CROWDSTRIKE HOLDINGS Reports First Quarter FY2024 Earnings Results

June 10, 2023

🌥️Earnings Overview

CROWDSTRIKE ($NASDAQ:CRWD): This was a 42.0% increase from the same period in the previous year. Additionally, net income for the quarter rose 101.6% year-over-year to USD 0.49 million.

Stock Price

CROWDSTRIKE HOLDINGS reported their first quarter FY2024 earnings results on Wednesday. The company’s stock opened at $158.8 and closed at $160.1, up by 1.0% from its prior closing price of 158.6. This reflects the strong performance of the company and its products. The company’s CEO George Kurtz commented that they have achieved their financial and operating goals in the first quarter. He added that they are confident in their ability to continue to drive growth and profitability over the long-term.

Looking ahead, CrowdStrike is optimistic about its financial performance as indicated in its guidance for fiscal 2024. Overall, investors seem to be encouraged by the company’s strong first quarter results and guidance for fiscal 2024. This is reflected in the increase in its stock price on Wednesday. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Crowdstrike Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 2.45k | -151.23 | -6.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Crowdstrike Holdings. More…

| Operations | Investing | Financing |

| 1.03k | -429.68 | 80.78 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Crowdstrike Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.14k | 3.5k | 6.77 |

Key Ratios Snapshot

Some of the financial key ratios for Crowdstrike Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 63.1% | – | -4.2% |

