CINCINNATI FINANCIAL Reports Fourth Quarter Fiscal Year 2022 Earnings Results on December 31 2022

March 8, 2023

Earnings Overview

CINCINNATI FINANCIAL ($NASDAQ:CINF) announced their fourth quarter fiscal year 2022 earnings results on December 31 2022. For the quarter, which concluded on February 6 2023, total revenue was reported as USD 1.0 billion, a decrease of 31.3% compared to the same quarter of the previous year. Net income also declined 6.3% year over year to USD 3.1 billion.

Transcripts Simplified

Investment income for the fourth quarter of 2022 was up 12%, and 9% for full year 2022 compared to the same periods of last year. Bond interest income was up 11% in the fourth quarter. Net equity securities purchased during 2022 totaled $36 million. Cash flow from operating activities for full year 2022 generated almost $2.1 billion, a record high amount, up 4% from a year ago.

Property casualty underwriting expense ratio was 0.2 percentage points lower than last year. Net increase in the property casualty loss and loss expense reserves was $1.029 billion, a 15% increase from the net reserve balance at year end 2021. Experienced $159 million of property casualty net favorable reserve development on prior accident years that benefited the combined ratio by 2.3 percentage points.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Cincinnati Financial. More…

| Total Revenues | Net Income | Net Margin |

| 6.56k | -486 | -7.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Cincinnati Financial. More…

| Operations | Investing | Financing |

| 1.88k | -1.06k | -685 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Cincinnati Financial. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 29.74k | 19.2k | 67.03 |

Key Ratios Snapshot

Some of the financial key ratios for Cincinnati Financial are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -6.1% | – | -9.8% |

| FCF Margin | ROE | ROA |

| 28.5% | -4.0% | -1.3% |

Market Price

The stock opened at $114.6 and closed at $115.3, slightly up by 0.1% from their last closing price of 115.1. CINCINNATI FINANCIAL’s strong performance in the fourth quarter was mainly driven by its investments in new products and services, as well as its continued focus on customer satisfaction and service excellence. The company also reported that its efforts to reduce operational costs and improve efficiency have resulted in higher margins in the fourth quarter. Investors are likely to be pleased with the company’s strong performance this quarter and will be eagerly awaiting further updates regarding the company’s future outlook. Live Quote…

