COGNIZANT TECHNOLOGY SOLUTIONS Reports Fourth Quarter Fiscal Year 2022 Earnings Results on February 2 2023

March 12, 2023

Earnings Overview

On February 2 2023, COGNIZANT TECHNOLOGY SOLUTIONS ($NASDAQ:CTSH) released its financial results for the fourth quarter of fiscal year 2022, which ended on December 31 2022. Total revenue for the quarter amounted to USD 521.0 million, a 9.5% decrease compared to the same quarter of the previous year. Despite the decrease in revenue, net income rose 1.3% year-over-year to USD 4839.0 million.

Transcripts Simplified

Cognizant Technology Solutions reported fourth quarter and full year 2022 revenue above the high end of the guidance range given on their third quarter earnings call in November, and in line with revised expectations provided on January 12th. Operating margin was negatively impacted by a previously disclosed non-cash charge in the quarter, however progress was made towards their operating margin goals driven by commercial discipline, the depreciation of the Indian rupee, and SG&A leverage. Digital revenue grew 4% year-over-year or 7% in constant currency, resulting in full year 2022 digital revenue growth of 11% or 13% in constant currency.

Bookings increased 12% year-over-year with a book-to-bill of approximately 1.2 times. Within Financial Services, revenue declined 1% due to a negative impact related to the sale of their Samlink subsidiary, partially offset by growth among public sector clients in the UK and insurance clients.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for CTSH. More…

| Total Revenues | Net Income | Net Margin |

| 19.43k | 2.29k | 11.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for CTSH. More…

| Operations | Investing | Financing |

| 2.57k | -106 | -1.94k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for CTSH. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 17.85k | 5.54k | 24.18 |

Key Ratios Snapshot

Some of the financial key ratios for CTSH are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.0% | 3.6% | 15.6% |

| FCF Margin | ROE | ROA |

| 11.5% | 15.6% | 10.6% |

Market Price

On Thursday, the company’s stock opened at $69.5 and closed at $70.7, an increase of 2.6% from its previous closing price of $68.8. This marked the second consecutive quarter of positive stock returns for the company, and analysts have attributed the surge to strong performance in the healthcare, manufacturing, and financial services industries. In addition to strong stock growth, COGNIZANT TECHNOLOGY SOLUTION’s earnings results showed impressive growth in both revenue and net income.

Overall, COGNIZANT TECHNOLOGY SOLUTIONS’s fourth quarter fiscal year 2022 earnings results have been viewed positively by investors and analysts alike. With market conditions expected to remain favorable in the near future, the company is well-positioned to continue its current trend of solid performance and stock growth. Live Quote…

