Certara Stock Fair Value – CERTARA Reports Record Earnings For Second Quarter of FY2023

August 12, 2023

🌥️Earnings Overview

On August 9 2023, CERTARA ($NASDAQ:CERT) revealed its earnings results for the second quarter of FY2023, which ended on June 30 2023. The company experienced a total revenue of USD 90.5 million, representing a 9.3% growth from the same time the previous year, and generated net income of USD 4.7 million, compared to a loss of -0.6 million in the year prior.

Market Price

The news sent their stock to open at $18.3 before closing at $17.9, down 2.6% from their previous closing price of 18.4. This was in contrast to the rest of the industry which saw a market-wide increase in share prices. CERTARA‘s success was attributed to their commitment to innovative software and services that enabled them to capitalize on the growing demand for virtual drug development and regulatory solutions. CERTARA’s network of experienced scientists, software engineers, and data analysts have enabled the company to be a leader in the field of drug development and regulatory processes.

In addition, CERTARA’s strategic partnerships with leading research institutions and biopharmaceutical companies have also been an integral part of their success. With their focus on delivering innovative solutions and technology, CERTARA is well-positioned to capitalize on the growing demand for virtual drug development and regulatory solutions in the pharmaceutical industry. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Certara. CERTARA_Reports_Record_Earnings_For_Second_Quarter_of_FY2023″>More…

| Total Revenues | Net Income | Net Margin |

| 352.08 | 19.17 | 5.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Certara. CERTARA_Reports_Record_Earnings_For_Second_Quarter_of_FY2023″>More…

| Operations | Investing | Financing |

| 87.5 | -30.39 | -9.58 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Certara. CERTARA_Reports_Record_Earnings_For_Second_Quarter_of_FY2023″>More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.57k | 475.05 | 6.86 |

Key Ratios Snapshot

Some of the financial key ratios for Certara are shown below. CERTARA_Reports_Record_Earnings_For_Second_Quarter_of_FY2023″>More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.2% | 18.4% | 12.7% |