Analysis

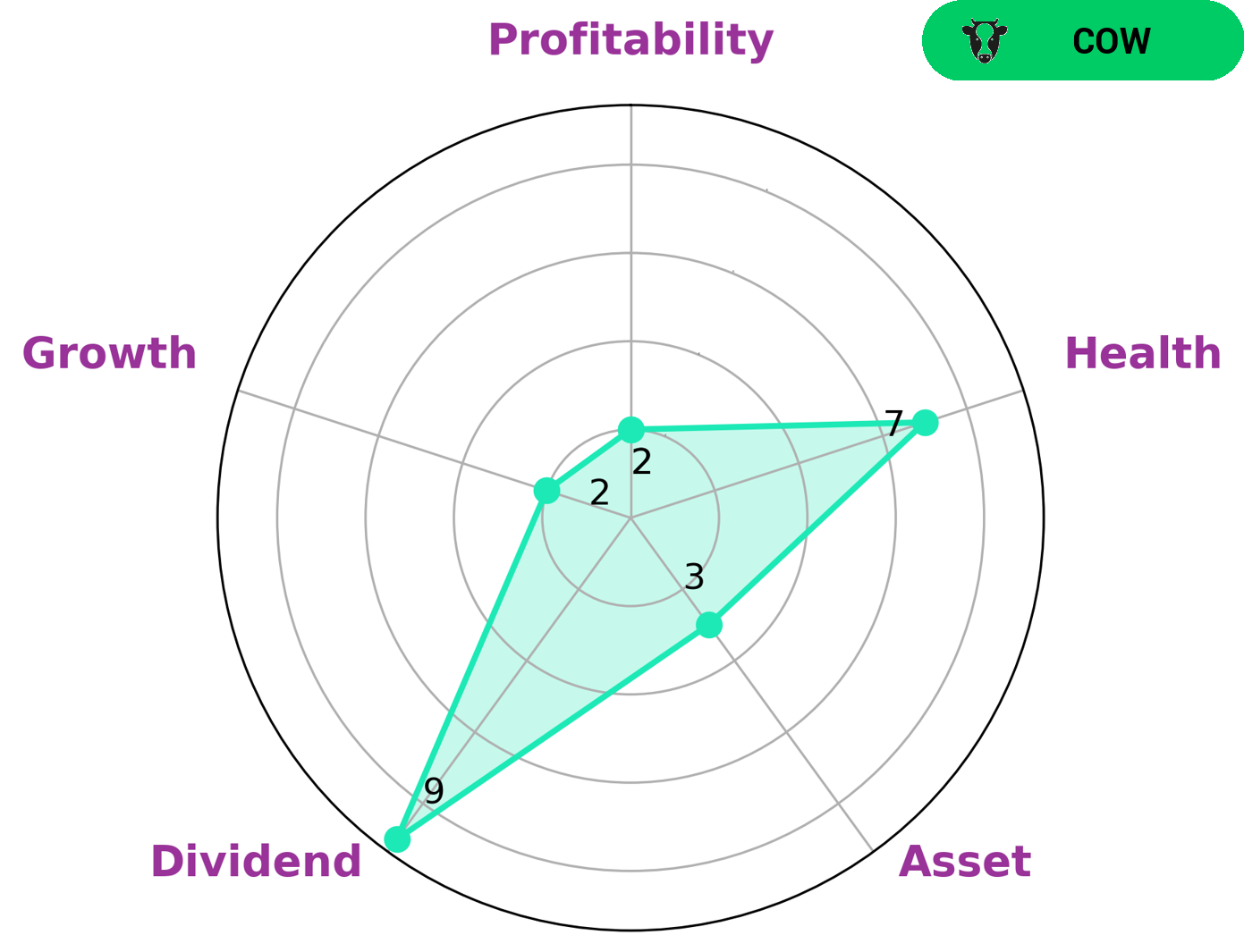

GoodWhale recently conducted an analysis of CINCINNATI FINANCIAL‘s fundamentals. Through our ‘Star Chart’ tool, we found that the company is strong in dividend and weak in asset, growth and profitability. This type of company is known as a ‘cow’, due to its track record of paying out consistent and sustainable dividends. Therefore, this may be of interest to investors who prioritize passive income and stability. We also assessed CINCINNATI FINANCIAL’s health score, which came out to 7/10. This indicates the company’s capability to sustain future operations even in times of crisis, as it has enough cash flows and low debt to weather any financial difficulties. All in all, CINCINNATI FINANCIAL appears to have a solid foundation that could make it an attractive investment option. More…

Peers

Cincinnati Financial Corp, Mercury General Corp, United Fire Group Inc, and FedNat Holding Co are all insurance companies. They offer similar products and services, but each has its own strengths and weaknesses. Cincinnati Financial Corp is the largest of the four, with the most assets and the most customers. Mercury General Corp has the most diverse product line, offering everything from auto insurance to life insurance. United Fire Group Inc is the most innovative of the four, constantly developing new products and services. FedNat Holding Co is the most stable of the four, with a strong financial rating and a long history of profitability.

– Mercury General Corp ($NYSE:MCY)

Mercury General Corporation is an insurance holding company that, through its subsidiaries, provides personal automobile insurance in the United States. The company operates through four segments: Personal Auto, Commercial Auto, Other Business, and Investment.

Mercury General’s market cap has declined significantly over the past few years, from over $5 billion in 2015 to just over $1.6 billion as of 2022. The company’s return on equity has also been negative in recent years, reaching -16.66% in 2021.

The company has struggled in recent years due to a combination of factors, including increased competition, higher claims costs, and lower investment returns. Mercury General has taken steps to improve its financial performance, including reducing expenses and increasing its focus on higher-margin business segments. However, it remains to be seen whether these efforts will be enough to turn the company around in the long term.

– United Fire Group Inc ($NASDAQ:UFCS)

United Fire Group, Inc., through its subsidiaries, provides insurance protection in the property and casualty market for individuals, families, and businesses worldwide. The company operates in three segments: Property and Casualty, Reinsurance, and Life. The Property and Casualty segment offers commercial and personal lines of property and casualty insurance products, including automobile, homeowners, workers’ compensation, general liability, commercial multi-peril, and commercial automobile insurance products; and reinsurance products. The Reinsurance segment provides property and casualty reinsurance products. The Life segment offers life insurance and annuity products. United Fire Group, Inc. was founded in 1834 and is headquartered in Cedar Rapids, Iowa.

– FedNat Holding Co ($NASDAQ:FNHC)

Founded in 1934, Federated National Holding Company is a provider of personal and commercial property and casualty insurance products in the United States. The company operates through the following segments: Personal Lines, Commercial Lines, and Specialty Lines. Federated National Holding Company offers its products through a network of independent agents and brokers.

Summary

Investors should take note of CINCINNATI FINANCIAL‘s fourth quarter fiscal year 2022 earnings report. Total revenue for the quarter reached USD 1.0 billion, a decrease of 31.3% compared to the same quarter of the previous year. Net income also fell 6.3% year over year to USD 3.1 billion. While the current performance is far from ideal, investors should consider the company’s overall performance during the year and its long-term growth prospects when making their investment decisions.

Recent Posts