Docgo Inc Intrinsic Value – DOCGO INC Reports Second Quarter Earnings Results for FY2023 on August 7, 2023

August 12, 2023

🌥️Earnings Overview

On August 7 2023, DOCGO INC ($NASDAQ:DCGO) reported their earnings results for the second quarter of FY2023, which concluded at the end of June 30 2023. Total revenue for the quarter totaled USD 125.5 million, up 14.6% compared to the same period of the previous year, while net income was USD -2.0 million, a decrease from 12.7 million in Q2 of FY2022.

Share Price

The announcement came as a positive surprise for investors. Stock opened at $9.0 and closed at $9.1, up by 1.8% from the prior closing price of $9.0. This signifies that the market is optimistic about the company’s future growth prospects.

Additionally, the company announced that it has no long-term debt. This puts the company in a solid financial position going into the third quarter of FY2023. Overall, investors appear to be pleased with DOCGO INC’s second quarter results. With strong financials, a healthy balance sheet, and an optimistic outlook, the company’s stock has seen a steady increase over the past few weeks. As DOCGO INC continues to deliver strong results, investors continue to show confidence in the company’s future performance. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Docgo Inc. More…

| Total Revenues | Net Income | Net Margin |

| 451.59 | 5.74 | 1.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Docgo Inc. More…

| Operations | Investing | Financing |

| -13.74 | -61.91 | -10.49 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Docgo Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 390.29 | 106.43 | 2.7 |

Key Ratios Snapshot

Some of the financial key ratios for Docgo Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 108.9% | – | -0.2% |