| FCF Margin | ROE | ROA |

| 21.0% | 2.6% | 1.8% |

Analysis – Certara Stock Fair Value

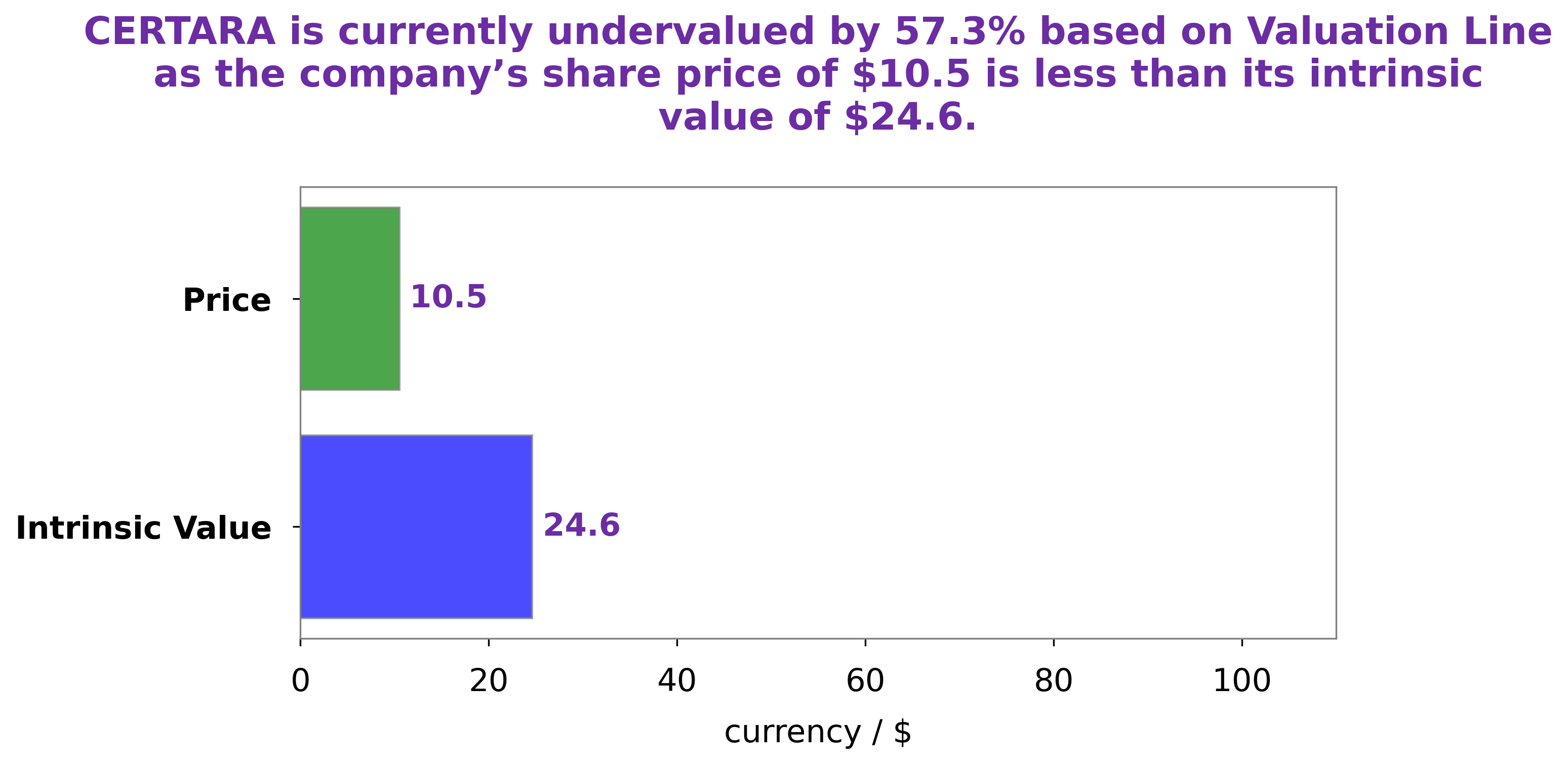

At GoodWhale, we conducted an in-depth analysis of CERTARA‘s fundamentals. Our proprietary Valuation Line indicated that the fair value of CERTARA’s share is around $28.3. However, this is quite different from the current market price of $17.9, a 36.7% undervaluation. This suggests that now is an ideal time to buy CERTARA shares as investors can benefit from this huge discount. We believe investors should consider this opportunity and take advantage of the current market conditions to get a good return on their investments. More…

Peers

The competition in the genomics market is heating up as Certara Inc goes up against 10x Genomics Inc, Cambridge Cognition Holdings PLC, and Schrodinger Inc. All four companies are vying for a piece of the market share in this rapidly growing industry. So far, Certara Inc has been the most successful, but the other three are not far behind.

– 10x Genomics Inc ($NASDAQ:TXG)

As of 2022, 10x Genomics Inc has a market cap of 2.93B. The company’s Return on Equity for that year was -10.81%. 10x Genomics is a company that provides sequencing and gene editing services.

– Cambridge Cognition Holdings PLC ($LSE:COG)

Cambridge Cognition Holdings PLC is a neuropsychological testing company. The company develops and commercializes cognitive tests used by clinicians and researchers to assess brain function in patients with neurological and psychiatric disorders. Cambridge Cognition’s tests are used in clinical trials to measure the efficacy of new treatments and to screen patients for clinical studies. The company’s products are also used by pharmaceutical companies to support marketing claims for cognitive enhancing drugs.

– Schrodinger Inc ($NASDAQ:SDGR)

Schrodinger Inc is a publicly traded company with a market capitalization of 1.55 billion as of 2022. The company has a return on equity of -15.16%. Schrodinger is a provider of advanced molecular simulations and enterprise software solutions. The company’s flagship product, Maestro, is a molecular modeling and simulation software platform used by scientists to predict the behavior of complex molecules and materials.

Summary

CERTARA‘s second quarter of FY2023 results, reported on August 9 2023, demonstrated strong growth for the company. Total revenues increased 9.3% year-over-year to USD 90.5 million and net income jumped to USD 4.7 million from -0.6 million in the prior year. This strong performance presents investors with a profitable opportunity to invest in CERTARA, as the company continues to demonstrate solid growth.

The growth in total revenue and net income indicate positive growth potential for the company going forward. Investors should look further into CERTARA’s financials and assess the company’s fundamentals to determine whether this investment opportunity presents a viable long-term option.

Recent Posts