DHT HOLDINGS Reports Record Fourth Quarter Earnings for FY 2022

February 24, 2023

Earnings Overview

On February 9, 2023, DHT HOLDINGS ($BER:D8EN) announced their fourth quarter earnings results for the fiscal year ending December 31, 2022. They achieved a total revenue of USD 62.0 million, a remarkable 2238.6% increase year-on-year. Additionally, their net income grew by a whopping 100.3%, reaching USD 167.9 million compared to the same period in the previous year.

Price History

On Thursday, DHT HOLDINGS reported record fourth quarter earnings for the fiscal year 2022. The company’s stock opened at €8.5 and closed at €8.5, showing a 2.7% increase from the previous closing price of 8.3. This unprecedented growth can be attributed to DHT HOLDINGS’ successful strategies that have enabled them to continue to expand profits in these tough economic times. The company’s strong performance can be attributed largely to its focus on increasing efficiency and productivity across all its business units as well as continued cost cutting initiatives. Furthermore, the company has also successfully implemented a strategy of diversifying its client base, which has enabled it to generate higher revenue from a wider range of customers.

The company has also sustained a recovery in its oil tanker business, which has had a positive impact on its financial performance. Overall, DHT HOLDINGS has done an impressive job sustaining its growth while navigating a difficult market environment. The company’s strong fourth quarter performance is testament to its ability to remain resilient even in the face of adversity. With a solid balance sheet and sound management team, there is no doubt that DHT HOLDINGS is well positioned to continue to outperform and generate long-term value for its shareholders. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Dht Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 454.14 | 61.52 | 6.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Dht Holdings. More…

| Operations | Investing | Financing |

| 127.91 | 110.52 | -173.34 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Dht Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.51k | 434.99 | 6.57 |

Key Ratios Snapshot

Some of the financial key ratios for Dht Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -5.3% | -26.7% | 19.5% |

| FCF Margin | ROE | ROA |

| 25.9% | 5.3% | 3.7% |

Analysis

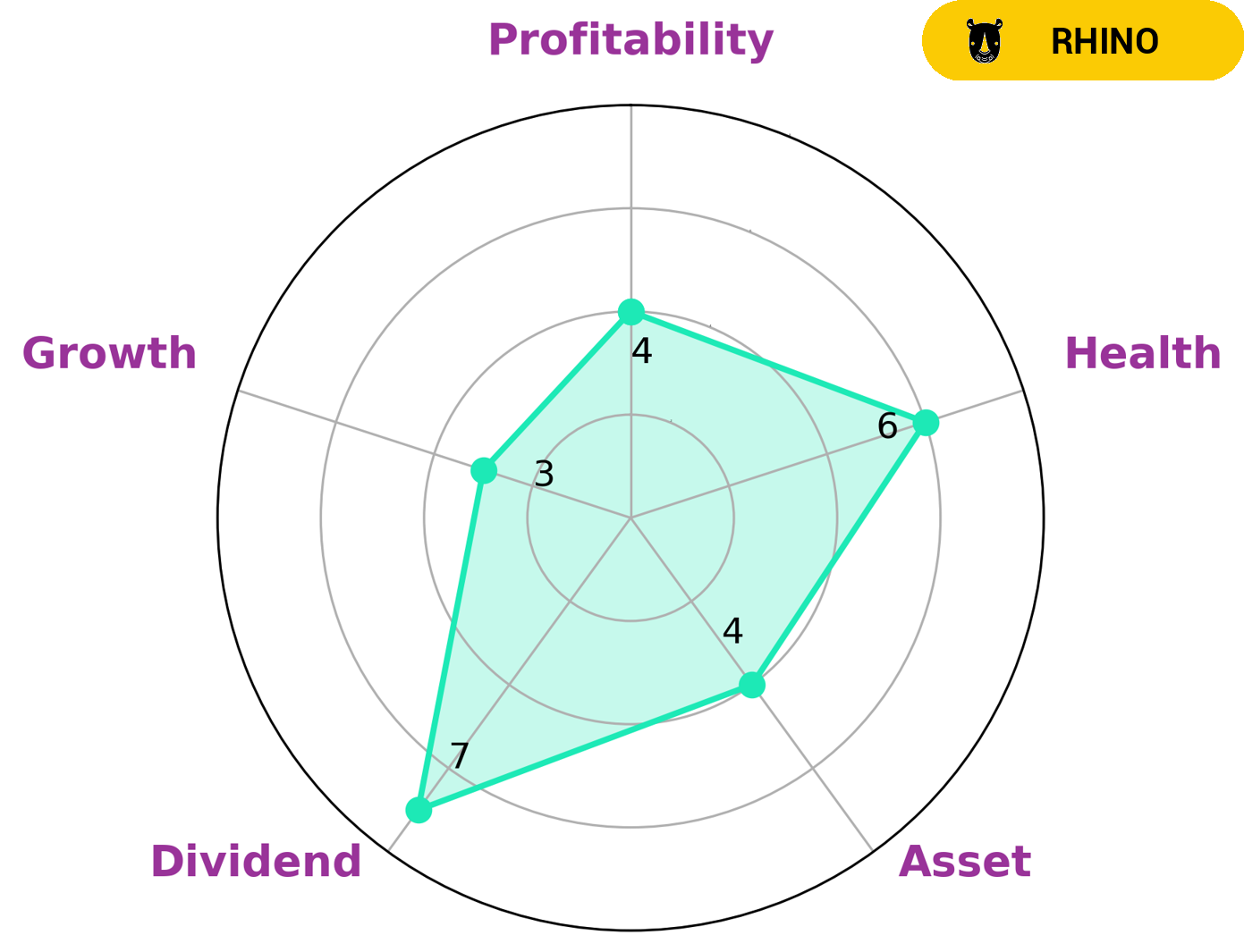

At GoodWhale, we have conducted an analysis of DHT Holdings‘ financials. According to our Star Chart, DHT Holdings is strong in dividend, medium in asset, profitability, and weak in growth. We have also assigned DHT Holdings an intermediate health score of 6/10. This score indicates that while it is likely to sustain future operations in times of crisis, it is not as financially well-positioned as companies with higher scores. It is a reliable source of returns for those investors who are seeking steady and reliable income without taking on too much risk. Investors who follow a long-term investment strategy may find this type of company attractive. Additionally, investors seeking exposure to the shipping industry may find it beneficial to invest in this company due to its strong dividend history. More…

Summary

DHT HOLDINGS has seen a tremendous amount of growth in their fourth quarter earnings for fiscal year 2022, posting revenue of USD 62.0 million, a growth of 2238.6%, and net income of USD 167.9 million, an increase of 100.3%. This impressive financial performance highlights DHT HOLDINGS as a potential investment opportunity for investors looking for real returns. The company’s balance sheet is strong and their performance indicates solid fiscal management and a commitment to continued growth. Their trend-setting performance and continued expansion signify that this may be a good time to look into investing in DHT HOLDINGS.

Recent Posts