DAVITA INC Reports Second Quarter Earnings Results for Fiscal Year 2023

August 21, 2023

🌥️Earnings Overview

DAVITA INC ($NYSE:DVA) reported a total revenue of USD 3000.4 million for the second quarter of its fiscal year 2023, which was 2.5% higher than the same period in the preceding year. Unfortunately, the company’s net income decreased by 20.5%, amounting to USD 178.7 million, compared to the prior year.

Price History

The company’s stock opened at $102.0 and closed at $101.6, down by 0.4% from the previous closing price of $102.0. The company attributed the decline in net income to higher costs associated with its investments in new products and services, as well as increased expenses related to marketing and promotional activities. Despite these setbacks, DAVITA INC was able to increase its operating margin to 20% during the quarter. The company is confident that its investments in new products and services will pay off in the long run and help it achieve sustainable growth in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Davita Inc. More…

| Total Revenues | Net Income | Net Margin |

| 11.74k | 467.71 | 3.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Davita Inc. More…

| Operations | Investing | Financing |

| 1.97k | -830.77 | -1.05k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Davita Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 16.96k | 14.33k | 11.15 |

Key Ratios Snapshot

Some of the financial key ratios for Davita Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.6% | -11.0% | 10.8% |

| FCF Margin | ROE | ROA |

| 11.6% | 86.1% | 4.7% |

Analysis

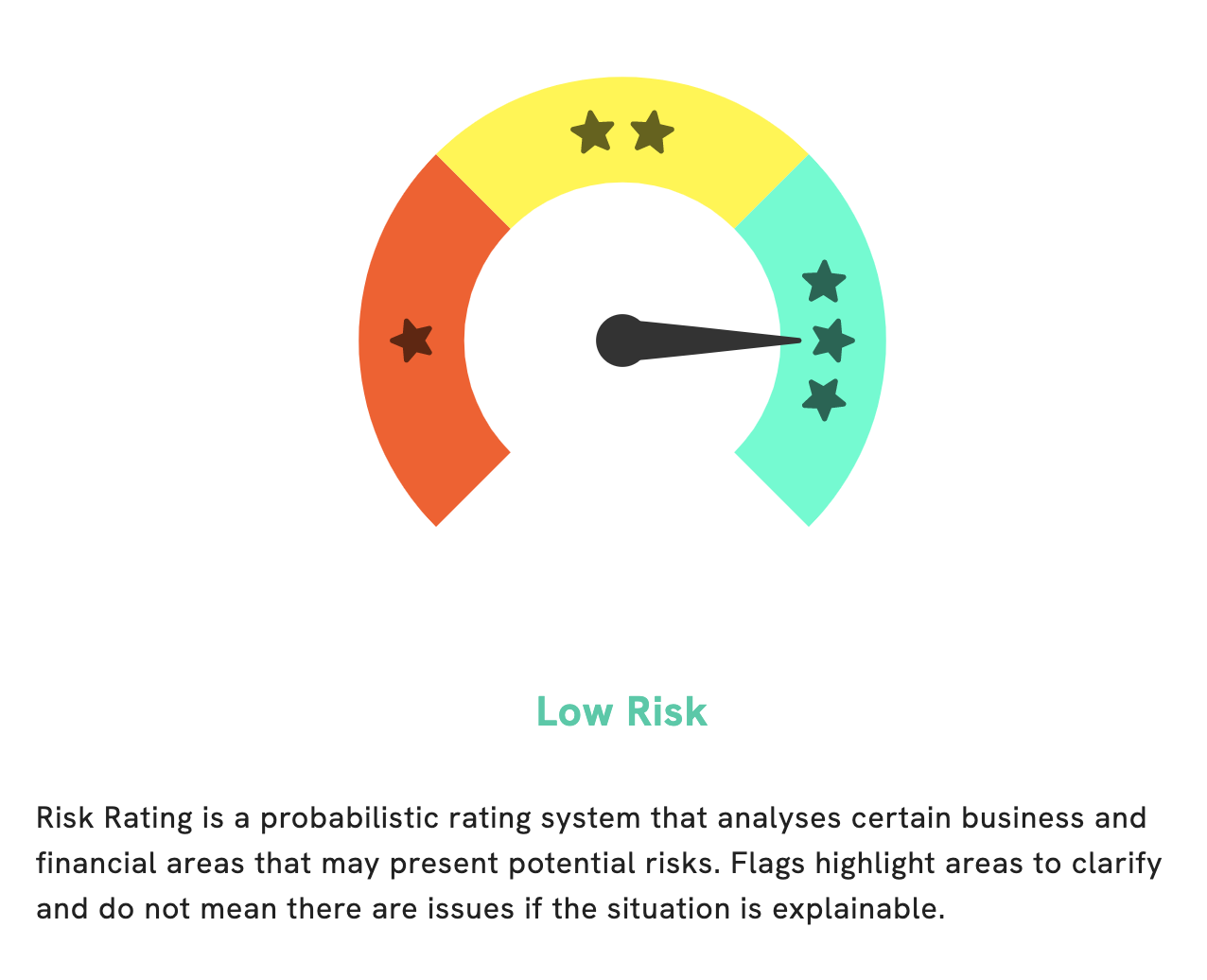

At GoodWhale, we recently completed an analysis of DAVITA INC‘s financials. After assessing the company’s financials and business operations, we’ve determined that DAVITA INC is a low risk investment, according to our Risk Rating system. However, our review of the company’s balance sheet and cash flow statement revealed two risk warnings that investors should be aware of. To get more details on these risks, we suggest registering on the GoodWhale website for a full financial review. More…

Peers

In the dialysis industry, DaVita Inc. competes with Acadia Healthcare Co Inc, Fresenius Medical Care AG & Co. KGaA, Medical Facilities Corp, and other companies. The company has a network of 2,664 outpatient dialysis centers in the United States that serve approximately 198,000 patients with end-stage renal disease.

