DOCUSIGN Reports Strong Second Quarter Earnings for FY2024

September 10, 2023

☀️Earnings Overview

On July 31, 2023, DOCUSIGN ($NASDAQ:DOCU) released their earnings results for the second quarter of FY2024 which ended September 7, 2023. Revenue for the quarter totaled USD 687.7 million, showing a 10.5% year-over-year increase. Net income jumped 116.4% year-over-year to USD 7.4 million.

Stock Price

Despite this positive news, their stock opened at $52.2 and closed at $52.1, down by 1.2% from last closing price of 52.8.

However, despite the slight dip in the stock price, DOCUSIGN‘s overall performance was seen as a success as the company reported impressive profits. This growth was mainly attributed to the launch of their new product line and their successful marketing campaigns. Overall, DOCUSIGN’s strong second quarter earnings were seen as a sign that the company is on a solid path towards continued growth and success. They have experienced steady gains in both their revenue and customer base and are now well-positioned to capitalize on upcoming opportunities. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Docusign. DOCUSIGN_Reports_Strong_Second_Quarter_Earnings_for_FY2024″>More…

| Total Revenues | Net Income | Net Margin |

| 2.65k | -16.67 | 0.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Docusign. DOCUSIGN_Reports_Strong_Second_Quarter_Earnings_for_FY2024″>More…

| Operations | Investing | Financing |

| 634.25 | -102.26 | -154.4 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Docusign. DOCUSIGN_Reports_Strong_Second_Quarter_Earnings_for_FY2024″>More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.27k | 2.42k | 4.19 |

Key Ratios Snapshot

Some of the financial key ratios for Docusign are shown below. DOCUSIGN_Reports_Strong_Second_Quarter_Earnings_for_FY2024″>More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 31.6% | – | 0.3% |

