EMBECTA CORP Reports Record Earnings Results for Third Quarter of FY2023

August 15, 2023

🌥️Earnings Overview

EMBECTA CORP ($NASDAQ:EMBC) reported their financial results for the third quarter of FY2023, which ended on June 30 2023. Total revenue for the quarter was USD 286.1 million, a 1.7% decrease compared to the previous year. Net income also decreased significantly year over year, by 75.6%, amounting to USD 15.2 million.

Market Price

The company’s stock opened at $23.7 and closed at $22.2, up 2.6% from the prior closing price of 21.6. This marked the fourth consecutive quarter of positive earnings growth, further cementing the company’s position as a leading provider of technological products and services. The company’s earnings report was well-received by the markets and investors, as they were impressed with the new products and services that EMBECTA CORP has introduced over the past few quarters. These new offerings have helped the company gain an edge over its competitors in the industry, while also creating more value for shareholders. In addition to the positive earnings results, EMBECTA CORP has also made a number of strategic acquisitions in order to expand its product and service portfolio.

This is helping the company to move into new sectors and markets, allowing it to diversify its revenue sources and drive long-term growth. The company is confident that these acquisitions will help it to achieve its long-term growth targets. Overall, EMBECTA CORP’s strong performance in the third quarter of FY2023 has once again demonstrated that the company is well-positioned for continued success in the future. With its robust portfolio of products and services, strategic acquisitions, and forward-looking strategy, EMBECTA CORP is well-poised to continue to deliver strong results in the months and years ahead. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Embecta Corp. More…

| Total Revenues | Net Income | Net Margin |

| 1.11k | 47.2 | 7.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Embecta Corp. More…

| Operations | Investing | Financing |

| 96.1 | -25.9 | -46.1 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Embecta Corp. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.25k | 2.06k | -14.13 |

Key Ratios Snapshot

Some of the financial key ratios for Embecta Corp are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.6% | -9.8% | 15.7% |