Analysis

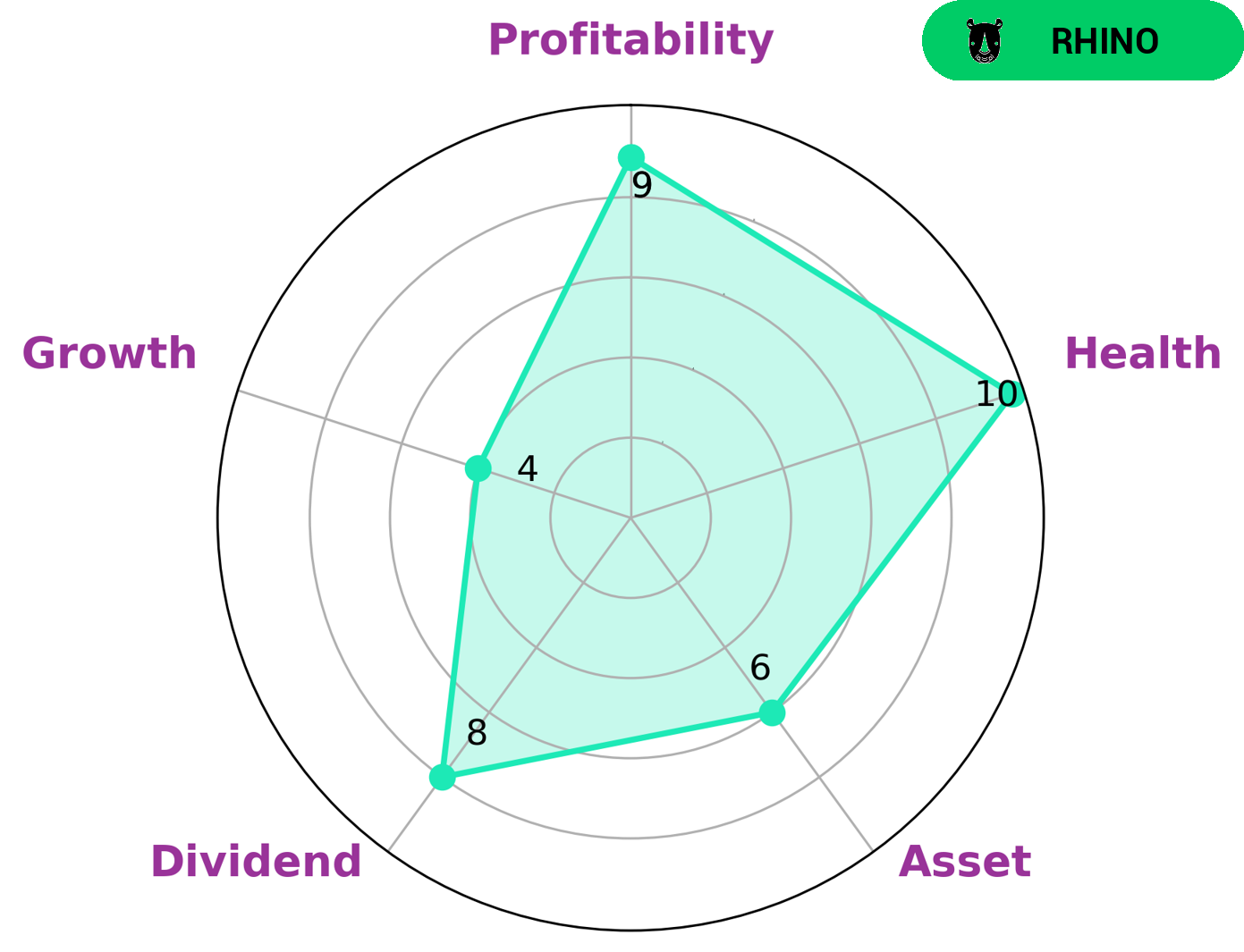

At GoodWhale, we believe it’s important to analyze the fundamentals of COGNIZANT TECHNOLOGY SOLUTIONS. After all, understanding the company’s financial health is essential when making any investment decision. Our Star Chart gives COGNIZANT TECHNOLOGY SOLUTIONS a health score of 10/10, indicating that it has strong cashflows and debt and is capable to safely ride out any crisis without the risk of bankruptcy. COGNIZANT TECHNOLOGY SOLUTIONS is classified as a ‘rhino’, which is a type of company that has achieved moderate revenue or earnings growth. It is strong in dividend and profitability, and medium in asset and growth. Investors who are interested in such a company should definitely consider investing in COGNIZANT TECHNOLOGY SOLUTIONS. With its strong financials and moderate growth rate, it could be an attractive option for those looking for a more conservative approach to investing. More…

Peers

Cognizant Technology Solutions Corp is a leading provider of information technology, consulting, and business process outsourcing services. It has a strong presence in India, the United States, and Europe. The company operates in four segments: Banking and Financial Services, Healthcare, Manufacturing, and Retail, Consumer Goods, and Logistics. Cognizant’s competitors include Accenture PLC, Genpact Ltd, Shunliban Information Service Co Ltd, and others.

– Accenture PLC ($NYSE:ACN)

Accenture PLC is a professional services company that provides consulting, technology, and outsourcing services. It has a market cap of 166.38B as of 2022 and a Return on Equity of 26.56%. The company operates in more than 200 countries and employs more than 373,000 people.

– Genpact Ltd ($NYSE:G)

Genpact is a global professional services firm that offers a range of services in the areas of consulting, digital transformation, technology, and operations. The company has a market cap of $8.29 billion and a return on equity of 17.54%. Genpact has a strong focus on digital transformation and offers a range of services that helps businesses to digitally transform their operations. The company has a strong client base and a strong track record in delivering results.

– Shunliban Information Service Co Ltd ($SZSE:000606)

Shunliban Information Service Co Ltd is a Chinese company that provides information services. It has a market cap of 1.34 billion as of 2022 and a return on equity of 130.37%. The company offers services such as data analysis, information management, and online marketing. It also provides software development and consultation services.

Summary

Cognizant Technology Solutions reported fourth quarter fiscal year 2022 earnings results on February 2 2023. Total revenue for the quarter decreased by 9.5% year-over-year to USD 521.0 million, while net income rose by 1.3% to USD 4839.0 million. From an investor’s perspective, Cognizant Technology Solutions has demonstrated resilience in the face of challenging market conditions, thanks to its strong management team, financial discipline, and focus on cost efficiency. Additional research is necessary for investors to determine whether Cognizant Technology Solutions is a suitable investment for their portfolios.

Recent Posts