| FCF Margin | ROE | ROA |

| -5.0% | -0.2% | -0.2% |

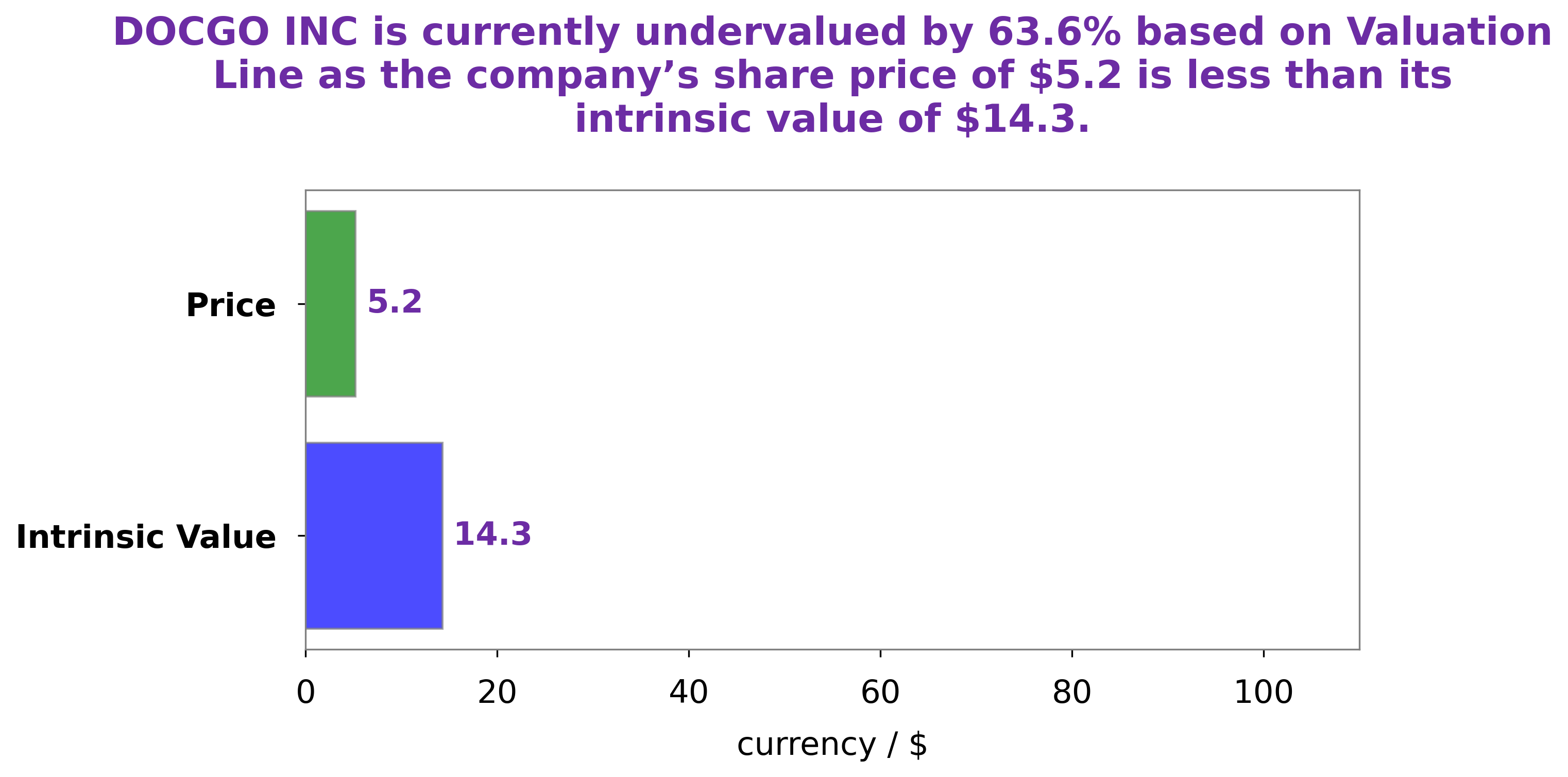

Analysis – Docgo Inc Intrinsic Value

GoodWhale has conducted an analysis of DOCGO INC‘s fundamentals, and the results are in. Our proprietary Valuation Line has determined that the fair value of a DOCGO INC share is around $13.1. Looking at the current market price, we can see that DOCGO INC stock is traded at $9.1, which is a discount of 30.6%. This makes DOCGO INC stock a great buy right now! More…

Peers

It offers a comprehensive suite of products and services that enable patients to receive the best possible care. The company’s products and services are designed to improve the quality of care and reduce the cost of care. DocGo Inc‘s competitors include Skylight Health Group Inc, P3 Health Partners Inc, and PT Metro Healthcare Indonesia Tbk.

– Skylight Health Group Inc ($TSXV:SLHG)

Skylight Health Group Inc is a Canadian publicly traded company that provides primary healthcare services. The company has a market cap of 25.09M as of 2022 and a Return on Equity of -54.94%. Skylight Health Group Inc operates a network of primary healthcare clinics across Ontario and Alberta. The company’s clinics offer a range of services, including family medicine, walk-in care, chronic disease management, and mental health services.

– P3 Health Partners Inc ($NASDAQ:PIII)

P3 Health Partners Inc is a healthcare technology company that provides software and services to help healthcare organizations improve the quality and efficiency of patient care. The company has a market cap of $198.75 million and a return on equity of 106.12%. P3 Health Partners is headquartered in Denver, Colorado.

– PT Metro Healthcare Indonesia Tbk ($IDX:CARE)

As of 2022, PT Metro Healthcare Indonesia Tbk has a market cap of 15.56T and a ROE of 0.73%. The company is a leading provider of healthcare services in Indonesia. It offers a wide range of services, including medical care, nursing care, and rehabilitation services. The company has a strong commitment to quality and customer satisfaction. It is one of the few companies in Indonesia that is ISO 9001:2008 certified.

Summary

DOCGO INC has seen a strong growth in revenue in its second quarter of FY2023, with a 14.6% year-on-year increase to USD 125.5 million. Unfortunately, this was offset by a net loss of USD -2.0 million, compared to a net income of 12.7 million in the same period of the previous year. For investors, the financial performance of DOCGO INC is an important indicator in assessing the company’s future prospects as it continues to scale its business. Its second quarter results show it is successfully growing its top line, but the net loss means investors will want to keep a close eye on the company’s bottom line.

Recent Posts