| FCF Margin | ROE | ROA |

| 6.3% | -13.4% | 8.7% |

Analysis

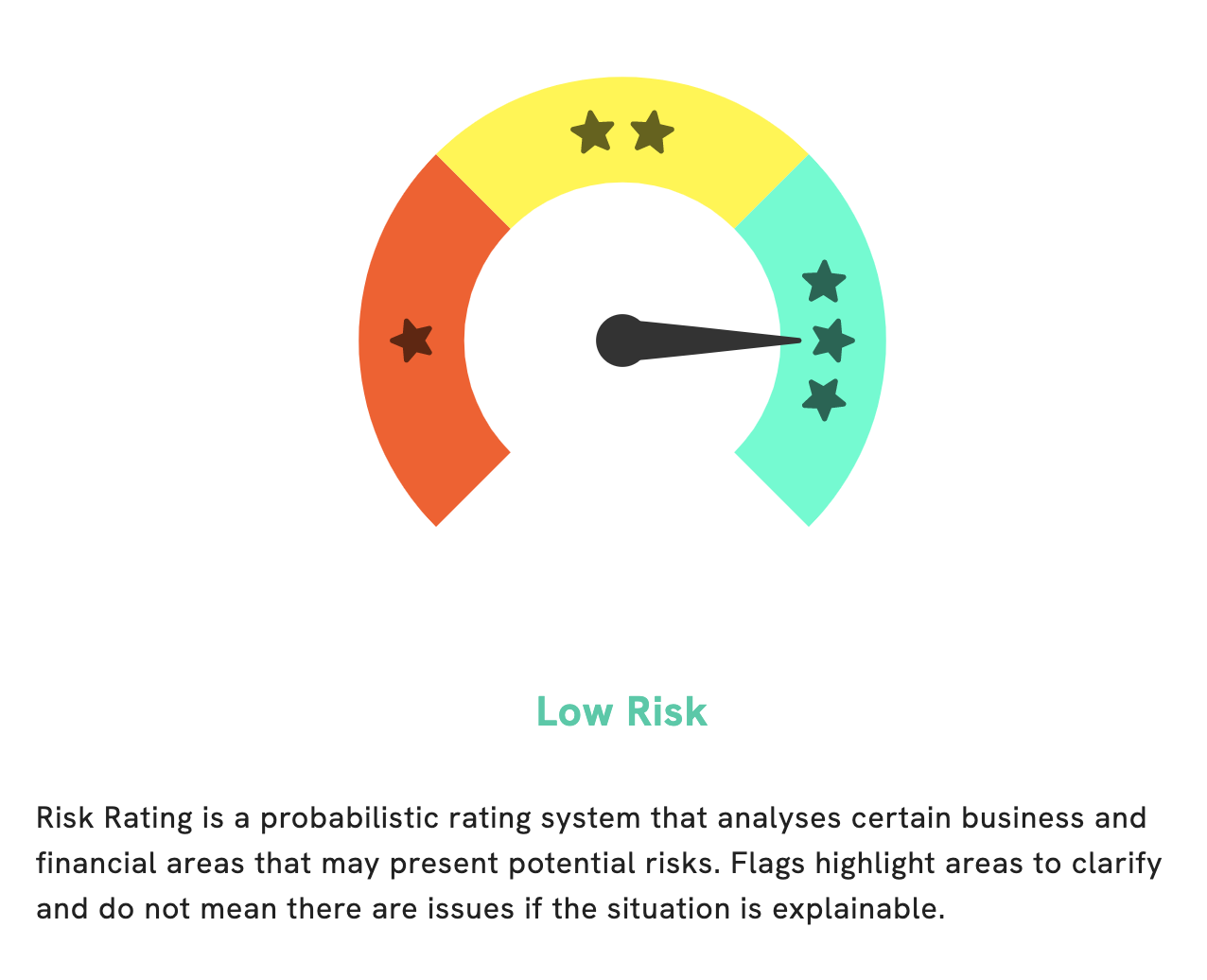

At GoodWhale, we believe that understanding the financial and business aspects of a company are essential for investors in order to make the best decisions when investing. As such, we have conducted an analysis of EMBECTA CORP‘s wellbeing, and are pleased to report that it has received a low risk rating. Although GoodWhale has detected one risk warning in EMBECTA CORP’s balance sheet, this is not enough to classify it as a high risk investment. If you are a registered user, you can check out the risk warning and decide for yourself whether or not you want to invest in EMBECTA CORP. Otherwise, we would recommend that investors invest with caution in EMBECTA CORP until more information is available. More…

Peers

The company was founded in 1980 and is headquartered in New York, NY. Embecta Corp‘s products include prescription drugs for the treatment of cardiovascular disease, diabetes, and cancer. The company’s competitors include Uluru Inc, RxSight Inc, and Modalis Therapeutics Corp.

– Uluru Inc ($OTCPK:ULUR)

RxSight Inc is a medical device company that develops and commercializes innovative ophthalmic implants that allow ophthalmologists to more precisely treat complex retinal diseases. As of 2022, the company has a market capitalization of 318.4 million and a return on equity of -31.3%.

– RxSight Inc ($NASDAQ:RXST)

Modalis Therapeutics Corp is a biopharmaceutical company that focuses on the development of therapeutics for the treatment of cancer and other diseases. The company has a market cap of 11.21B as of 2022 and a return on equity of -13.14%. Modalis Therapeutics Corp is headquartered in New York, New York.

Summary

Investors should take note of EMECTA CORP’s third quarter earnings results, which showed decreased revenue of 1.7% from the previous year and a dramatic drop in net income of 75.6%. This could be a sign of further instability in the company’s financial performance and may be cause for concern for investors. Additionally, investors should review the company’s financials and monitor changes in the company’s performance to ensure that their investments remain sound.

Recent Posts