Cognizant Technology Solutions Reports FY2023 Q2 Earnings Results for June 30th, 2023

August 28, 2023

☀️Earnings Overview

On August 2 2023, COGNIZANT TECHNOLOGY SOLUTIONS ($NASDAQ:CTSH) reported their earnings for the second quarter of FY2023 ending June 30 2023, showing a total revenue of USD 4886.0 million, representing a 0.4% decrease from the same period last year. Additionally, net income was reported to be USD 463.0 million, an 19.8% decline from FY2022 Q2.

Price History

On Wednesday, COGNIZANT TECHNOLOGY SOLUTIONS reported their financial results for the fiscal year 2023 Q2, ending June 30th, 2023. The stock opened at $65.4 and closed slightly lower at $65.3, down 0.8% from the prior closing price of 65.8. Overall, the financial results show that COGNIZANT TECHNOLOGY SOLUTIONS is continuing to grow and is on track to have another successful year in 2023. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for CTSH. More…

| Total Revenues | Net Income | Net Margin |

| 19.39k | 2.19k | 11.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for CTSH. More…

| Operations | Investing | Financing |

| 2.5k | -635 | -1.59k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for CTSH. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 17.97k | 5.06k | 25.55 |

Key Ratios Snapshot

Some of the financial key ratios for CTSH are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.0% | 3.0% | 14.9% |

