DHT HOLDINGS Reports Fourth Quarter Earnings Results for FY2022 on February 9 2023.

February 21, 2023

Earnings Overview

On February 9 2023, DHT HOLDINGS ($BER:D8EN) shared their fourth-quarter FY2022 earnings results, covering the period up to December 31 2022. There was an impressive 2238.6% year-over-year surge in total revenue, which amounted to USD 62.0 million, and a 100.3% year-over-year increase in net income, reaching USD 167.9 million.

Market Price

On Thursday, February 9 2023, DHT HOLDINGS released its financial results for the fourth quarter of FY2022. The company’s stock opened at €8.5 and closed at €8.5, showing a 2.7% increase compared to the previous closing price of 8.3. The market reacted positively to the announcement and the trading volumes went up significantly. The company plans to continue investing in infrastructure and cutting costs to improve efficiency and maximize profits in the upcoming year.

Over the course of the past year, DHT HOLDINGS has strengthened its position in the market by launching new products, expanding its client base, and restructuring its operations. Overall, the financial results of DHT HOLDINGS’ fourth quarter of FY2022 demonstrate healthy progress towards profitability, paving the way for a bright future for the company. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Dht Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 454.14 | 61.52 | 6.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Dht Holdings. More…

| Operations | Investing | Financing |

| 127.91 | 110.52 | -173.34 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Dht Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.51k | 434.99 | 6.57 |

Key Ratios Snapshot

Some of the financial key ratios for Dht Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -5.3% | -26.7% | 19.5% |

| FCF Margin | ROE | ROA |

| 25.9% | 5.3% | 3.7% |

Analysis

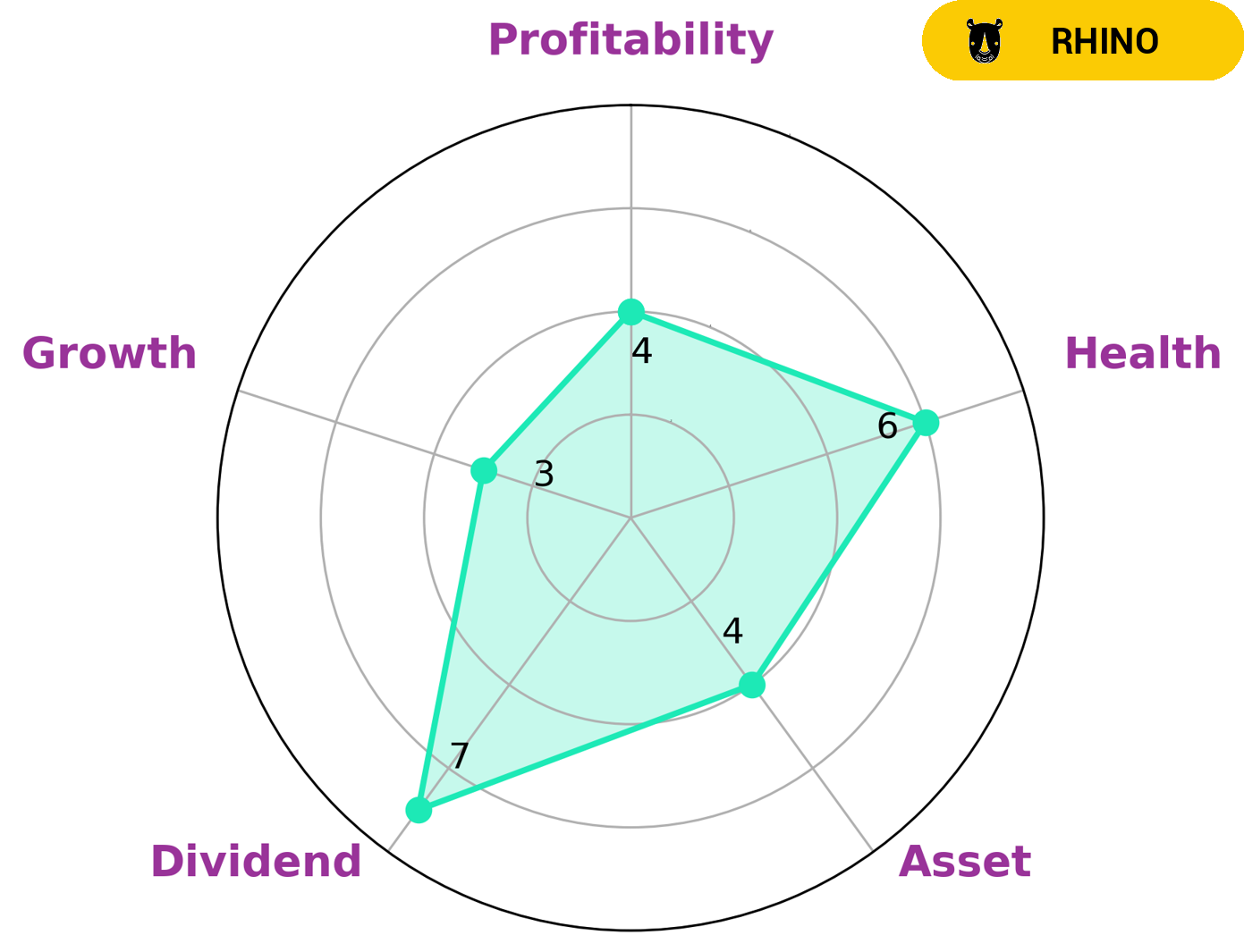

Our examination of DHT HOLDINGS‘s fundamentals has revealed some interesting findings. According to our Star Chart, DHT HOLDINGS is classified as ‘rhino’, which indicates a company that has achieved moderate revenue or earnings growth. This makes it an attractive option for investors who are seeking steady growth and reliable dividends. DHT HOLDINGS is strong in dividends, medium in assets and profitability, and weak in growth, which paint a picture of a company that may have hit its peak in terms of growth but is still an attractive option for long-term investments. Additionally, DHT HOLDINGS has an intermediate health score of 6/10 with regard to its cashflows and debt, indicating that the company is likely to be able to pay off its debt and fund future operations. All of these factors make DHT HOLDINGS an attractive option for investors who are seeking steady growth and reliable dividends. More…

Summary

DHT HOLDINGS saw an impressive financial performance for the fourth quarter of FY2022. Total revenue showed a 2238.6% year over year increase, reaching USD 62.0 million. The increase in net income was also outstanding, with a 100.3% year over year growth, amounting to USD 167.9 million.

From an investor perspective, this should be seen as a very positive sign of the company’s growth and its strong ability to generate profits. Going forward, investors should keep an eye on the company’s performance, as future success is likely to be dependent on continued performance.

Recent Posts