– Acadia Healthcare Co Inc ($NASDAQ:ACHC)

Acadia Healthcare Company, Inc. is a provider of behavioral healthcare services. It operates a network of behavioral healthcare facilities in the United States, Puerto Rico, and the United Kingdom. The company offers inpatient psychiatric and substance abuse services, residential treatment, outpatient behavioral health services, and specialty behavioral healthcare services.

– Fresenius Medical Care AG & Co. KGaA ($LTS:0H9X)

Fresenius Medical Care AG & Co. KGaA, a renal care company, provides products and services for patients with renal diseases worldwide. The company’s products and services include dialysis machines, dialyzers, and related disposable products, as well as renal pharmaceuticals. It also offers clinical laboratory testing services. The company was founded in 1912 and is headquartered in Bad Homburg vor der Höhe, Germany.

– Medical Facilities Corp ($TSX:DR)

Medical Facilities Corporation is a leading operator of specialty surgical hospitals and ancillary services in the United States. The company owns and operates seven specialty surgical hospitals, one surgical hospital, and three surgical facilities located in Arkansas, Illinois, Louisiana, Mississippi, Oklahoma, and Texas. Medical Facilities Corporation’s hospitals offer a broad range of services, including general surgery, cardiovascular surgery, orthopedic surgery, pain management, gastroenterology, urology, and otolaryngology. The company’s hospitals are accredited by the Joint Commission on Accreditation of Healthcare Organizations and are licensed by the respective state Departments of Health.

Summary

Investors in DAVITA INC will be pleased to note that the company reported a 2.5% year-over-year increase in total revenue to USD 3000.4 million for the second quarter of its fiscal year 2023, despite the challenging economic climate. However, its net income was down by 20.5% compared to the same period last year, amounting to USD 178.7 million. This suggests that DAVITA INC is struggling to optimize its costs and generate profits from its existing business operations. Investors should carefully evaluate the company’s financial performance before making any investment decisions.

Recent Posts