| FCF Margin | ROE | ROA |

| 11.2% | 14.1% | 10.0% |

Analysis

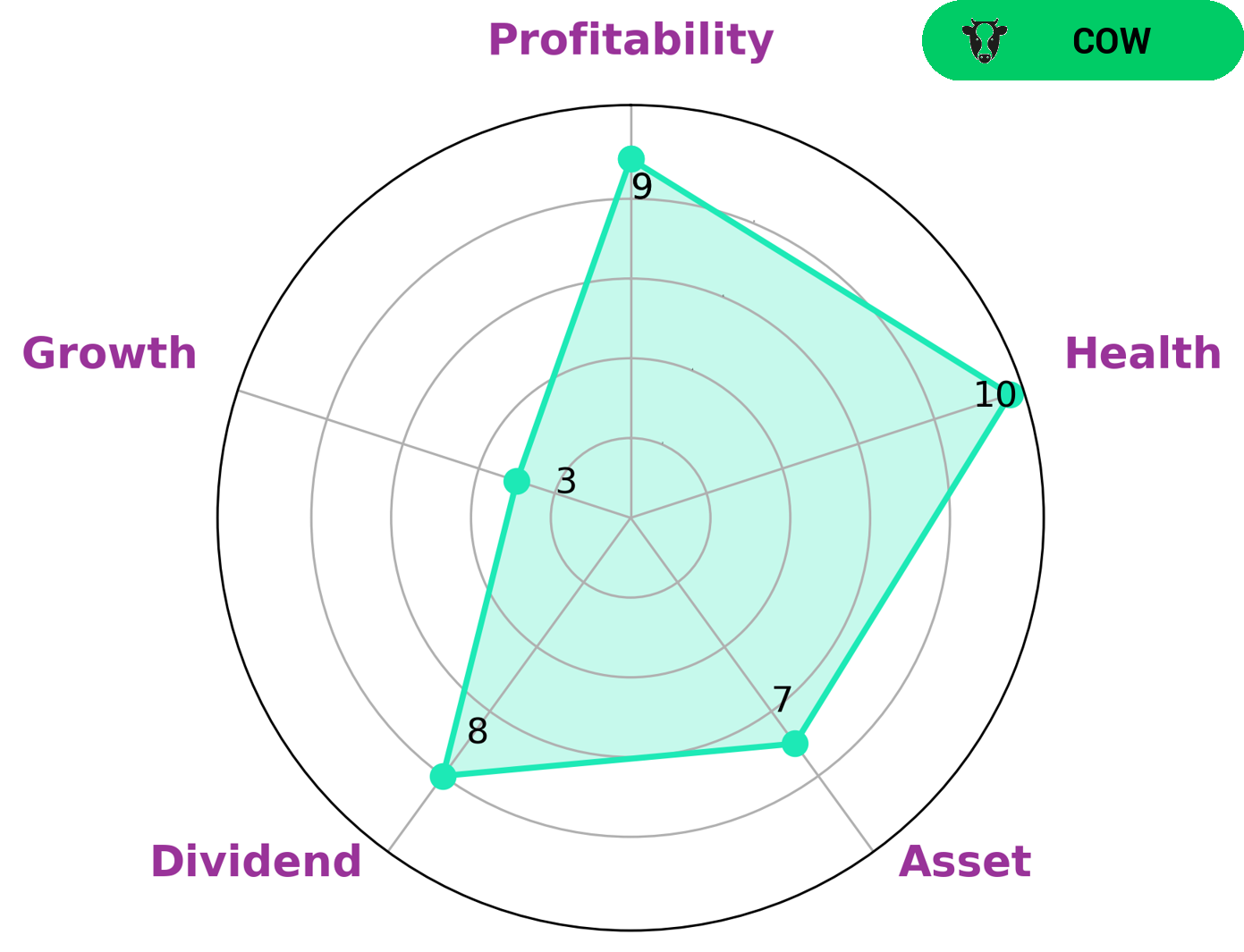

At GoodWhale, we analyze COGNIZANT TECHNOLOGY SOLUTIONS’s financials to provide investors with a better understanding of the company. Our star chart shows that COGNIZANT TECHNOLOGY SOLUTIONS has a 10/10 health score, indicating a strong ability to pay off debt and fund future operations. We classify this company as a ‘cow’, meaning it has a strong track record of paying out consistent and sustainable dividends. Given the company’s strong dividend, profitability, and medium asset scores, it is likely to attract investors who are seeking a stable investment. However, its weak growth score means that investors may find better returns in other industries. Overall, COGNIZANT TECHNOLOGY SOLUTIONS appears to be a reliable source for investors in search of stability and consistent returns. More…

Peers

Cognizant Technology Solutions Corp is a leading provider of information technology, consulting, and business process outsourcing services. It has a strong presence in India, the United States, and Europe. The company operates in four segments: Banking and Financial Services, Healthcare, Manufacturing, and Retail, Consumer Goods, and Logistics. Cognizant’s competitors include Accenture PLC, Genpact Ltd, Shunliban Information Service Co Ltd, and others.

– Accenture PLC ($NYSE:ACN)

Accenture PLC is a professional services company that provides consulting, technology, and outsourcing services. It has a market cap of 166.38B as of 2022 and a Return on Equity of 26.56%. The company operates in more than 200 countries and employs more than 373,000 people.

– Genpact Ltd ($NYSE:G)

Genpact is a global professional services firm that offers a range of services in the areas of consulting, digital transformation, technology, and operations. The company has a market cap of $8.29 billion and a return on equity of 17.54%. Genpact has a strong focus on digital transformation and offers a range of services that helps businesses to digitally transform their operations. The company has a strong client base and a strong track record in delivering results.

– Shunliban Information Service Co Ltd ($SZSE:000606)

Shunliban Information Service Co Ltd is a Chinese company that provides information services. It has a market cap of 1.34 billion as of 2022 and a return on equity of 130.37%. The company offers services such as data analysis, information management, and online marketing. It also provides software development and consultation services.

Summary

Cognizant Technology Solutions reported their Q2 FY2023 earnings results on August 2. Net income was $463 million, a 19.8% decrease from the same quarter in the prior year. Despite this, analysts remain optimistic that Cognizant will rebound with increased efficiency and cost-saving measures.

Investors should note that the company has a strong balance sheet and a long-term track record of steady profits. It is worth considering as a long-term investment option given its potential for growth and stability.

Recent Posts