CINCINNATI FINANCIAL Reports Fourth Quarter FY2022 Earnings Results on February 6 2023.

March 6, 2023

Earnings report

CINCINNATI FINANCIAL ($NASDAQ:CINF) announced its earnings results for the fourth quarter of FY2022, ended December 31 2022, on February 6 2023. The financial services company reported total revenue of USD 1.0 billion, a decrease of 31.3% year-over-year. Net income reported was USD 3.1 billion, a decrease of 6.3% compared to the same period the year before. Despite this decrease in income, the company managed to maintain strong bottom line performance, which is encouraging in a challenging market environment. The company also highlighted its focus on expense control and operational efficiency, as well as its commitment to delivering value to customers and shareholders.

In addition, the company noted that its investments in technology and automation are expected to support their growth and long-term success. CINCINNATI FINANCIAL is confident in its ability to navigate the current environment and remain profitable in the long-term. The company looks forward to continuing to provide quality products and services to customers and rewarding shareholders with attractive returns in the years ahead.

Share Price

The company opened the market day with a stock price at $114.6 and closed at $115.3, an increase of 0.1% from the previous closing of $115.1. The announcement comes as CINCINNATI FINANCIAL continues to show strong performance with its financials and portfolio of holdings. Analysts have forecasted positive growth in the coming quarters and are satisfied with CINCINNATI FINANCIAL’s current earnings performance. Investors remain optimistic in their outlook on the company, expecting further increases in the stock price and overall financial stability.

The most recent results indicate that CINCINNATI FINANCIAL is headed in the right direction, with their financials and stock prices rising for the better. With no signs of slowing down in the near future, CINCINNATI FINANCIAL is still a well-positioned company with strong financials and a healthy portfolio of holdings. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Cincinnati Financial. More…

| Total Revenues | Net Income | Net Margin |

| 6.56k | -486 | -7.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Cincinnati Financial. More…

| Operations | Investing | Financing |

| 1.88k | -1.06k | -685 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Cincinnati Financial. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 29.74k | 19.2k | 67.03 |

Key Ratios Snapshot

Some of the financial key ratios for Cincinnati Financial are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -6.1% | – | -9.8% |