| FCF Margin | ROE | ROA |

| 20.6% | 0.7% | 0.2% |

Analysis

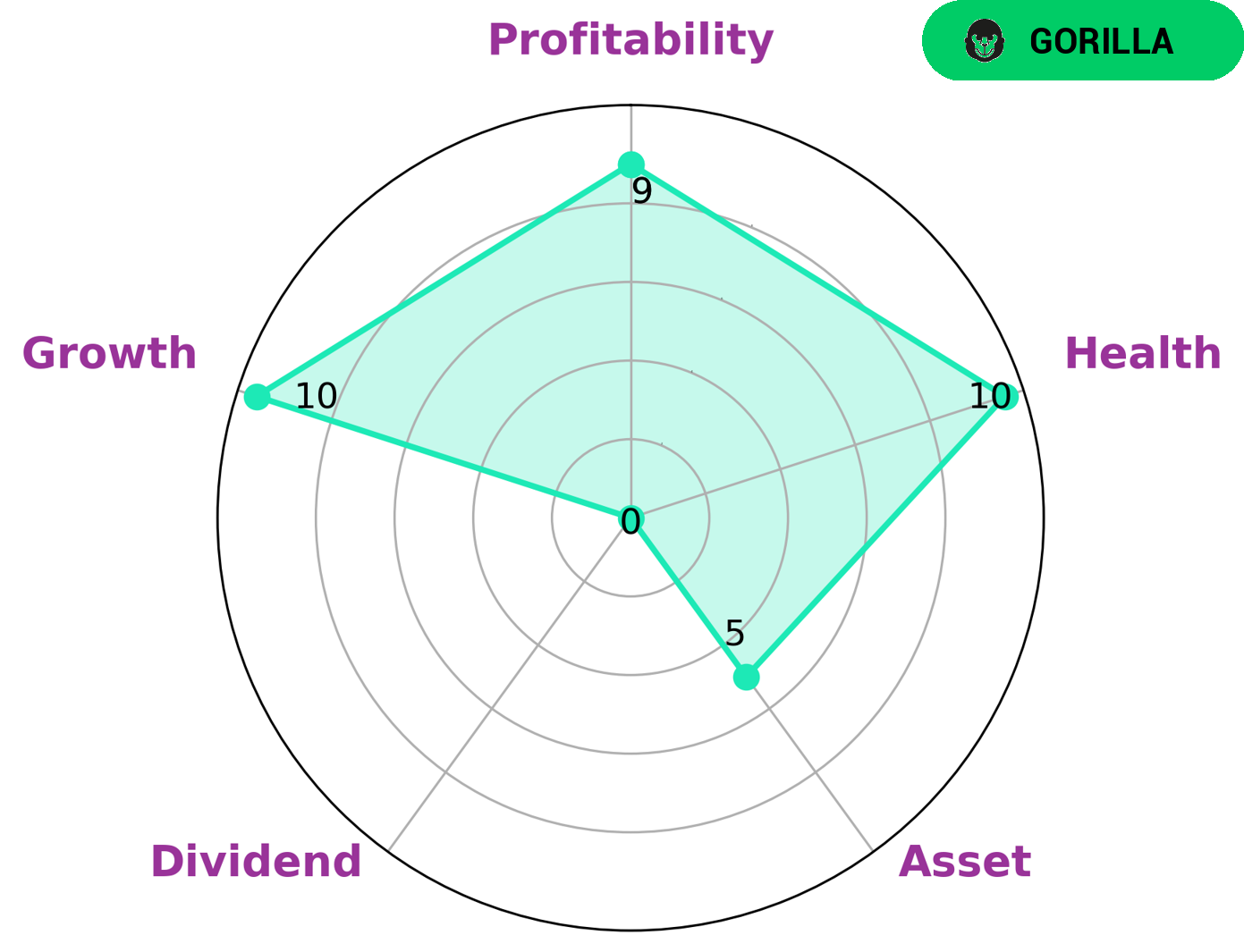

As GoodWhale, we have analyzed DOCUSIGN‘s fundamentals and identified them as a ‘gorilla’ company. This means that DOCUSIGN is able to achieve stable and high revenue or earning growth due to its strong competitive advantage. Consequently, this type of company will be of interest to investors seeking to make long-term investments with attractive returns. We have also assessed DOCUSIGN’s health score to be 8/10. This means that DOCUSIGN’s cashflows and debt are strong, and the company is capable of sustaining future operations in times of crisis. Additionally, looking at the other criteria, DOCUSIGN is strong in growth, profitability, and medium in assets, while it is weak in dividend. More…

Peers

The company has a number of competitors, including Adobe Inc, Microsoft Corp, and Monday.Com Ltd.

– Adobe Inc ($NASDAQ:ADBE)

Adobe Inc. is an American multinational computer software company headquartered in San Jose, California. The company has a market cap of 153.82B as of 2022 and a ROE of 26.76%. Adobe Inc. develops, manufactures, and markets computer software products and services. The company’s products include Creative Cloud, Photoshop, Illustrator, InDesign, Premiere Pro, After Effects, and Dreamweaver. Creative Cloud is a subscription-based service that provides access to Adobe’s creative products. Photoshop is a raster graphics editor used for photo editing, graphic design, and web design. Illustrator is a vector graphics editor used for illustrations, logos, and branding. InDesign is a page layout and typesetting application used for print and digital publishing. Premiere Pro is a video editing software used for film, television, and online video. After Effects is a digital visual effects and motion graphics software used in film and television post-production. Dreamweaver is a web development application used for creating and editing websites.

– Microsoft Corp ($NASDAQ:MSFT)

Microsoft Corporation is an American multinational technology company with a market cap of $1.8 trillion and a ROE of 31.9%. The company develops, manufactures, licenses, supports, and sells computer software, consumer electronics, personal computers, and services. Its best known software products are the Microsoft Windows line of operating systems, the Microsoft Office suite, and the Internet Explorer and Edge web browsers.

– Monday.Com Ltd ($NASDAQ:MNDY)

Monday.com Ltd is a publicly traded company with a market capitalization of 4.36 billion as of 2022. The company has a return on equity of -16.81%. Monday.com Ltd is a provider of enterprise software solutions. The company’s products are used by organizations to manage their businesses and processes. Monday.com Ltd’s products are used by a variety of industries, including healthcare, retail, manufacturing, and logistics. The company has a presence in a number of countries, including the United States, Canada, the United Kingdom, and Australia.

Summary

DOCUSIGN reported strong financials for Q2 of FY2024, with total revenue rising 10.5% YoY to USD 687.7 million and net income increasing 116.4% YoY to USD 7.4 million. This positive performance is encouraging for potential investors, suggesting that DOCUSIGN is a profitable company with a strong growth trajectory. Moreover, the impressive YoY increase in net income further suggests that the company is realizing favorable returns on its investments and investments in DOCUSIGN could be a sound choice.

Recent Posts