. Overall, the record first quarter earnings demonstrate Franklin Covey’s ability to navigate a difficult economic climate and remain profitable. Its strategic planning and operational execution have been key in maintaining strong financial performance, and the company is well-positioned to continue its growth in the coming quarters. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Franklin Covey. More…

| Total Revenues | Net Income | Net Margin |

| 270.95 | 19.29 | 7.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Franklin Covey. More…

| Operations | Investing | Financing |

| 52.25 | -5.33 | -32.67 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Franklin Covey. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 237.43 | 147.81 | 6.45 |

Key Ratios Snapshot

Some of the financial key ratios for Franklin Covey are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.6% | 98.2% | 9.1% |

| FCF Margin | ROE | ROA |

| 17.3% | 17.8% | 6.5% |

VI Analysis

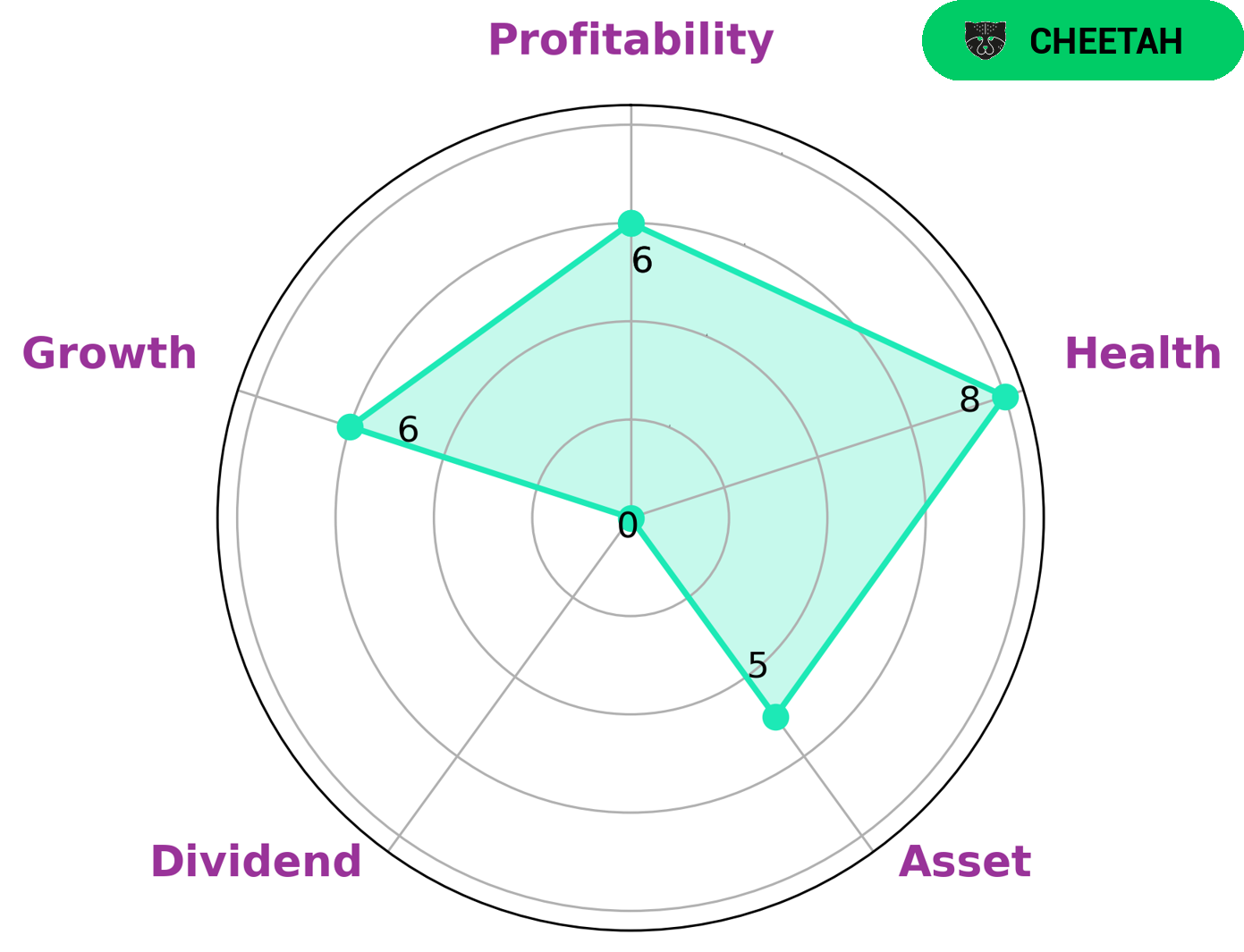

Investors looking for companies with potential for high revenue or earnings growth may be interested in Franklin Covey. The VI Star Chart classifies the company as a “cheetah”, indicating a type of company with higher growth potential but lower stability due to lower profitability. However, Franklin Covey has a healthy score of 8 out of 10 for cashflows and debt, meaning it is capable of riding out any crisis without the risk of bankruptcy. In terms of its fundamentals, Franklin Covey is strong in liquidity, medium in asset, growth, and profitability, and weak in dividend. This indicates that the company is more focused on increasing its revenues than on paying dividends to shareholders. The company’s strong liquidity can help it during economic downturns, while the medium asset, growth and profitability ratings indicate that Franklin Covey is well-positioned to continue increasing its revenues in the future. Overall, Franklin Covey is an attractive investment option for those who wish to invest in a company with higher growth potential but lower stability due to lower profitability. The company’s strong liquidity and medium asset, growth and profitability ratings all make it a great option for investors who want to take advantage of the potential for higher returns in the long run. More…

VI Peers

Franklin Covey Co. competes with American Education Center Inc, Sportsfield Co Ltd, and PageGroup PLC in the market for educational and training services. The company offers a variety of services, including online and offline courses, as well as customized programs for businesses and organizations. Franklin Covey Co. has a strong brand and a loyal customer base, which gives it a competitive advantage in the market.

– American Education Center Inc ($OTCPK:AMCT)

American Education Center Inc is a for-profit corporation that provides educational services. It offers a variety of programs and services to students, including English language classes, academic advising, and cultural activities. The company was founded in 1992 and is headquartered in New York, NY.

– Sportsfield Co Ltd ($TSE:7080)

Field Co Ltd is a sports equipment company that manufactures and sells a variety of products, including baseballs, basketballs, footballs, and other sports equipment. The company has a market cap of 3.67B as of 2022 and a return on equity of 40.91%. Field Co Ltd is a publicly traded company listed on the New York Stock Exchange.

– PageGroup PLC ($LSE:PAGE)

PLC Group is a leading provider of integrated solutions for the design, development, manufacture, and support of high-performance products and systems. We serve a variety of industries, including aerospace and defense, medical device, semiconductor, and others. We have a long history of providing innovative solutions to our customers’ most challenging problems. Our team of highly skilled engineers, scientists, and technicians work together to provide the best possible products and services to our customers.

Summary

Franklin Covey Co. (FC) recently reported record-breaking first quarter earnings, surpassing analyst estimates by $3 million. Despite this positive news, the stock price moved down on the same day. Analysts attributed the decline to investors focusing on the fact that revenues were down from the previous quarter. The company also posted a decline in net income as a result of higher operating expenses.

Despite these results, analysts remain optimistic about FC’s long-term prospects, citing their strong balance sheet and continued commitment to innovation. Investing analysts recommend that investors take a long-term view and consider the company’s fundamentals when making decisions.

Recent Posts