| FCF Margin | ROE | ROA |

| 28.5% | -4.0% | -1.3% |

Analysis

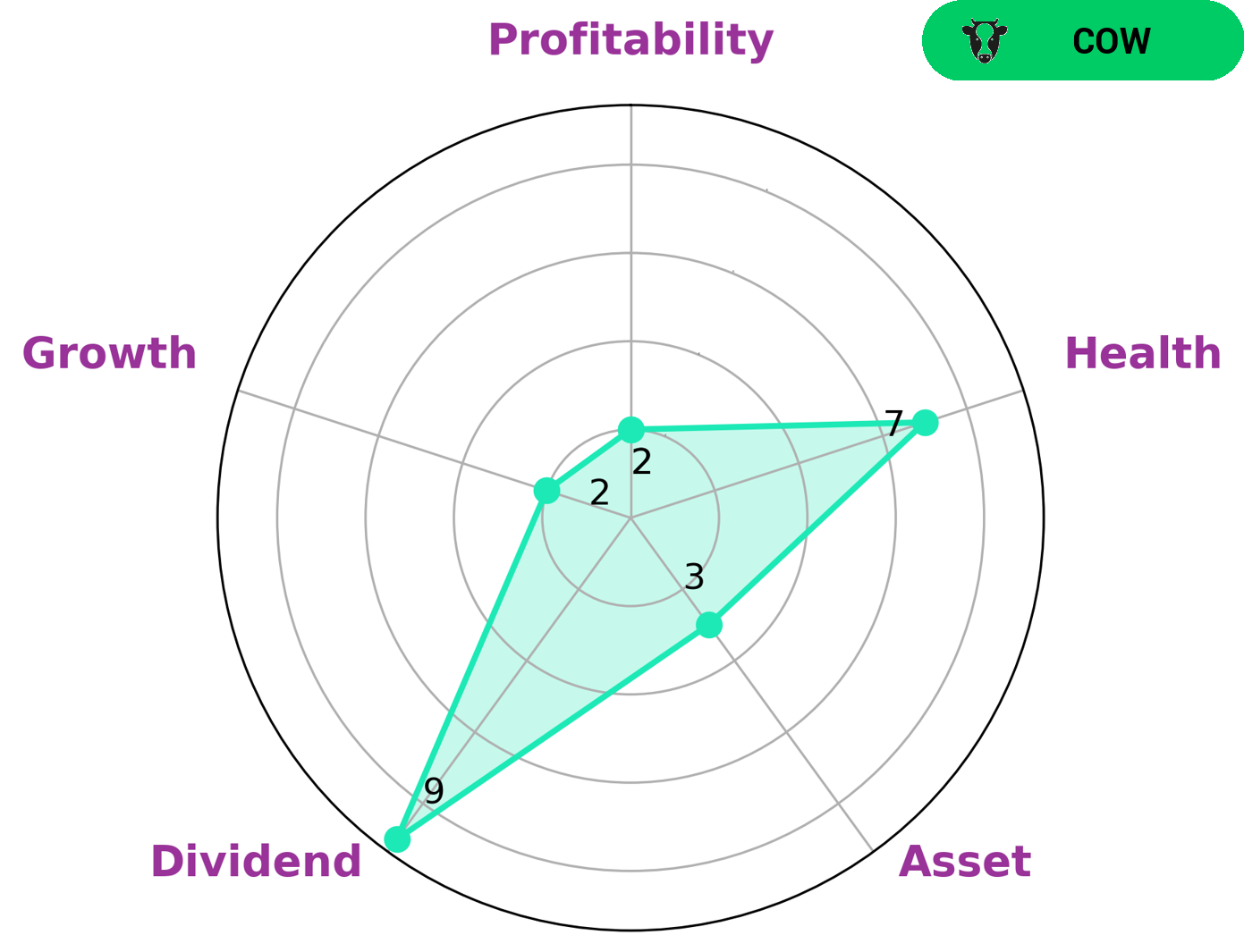

GoodWhale has conducted a thorough analysis of CINCINNATI FINANCIAL‘s fundamentals and based on our Star Chart, CINCINNATI FINANCIAL is classified as a ‘cow’ – a type of company that has the track record of paying out consistent and sustainable dividends. This makes it an attractive investment for investors looking for steady income, especially stability-minded individuals such as retirees and pensioners. CINCINNATI FINANCIAL has a high health score of 7/10 indicating that it is capable to sustain future operations even in times of crisis due to its record of cashflows and debt. However, CINCINNATI FINANCIAL is weak in asset, growth, and profitability. Despite this, the company is strong in dividend and is likely to continue to offer consistent returns to its investors. More…

Peers

Cincinnati Financial Corp, Mercury General Corp, United Fire Group Inc, and FedNat Holding Co are all insurance companies. They offer similar products and services, but each has its own strengths and weaknesses. Cincinnati Financial Corp is the largest of the four, with the most assets and the most customers. Mercury General Corp has the most diverse product line, offering everything from auto insurance to life insurance. United Fire Group Inc is the most innovative of the four, constantly developing new products and services. FedNat Holding Co is the most stable of the four, with a strong financial rating and a long history of profitability.

– Mercury General Corp ($NYSE:MCY)

Mercury General Corporation is an insurance holding company that, through its subsidiaries, provides personal automobile insurance in the United States. The company operates through four segments: Personal Auto, Commercial Auto, Other Business, and Investment.

Mercury General’s market cap has declined significantly over the past few years, from over $5 billion in 2015 to just over $1.6 billion as of 2022. The company’s return on equity has also been negative in recent years, reaching -16.66% in 2021.

The company has struggled in recent years due to a combination of factors, including increased competition, higher claims costs, and lower investment returns. Mercury General has taken steps to improve its financial performance, including reducing expenses and increasing its focus on higher-margin business segments. However, it remains to be seen whether these efforts will be enough to turn the company around in the long term.

– United Fire Group Inc ($NASDAQ:UFCS)

United Fire Group, Inc., through its subsidiaries, provides insurance protection in the property and casualty market for individuals, families, and businesses worldwide. The company operates in three segments: Property and Casualty, Reinsurance, and Life. The Property and Casualty segment offers commercial and personal lines of property and casualty insurance products, including automobile, homeowners, workers’ compensation, general liability, commercial multi-peril, and commercial automobile insurance products; and reinsurance products. The Reinsurance segment provides property and casualty reinsurance products. The Life segment offers life insurance and annuity products. United Fire Group, Inc. was founded in 1834 and is headquartered in Cedar Rapids, Iowa.

– FedNat Holding Co ($NASDAQ:FNHC)

Founded in 1934, Federated National Holding Company is a provider of personal and commercial property and casualty insurance products in the United States. The company operates through the following segments: Personal Lines, Commercial Lines, and Specialty Lines. Federated National Holding Company offers its products through a network of independent agents and brokers.

Summary

Net income for the quarter was USD 3.1 billion, a decrease of 6.3% compared to the same period the year before. Investors should be wary of investing in Cincinnati Financial as both revenue and earnings have decreased quarter over quarter. Furthermore, the company is facing headwinds such as a challenging economic environment, decreased demand, and changes to regulations that could all have an effect on the bottom line. Investors should weigh all of these factors before jumping into the stock.

Recent Posts