| FCF Margin | ROE | ROA |

| 30.5% | -4.2% | -1.2% |

Analysis

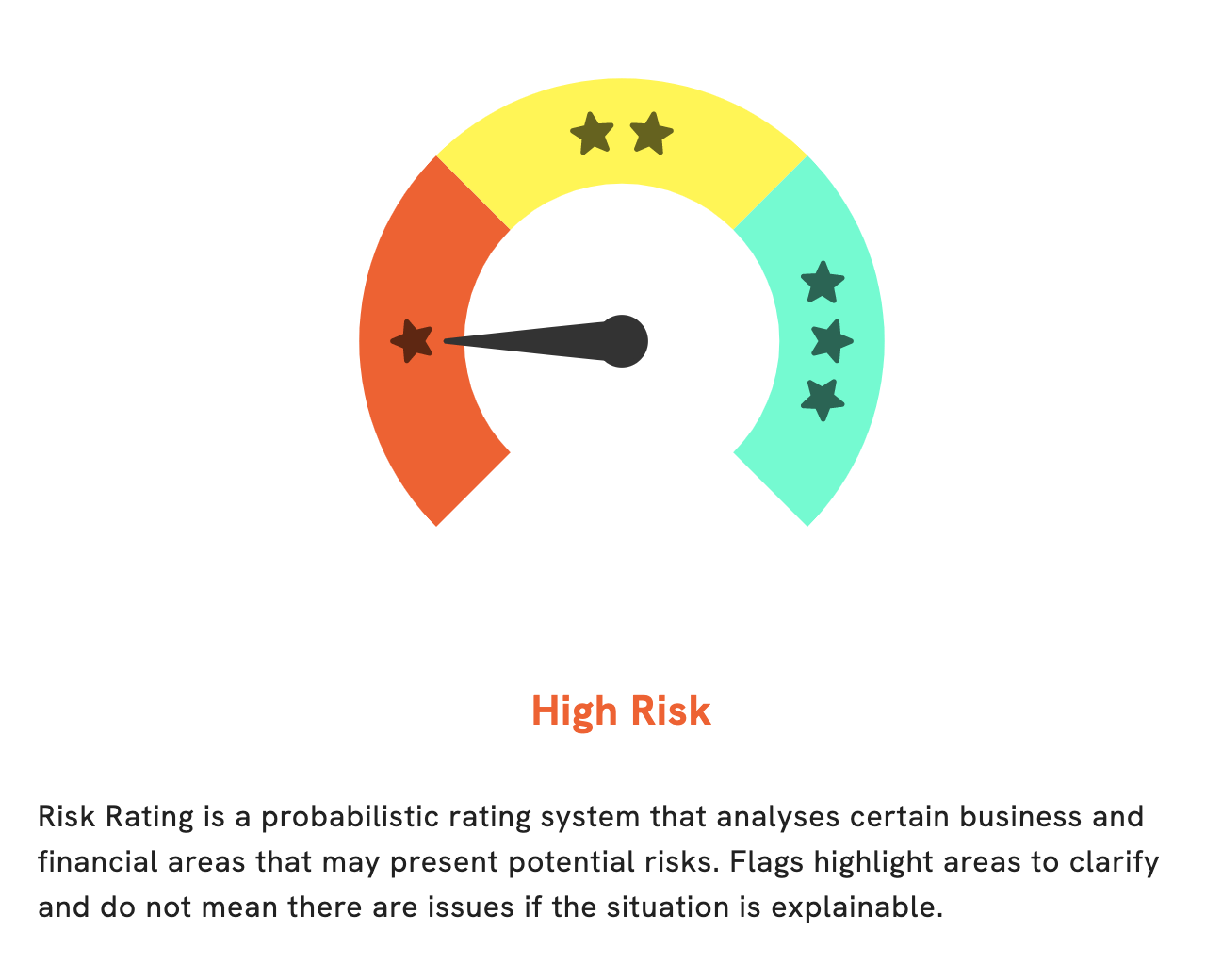

At GoodWhale, we are dedicated to helping you make informed decisions about your investments. If you’re considering investing in CROWDSTRIKE HOLDINGS, we can help you analyze their financials and uncover any potential risks. We’ve assigned a Risk Rating of “High” to this investment, which indicates that there could be some financial and business risks associated with investing in it. To help you make a more informed decision, we’ve identified four risk warnings on the income sheet, balance sheet, cashflow statement, and non-financial. Register with us to access the full report so you can read the details of each risk warning. With our help, you can be sure that you’re making an informed decision about your investments. More…

Peers

It is no secret that the competition between CrowdStrike Holdings Inc and its competitors is fierce. Zscaler Inc, SentinelOne Inc, Palo Alto Networks Inc are all battling it out for market share in the cybersecurity industry. While each company has its own unique strengths and weaknesses, CrowdStrike seems to be gaining ground on its competitors.

– Zscaler Inc ($NASDAQ:ZS)

Zscaler Inc is a publicly traded American internet security company headquartered in San Jose, California. Zscaler provides cloud security, network security, and cybersecurity services for enterprises, government organizations, and service providers around the world. The company was founded in 2007 by Jay Chaudhry and K.K. Mookhey.

Zscaler has a market cap of $19.36 billion as of 2022 and a return on equity of -37.32%. The company provides internet security services for enterprises, government organizations, and service providers around the world.

– SentinelOne Inc ($NYSE:S)

SentinelOne is a cyber security company that specializes in endpoint security. The company was founded in 2013 and is headquartered in Mountain View, California. As of 2022, SentinelOne has a market cap of $5.82B and a return on equity of -12.5%. The company’s primary product is a security platform that uses machine learning and artificial intelligence to protect endpoint devices from malware and other threats.

– Palo Alto Networks Inc ($NASDAQ:PANW)

Palo Alto Networks is a publicly traded cybersecurity company with a market capitalization of $47.44 billion as of April 2021. The company’s return on equity (ROE) for 2020 was -42.69%. Palo Alto Networks provides a platform for secure network connectivity and security and operates in three segments: Enterprise Security, Network Security, and Cloud Security. The company was founded in 2005 and is headquartered in Santa Clara, California.

Summary

Investors should be encouraged by the strong financial results announced by CROWDSTRIKE HOLDINGS for the first quarter of FY2024. Total revenue increased by 42.0%, while net income rose by an impressive 101.6%. These figures demonstrate the company’s ability to generate robust growth and profitability.

Additionally, its strong balance sheet and cash position suggest that the company is well-positioned to continue to deliver exceptional returns in the near-term. With attractive valuations and a bullish outlook, investing in CROWDSTRIKE HOLDINGS could be a lucrative opportunity.

Recent Posts